DEPARTMENT OF HEALTH AND SOCIAL SERVICES

Division of Medicaid and Medical Assistance

PROPOSED

PUBLIC NOTICE

Medicaid Recovery Audit Contractors Program

In compliance with the State's Administrative Procedures Act (APA - Title 29, Chapter 101 of the Delaware Code) and under the authority of 31 Del.C. §512, Delaware Health and Social Services ("Department") / Division of Medicaid and Medical Assistance (DHSS/DMMA) is proposing to amend Title XIX Medicaid State Plan regarding the Medicaid Recovery Audit Contractor (RAC) Program, specifically, to request an exception to the RAC contracting requirements.

Any person who wishes to make written suggestions, compilations of data, testimony, briefs or other written materials concerning the proposed new regulations must submit same to, Planning and Policy Unit, Division of Medicaid and Medical Assistance, 1901 North DuPont Highway, P.O. Box 906, New Castle, Delaware 19720-0906, by email to Kimberly.Xavier@delaware.gov, or by fax to 302-255-4413 by 4:30 p.m. on October 3, 2022. Please identify in the subject line: Medicaid Recovery Audit Contractors Program.

The action concerning the determination of whether to adopt the proposed regulation will be based upon the results of Department and Division staff analysis and the consideration of the comments and written materials filed by other interested persons.

SUMMARY OF PROPOSAL

The purpose of this notice is to advise the public that Delaware Health and Social Services (DHSS)/Division of Medicaid and Medical Assistance (DMMA) is proposing to amend Title XIX Medicaid State Plan regarding the Medicaid Recovery Audit Contractor (RAC) Program, specifically, to request an exception to the RAC contracting requirements.

Statutory Authority

Background

Under Section 1902(a)(42)(B)(i) of the Act, states and territories are required to establish programs to contract with one or more Medicaid Recovery Audit Contractors (RACs) to identify underpayments and overpayments, as well as recouping overpayments, under the Medicaid State Plan and any Medicaid State Plan Waivers. This applies to all services for which payment is made to any entity under such plan or waiver. States must establish these programs in a manner consistent with State law and generally in the same way as the Secretary contracts with contingency fee contractors for the Medicare RAC program.

Section 1902(a)(42)(B)(i) of the Act specifies that States shall establish programs under which they contract with Medicaid RACs subject to such exceptions or requirements as the Secretary may require for purposes of a particular State. This provision enables the Centers for Medicare and Medicaid Services (CMS) to vary the Medicaid RAC program requirements. For example, CMS may exempt a State from the requirement to pay Medicaid RACs on a contingent basis for collecting overpayments when State law expressly prohibits contingency fee contracting. However, another fee structure could be required under any such exception (e.g., a flat fee arrangement).

States that otherwise wish to request variances concerning, or an exception from, Medicaid RAC program requirements must submit a request to CMS from the State's Medicaid Director to the CMS/Medicaid Integrity Group.

Although the Delaware Division of Medicaid and Medical Assistance (DMMA) previously had a Recovery Audit Contract (RAC) vendor, that contract is no longer in place. DMMA posted a Request for Proposals (RFPs) to attract a new RAC vendor but received no bids. Most of Delaware's Medicaid population is enrolled in managed care, and the providers treating them are not subject to audit recovery contracting. There is not sufficient revenue generation to fund an adequate contingency fee.

In a letter dated December 26, 2020, the Centers for Medicare & Medicaid Services (CMS) approved an amendment modifying the State Plan to grant Delaware an exception to the RAC requirements for a 2-year period ending June 30, 2020. After careful review, the RAC requirements continue to be impractical and not cost-effective for Delaware's Medicaid program. Delaware will submit an amendment to modify the State Plan to grant Delaware an exception to the RAC requirements.

Summary of Proposal

Purpose

The purpose of this proposed regulation is to request an exception to the RAC contracting requirements.

Summary of Proposed Changes

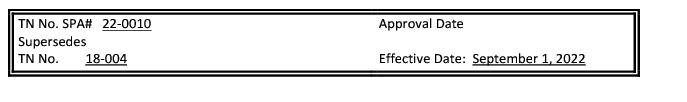

Effective for services provided on and after September 1, 2022, DHSS/DMMA proposes to amend Title XIX Medicaid State Plan to request an exception to the RAC contracting requirements.

Public Notice

In accordance with the federal public notice requirements established in Section 1902(a)(13)(A) of the Social Security Act and 42 CFR 440.386 and the state public notice requirements of Title 29, Chapter 101 of the Delaware Code, DHSS/DMMA gives public notice and provides an open comment period for 30 days to allow all stakeholders an opportunity to provide input on the proposed regulation. Comments must be received by 4:30 p.m. on October 3, 2022.

Centers for Medicare and Medicaid Services Review and Approval

The provisions of this state plan amendment (SPA) are subject to approval by the Centers for Medicare and Medicaid Services (CMS). The draft SPA page(s) may undergo further revisions before and after submittal to CMS based upon public comment and/or CMS feedback. The final version may be subject to significant change.

Provider Manuals and Communications Update

Also, there may be additional provider manuals that may require updates as a result of these changes. The applicable Delaware Medical Assistance Program (DMAP) Provider Policy Specific Manuals and/or Delaware Medical Assistance Portal will be updated. Manual updates, revised pages or additions to the provider manual are issued, as required, for new policy, policy clarification, and/or revisions to the DMAP program. Provider billing guidelines or instructions to incorporate any new requirement may also be issued. A newsletter system is utilized to distribute new or revised manual material and to provide any other pertinent information regarding DMAP updates. DMAP updates are available on the Delaware Medical Assistance Portal website: https://medicaid.dhss.delaware.gov/provider

Fiscal Impact

There is no anticipated fiscal impact.

36a

STATE PLAN UNDER TITLE XIX OF THE SOCIAL SECURITY ACT

STATE/TERRITORY: DELAWARE

4.5 Medicaid Recovery Audit Contractor Program

Citation

|

Section 1902(a)(42)(B)(i)

of the Social Security Act

|

|

The State has established a program under which it will contract with one or more recovery audit contractors (RACs) for the purpose of identifying underpayments and overpayments of Medicaid claims under the State plan and under any waiver of the State plan.

|

|

Section 1902(a)(42)(B)(ii)(I)

of the Act

|

|

The State is seeking an exception to establishing such program for the following reasons:

|

|

|

|

Although the Delaware Division of Medicaid and Medical Assistance (DMMA) previously had a Recovery Audit Contract (RAC) vendor, that contract is no longer in place. DMMA posted a Request for Proposals (RFPs) in an attempt to attract a new RAC vendor but received no bids. The majority of Delaware's Medicaid population is enrolled in managed care and the providers treating them are not subject to audit recovery contracting. There is not sufficient revenue generation to fund an adequate contingency fee. Program review and assessment indicate RAC requirements as impractical and not cost-effective for Delaware's Medicaid program.

|

|

|

|

The State/Medicaid agency has contracts of the type(s) listed in section 1902(a)(42)(B)(ii)(I) of the Act. All contracts meet the requirements of the statute. RACs are consistent with the statute. Delaware RFP for RACs is completed.

|

|

|

Place a check mark to provide assurance of the following:

|

|

|

|

|

The State will make payments to the RAC(s) only from amounts recovered.

|

|

Section 1902(a)(42)(B)(ii)(ll)(aa) of the Act

|

|

The State will make payments to the RAC(s) on a contingent basis for collecting overpayments.

|

|

|

The following payment methodology shall be used to determine State payments to Medicaid RACs for identification and recovery of overpayments (e.g., the percentage of the contingency fee):

|

|

|

|

|

The State attests that the contingency fee rate paid to the Medicaid RAC will not exceed the highest rate paid to Medicare RACs, as published in the Federal Register

|