DEPARTMENT OF HEALTH AND SOCIAL SERVICES

Division of Medicaid and Medical Assistance

PROPOSED

PUBLIC NOTICE

Medicaid Workers with Disabilities (MWD) Premiums

In compliance with the State's Administrative Procedures Act (APA - Title 29, Chapter 101 of the Delaware Code) and under the authority of 31 Del.C. §512, Delaware Health and Social Services ("Department") / Division of Medicaid and Medical Assistance (DHSS/DMMA) is proposing to amend the Division of Social Services Manual (DSSM) 17800, 17908, 17911, 17912, 17913, Title XIX Medicaid State Plan Attachment 2.6-A pages n-o and Attachment 2.6-A Supplement 8A page 1 regarding Medicaid Workers with Disabilities Premiums, specifically, to remove the requirement of premiums for participation in the MWD Program.

Any person who wishes to make written suggestions, compilations of data, testimony, briefs, or other written materials concerning the proposed new regulations must submit same to, Planning and Policy Unit, Division of Medicaid and Medical Assistance, 1901 North DuPont Highway, P.O. Box 906, New Castle, Delaware 19720-0906, by email to DHSS_DMMA_Publiccomment@Delaware.gov, or by fax to 302-255-4413 by 4:30 p.m. on May 31, 2024. Please identify in the subject line: Medicaid Workers with Disabilities Premiums

The action concerning the determination of whether to adopt the proposed regulation will be based upon the results of Department and Division staff analysis and the consideration of the comments and written materials filed by other interested persons.

SUMMARY OF PROPOSAL

The purpose of this notice is to advise the public that Delaware Health and Social Services (DHSS)/Division of Medicaid and Medical Assistance (DMMA) is proposing to amend Title XIX Medicaid State Plan and Division of Social Services Manual (DSSM) regarding Medicaid Workers with Disabilities Premiums.

Statutory Authority

Background

The Consolidated Appropriations Act (CAA) of 2023 requires states to provide 12-months continuous eligibility to children under the age of 19 in Medicaid and Childrens Healthy Insurance Program (CHIP). This requirement is regardless of the Medicaid program the child is enrolled in. Medicaid for Workers with Disabilities (MWD) may include eligible individuals within the ages 16-65. Under Delaware's current MWD program, individuals are required to pay a monthly premium, depending on their income.

Sections 1902(e)(12) and 2107(e)(1)(K) of the Social Security Act (the Act), as modified by Section 5112 of the Consolidated Appropriations Act, 2023 (CAA, 2023), provide for limited exceptions to the requirement that all states provide 12 months of continuous eligibility for children regardless of any changes in circumstances that otherwise would result in loss of coverage.

On October 27, 2023, CMS issued guidance explaining that states will no longer be permitted to terminate the Medicaid or CHIP eligibility of a child under age 19 during a CE period for non-payment of premiums.

Summary of Proposal

Purpose

The purpose of this proposed regulation is to remove the requirement of premiums for participation in the MWD Program, and to provide clarity to other sections of the MWD regulations.

Summary of Proposed Changes

Effective July 1, 2024, the DHSS/DMMA proposes to amend the Division of Social Services Manual (DSSM) and Title XIX Medicaid State Plan to remove the requirement of premiums for participation in the MWD Program, and to provide clarity to other sections of the MWD regulations.

Public Notice

In accordance with the federal public notice requirements established in Section 1902(a)(13)(A) of the Social Security Act and 42 CFR 440.386 and the state public notice requirements of Title 29, Chapter 101 of the Delaware Code, DHSS/DMMA gives public notice and provides an open comment period for 30 days to allow all stakeholders an opportunity to provide input on the proposed regulation. Comments must be received by 4:30 p.m. on May 31, 2024.

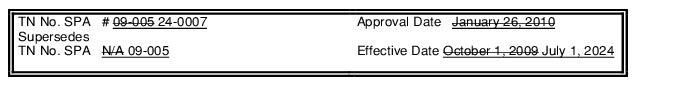

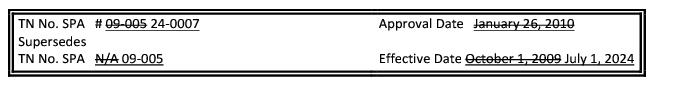

Centers for Medicare and Medicaid Services Review and Approval

The provisions of this state plan amendment (SPA) are subject to approval by the Centers for Medicare and Medicaid Services (CMS). The draft SPA page(s) may undergo further revisions before and after submittal to CMS based upon public comment and/or CMS feedback. The final version may be subject to significant change.

Provider Manuals and Communications Update

Also, there may be additional provider manuals that may require updates as a result of these changes. The applicable Delaware Medical Assistance Program (DMAP) Provider Policy Specific Manuals and/or Delaware Medical Assistance Portal will be updated. Manual updates, revised pages or additions to the provider manual are issued, as required, for new policy, policy clarification, and/or revisions to the DMAP program. Provider billing guidelines or instructions to incorporate any new requirement may also be issued. A newsletter system is utilized to distribute new or revised manual material and provide other pertinent information regarding DMAP updates. DMAP updates are available on the Delaware Medical Assistance Portal website: https://medicaid.dhss.delaware.gov/provider

Fiscal Impact

|

|

Federal Fiscal Year 2024

|

Federal Fiscal Year 2025

|

|

General (State) funds

|

$237

|

$952

|

|

Federal funds

|

$353

|

$1411

|

Attachment 2.6 A

Page 12n

STATE PLAN UNDER TITLE XIX OF THE SOCIAL SECURITY ACT

STATE/TERRITORY: DELAWARE

|

Citation(s)

|

Condition or Requirement

|

|

1902(a)(10)(A)(ii)(XIII),

(XV), (XVI), and 1916(g)

of the Act (cont.)

|

For individuals eligible under the Basic Coverage Group described in No. 24 on page 23d of the Attachment 2.2-A and the Medical Improvement Group described in No. 25 on page 23d of Attachment 2.2-A:

|

|

|

NOTE: Regardless of the option selected below, the agency MUST require that individuals whose annual adjusted gross income, as defined under IRS statute, exceeds $75,000 pay 100 percent of premiums.

|

|

|

X The agency individuals to pay premiums or other cost-sharing charges on a sliding scale based on income. For individuals with net annual income below 450 percent of the Federal poverty level for a family of the size involved, the

Amount of premiums cannot exceed 7.5 percent of the individual's income.

|

|

|

The premiums or other cost-sharing charges, and how they are applied, are described on page 12o.

|

Attachment 2.6 A

Page 12o

STATE PLAN UNDER TITLE XIX OF THE SOCIAL SECURITY ACT

STATE/TERRITORY: DELAWARE

Citation(s) | Condition or Requirement |

1902(a)(10)(A)(ii) (XV), (XVI), and 1916(g) of the Act (cont.) | Premiums and Other Cost-Sharing Charges |

For the Basic Coverage Group, the agency's premium or other cost-sharing charges and how they are applied, are described below. Effective July 1, 2024, premiums are no longer required. | |

Individuals eligible for Medicaid under this section must pay a monthly premium subject to the following premium structure: |

Cost Sharing Schedule | |

Percentage of FPL | Monthly Premium Amount |

100% - 125% | $25 |

125% - 150% | $35 |

150% - 175% | $45 |

175% - 200% | $60 |

200% - 225% | $75 |

225% - 250% | $90 |

250% - 275% | $105 |

17000 SSI Related Programs

42 CFR 435.232

Under 42 CFR 435.232 Medicaid may be provided to individuals who receive only an optional State supplement and who would be eligible for SSI except for the level of their income.

The rules in this section set forth the eligibility requirements for coverage under this state-administered Optional State Supplementation group - Medical Assistance during Transition to Medicare (MAT). The MAT group is implemented March 1, 2001. Eligibility under this group is not retroactive. Effective January 1, 2025, this group is eligible for retroactive eligibility.

Unearned income is excluded up to $956.00 per month for the individual. There is no $956.00 per month unearned income exclusion for a spouse who is not applying for MWD. This the standard established by Delaware Medicaid and Medical Assistance (DMMA). The unearned income exclusion determined in 2009 was $956.00 per month. The unearned income exclusion will be is increased annually by the Cost of Living Adjustment (COLA) announced by the SSA in the Federal Register. There is no unearned income exclusion for a spouse who is not applying for MWD.

There are two income tests used to determine financial eligibility:

1. If the monthly unearned income of the individual exceeds $956.00 the standard established by Delaware Medicaid and Medical Assistance (DMMA), the individual is ineligible. The unearned income limit was determined to be $956.00 per month in 2009. This unearned income limit will be is increased annually by the Cost of Living Adjustment (COLA) announced by the SSA in the Federal Register.

2. Countable income must be at or below 275% of the Federal Poverty Level for the appropriate family size (individual or couple).

The individual may be found eligible for up to three months prior to the month of application as described at DSSM 14920-14920.6 provided the premium requirements under MWD are met. Eligibility cannot be retroactive prior to October 1, 2009.

Individuals with countable income over 100% FPL are required to pay a monthly premium to receive coverage. Countable income is the same amount that is used to determine eligibility. When a husband and wife are both MWD eligible, a monthly premium is assessed on each spouse.

The monthly premium will be based on a sliding scale as follows:

Percentage of FPL | Monthly Premium |

101-125% | $25 |

126-150% | $35 |

151-175% | $45 |

176-200% | $60 |

201-225% | $75 |

226-250% | $90 |

251-275% | $105 |

Exception to sliding scale: An individual or couple whose adjusted gross annual income (as determined under the IRS statute) exceeds $90,008 must pay the highest premium amount listed on the sliding scale. This adjusted gross annual income amount will increase each year by the COLA.

A premium is assessed the month an individual is added for coverage including any months of retroactive eligibility. Eligibility for a month is contingent upon the payment of the premium. Payments that are less than one month’s premium will not be accepted.

A monthly premium notice for ongoing coverage will be sent to the individual. The premium is due by the 15th of the month for the next month’s coverage.

Coverage will be cancelled when the individual is in arrears for two premium payments. The coverage will end the last day of the month when the second payment is due. If one premium payment is received by the last day of the cancellation month, coverage will be reinstated.

Coverage continues pending a fair hearing decision if the fair hearing request is filed within the timely notice period, even if the individual is not paying premiums that are due.

Effective July 1, 2024, premiums are no longer required.

*Please Note: Due to formatting of certain amendments to the regulation, they are not being published here. Copies of the documents are available at: