DEPARTMENT OF HEALTH AND SOCIAL SERVICES

Division of Medicaid and Medical Assistance

PROPOSED

PUBLIC NOTICE

Reasonable Limits on Care Expenses

In compliance with the State's Administrative Procedures Act (APA - Title 29, Chapter 101 of the Delaware Code), 42 CFR §447.205, and under the authority of Title 31 of the Delaware Code, Chapter 5, Section 512, Delaware Health and Social Services (DHSS) / Division of Medicaid and Medical Assistance (DMMA) is proposing to amend Title XIX Medicaid State Plan regarding Reasonable Limits on Care Expenses, specifically, to clarify remedial care deductions for pre-incurred Medical expenses.

Any person who wishes to make written suggestions, compilations of data, testimony, briefs or other written materials concerning the proposed new regulations must submit same to, Planning, Policy and Quality Unit, Division of Medicaid and Medical Assistance, 1901 North DuPont Highway, P.O. Box 906, New Castle, Delaware 19720-0906, by email to Nicole.M.Cunningham@state.de.us, or by fax to 302-255-4413 by 4:30 p.m. on October 2, 2017. Please identify in the subject line: Reasonable Limits on Care Expenses.

The action concerning the determination of whether to adopt the proposed regulation will be based upon the results of Department and Division staff analysis and the consideration of the comments and written materials filed by other interested persons.

SUMMARY OF PROPOSAL

The purpose of this notice is to advise the public that Delaware Health and Social Services (DHSS)/Division of Medicaid and Medical Assistance (DMMA) is proposing to amend Title XIX Medicaid State Plan regarding Reasonable Limits on Care Expenses, specifically, to clarify remedial care deductions for pre-incurred Medical expenses.

Statutory Authority

Background

Section 1902(r)(1)(A) of the Social Security Act requires States to take into account, under the post-eligibility process, amounts for incurred medical and remedial care expenses that are not subject to payment by a third party. Section l 902(r)(I)(A)(ii) permits States to place "reasonable" limits on the amounts of necessary medical and remedial care expenses recognized under State law but not covered under the State plan. However, those reasonable limits must ensure that nursing home residents are able to use their funds to purchase necessary medical or remedial care not paid for by the State Medicaid program or another third party.

Delaware Health and Social Services (DHSS)/Division of Medicaid and Medical Assistance (DMMA) will be submitting a state plan amendment to recognize incurred medical or remedial care expenses as those that are incurred during the three months preceding the month of application.

Summary of Proposal

Purpose

The purpose of this proposed regulation is to clarify remedial care deductions for pre-incurred Medical expenses.

Summary of Proposed Changes

Effective for services provided on and after July 1, 2017 Delaware Health and Social Services/Division of Medicaid and Medical Assistance (DHSS/DMMA) proposes to amend Title XIX Medicaid State Plan to clarify remedial care deductions for pre-incurred Medical expenses.

Public Notice

In accordance with the federal public notice requirements established at Section 1902(a)(13)(A) of the Social Security Act and 42 CFR 447.205 and the state public notice requirements of Title 29, Chapter 101 of the Delaware Code, Delaware Health and Social Services (DHSS)/Division of Medicaid and Medical Assistance (DMMA) gives public notice and provides an open comment period for thirty (30) days to allow all stakeholders an opportunity to provide input on the proposed regulation. Comments must be received by 4:30 p.m. on October 2, 2017.

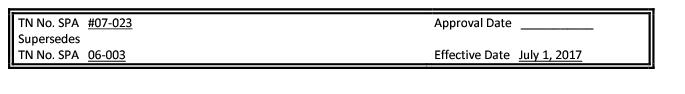

Centers for Medicare and Medicaid Services Review and Approval

The provisions of this state plan amendment (SPA) are subject to approval by the Centers for Medicare and Medicaid Services (CMS). The draft SPA page(s) may undergo further revisions before and after submittal to CMS based upon public comment and/or CMS feedback. The final version may be subject to significant change.

Provider Manuals Update

Also, upon CMS approval, the applicable Delaware Medical Assistance Program (DMAP) Provider Policy Specific Manuals will be updated. Manual updates, revised pages or additions to the provider manual are issued, as required, for new policy, policy clarification, and/or revisions to the DMAP program. Provider billing guidelines or instructions to incorporate any new requirement may also be issued. A newsletter system is utilized to distribute new or revised manual material and to provide any other pertinent information regarding manual updates.

DMAP provider manuals and official notices are available on the Delaware Medical Assistance Provider Portal website: https://medicaid.dhss.delaware.gov/provider

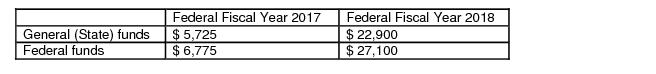

Fiscal Impact

The following fiscal impact is projected:

AMENDED

Supplement 3 to

Attachment 2.6-A

Page 1

STATE PLAN UNDER TITLE XIX OF THE SOCIAL SECURITY ACT

STATE/TERRITORY: DELAWARE

REASONABLE LIMITS IN AMOUNTS FOR NECESSARY MEDICAL OR

REMEDIAL CARE NOT COVERED UNDER MEDICAID

Reasonable and necessary medical expense not covered by Medicaid, incurred in the three (3) months period prior to the month of application are allowable deductions. Expenses incurred prior to this three month period are not allowable deductions.

The deduction for medical and remedial care expenses that were incurred as the result of imposition of a transfer of asset penalty period is limited to zero.

AMENDED

20620.2.3 Prior Medical Costs

Medical costs incurred in a prior period of ineligibility (if approved by Medicaid) may be protected from his/her income. Costs incurred in a period of ineligibility must be approved by the Medicaid State Office prior to being protected and will only be considered if incurred within 30 days three (3) months of the beginning date of Medicaid eligibility.

The recipient's reimbursement level and patient pay amount must be identified. Medicaid will protect at the Medicaid reimbursement rate, not the private pay rate.

The period of ineligibility may be caused by excess resources or excess income.

Protections for which the individual is seeking coverage will not be granted if the ineligible period occurred during a transfer of assets penalty phase.