department of health and social services

Division of Medicaid and Medical Assistance

FINAL

ORDER

Medicaid Recovery Audit Contractor Program

NATURE OF THE PROCEEDINGS:

Delaware Health and Social Services (“Department”) / Division of Medicaid and Medical Assistance (DMMA) initiated proceedings to amend the Title XIX Medicaid State Plan regarding the Medicaid Recovery Audit Contractor Program. The Department’s proceedings to amend its regulations were initiated pursuant to 29 Delaware Code Section 10114 and its authority as prescribed by 31 Delaware Code Section 512.

The Department published its notice of proposed regulation changes pursuant to 29 Delaware Code Section 10115 in the December 2010 Delaware Register of Regulations, requiring written materials and suggestions from the public concerning the proposed regulations to be produced by December 31, 2010 at which time the Department would receive information, factual evidence and public comment to the said proposed changes to the regulations.

SUMMARY OF PROPOSAL

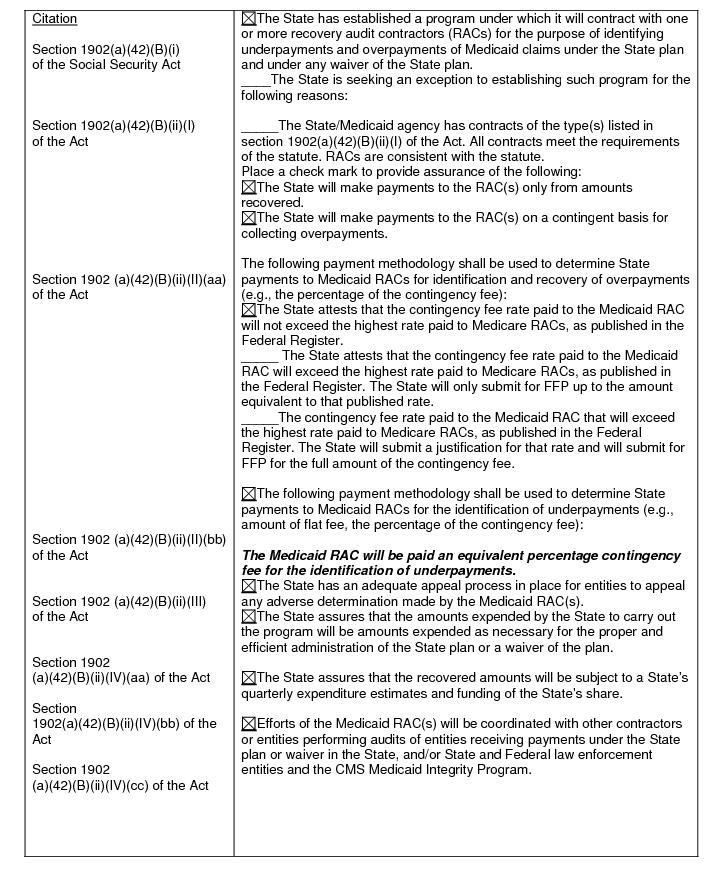

The proposal amends the Title XIX Medicaid State Plan to comply with section 6411 of the Affordable Care Act which amends section 1902(a)(42) of the Social Security Act (the Act) requiring States to establish programs to contract with RACs to audit payments to Medicaid providers by December 31, 2010.

Statutory Authority

The Patient Protection and Affordable Care Act, Public Law 111-148, Section 6411, Expansion of the Recovery Audit Contractor (RAC) program

Background

State Medicaid RACs

Under Section 1902(a)(42)(B)(i) of the Act, States and Territories are required to establish programs to contract with one or more Medicaid RACs for the purpose of identifying underpayments and overpayments and recouping overpayments under the State plan and under any waiver of the State plan with respect to all services for which payment is made to any entity under such plan or waiver. States must establish these programs in a manner consistent with State law, and generally in the same manner as the Secretary contracts with contingency fee contractors for the Medicare RAC program.

The Centers for Medicare and Medicaid Services (CMS) will allow States to maintain flexibility in the design of Medicaid RAC program requirements and the number of entities with which the States elect to contract within the parameters of the statutory requirements. There are a number of operational and policy considerations in State Medicaid RAC program design (some of which will be discussed in greater depth in future rulemaking) such as:

a. Qualifications of Medicaid RACs;

b. Required personnel - for example physicians and certified coders;

c. Contract duration;

d. RAC responsibilities;

e. Timeframes for completion of audits/recoveries;

f. Audit look-back periods;

g. Coordination with other contractors and law enforcement;

h. Appeals; and

i. Contingency fee considerations.

Contingency Fees

Sections 1902(a)(42)(B)(ii)(I) and (II) of the Act provide that payments to Medicaid RACs are to be made only from amounts “recovered” on a contingent basis for collecting overpayments and in amounts specified by the State for identifying underpayments. CMS will not dictate contingency fee rates, but will establish a maximum contingency rate for which Federal Financial participation (FFP) will be available. This rate will be the highest contingency fee rate that is paid by CMS under the Medicare RAC program.

Appeals

Section 1902(a)(42)(B)(ii)(III) of the Act requires States to have an adequate process for entities to appeal any adverse decisions made by the Medicaid RACs. Each State has existing administrative appeals processes with respect to audits of Medicaid providers. So long as States are able to accommodate Medicaid RAC appeals within their existing Medicaid provider appeal structure, CMS is not requiring States to adopt a new administrative review infrastructure to conduct Medicaid RAC appeals.

Reporting

States will be required to report to CMS their contingency fee rates, along with other Medicaid RAC contract metrics such as the number of audits conducted, recovery amounts, number of cases referred for potential fraud, contract periods of performance, contractors’ names, and other factors such as whether a State has implemented provider or service-specific Medicaid RACs. States will report certain elements of this information via the quarterly Form CMS-64, and other information via separate data reporting forms CMS will require.

Coordination

Section 1902(a)(42)(B)(ii)(IV)(cc) of the Act requires that CMS ensure that States and their Medicaid RACs coordinate their recovery audit efforts with other entities.

Summary of Proposal

In accordance with the statutory requirements of Section 6411 of the Affordable Care Act, the Division of Medicaid and Medical Assistance (DMMA) intends to submit a State plan amendment (SPA) through which Delaware will attest that it will establish a compliant Medicaid RAC program by December 31, 2010.

State programs to contract with Medicaid RACs are not required to be fully operational by December 31, 2010. However, CMS expects States to fully implement their RAC programs by April 1, 2011.

The provisions of this state plan amendment are subject to approval by the Centers for Medicare and Medicaid Services (CMS).

Fiscal Impact Statement

This revision imposes no increase in cost on the General Fund; however, there is the potential for administrative and system change costs.

SUMMARY OF COMMENTS RECEIVED WITH AGENCY RESPONSE

The State Council for Persons with Disabilities (SCPD) offered the following observations and recommendations summarized below. The Division of Medicaid and Medical Assistance (DMMA) has considered each comment and responds as follows.

Consistent with the “Background” section of this proposed regulation, the DMMA is required by a change in federal law (Affordable Care Act) to contract with one or more entities to conduct audits of Medicaid providers to identify overpayments and underpayments. The contractors would be paid for overpayments on a contingency fee basis out of amounts recovered. Contractors would be paid for underpayments based on a rate to be determined by DMMA. DMMA must amend the State Plan by December 31, 2010 to comply with federal law and ensure implementation by April 1, 2011.

SCPD has misgivings about a model in which the auditor is compensated through identification of overpayments. Logically, this may lead to any benefit of the doubt in “gray” areas being resolved against the medical provider and prompt “overzealous” collection. As a result, providers may simply withdraw from the Medicaid program. This concern is partially offset by the Plan amendment provision that the contractor would be “paid an equivalent percentage contingency fee for the identification of underpayments.” However, in theory, audit results could be skewed if there are offsetting overpayments and underpayments. For example, it would be against the auditor’s interests to identify offsetting overpayments and underpayments since the auditor could then be paid zero. The same zero payment occurs if no overpayment or underpayment is identified.

Since this initiative is prompted by CMS, SCPD endorses a Plan amendment by December 31, 2010. However, the Council recommends that DMMA adopt arrangements with audit contractors which promote application of principled restraint in audits. If medical providers are beset by auditors with a “feeding frenzy” orientation, the result may be a mass exodus from participation in the Medicaid program. Findings should be based on definitive evidence of incorrect payment and the appeal process could include some informal options which supplement the administrative hearing process.

Agency Response: The Recovery Audit Contractor (RAC) will be required to maintain quality customer service to providers as well as demonstrate that they have experience in successfully conducting audits. There will be reporting requirements, staffing requirements and processes; and, reports that will be approved by DMMA. DMMA will work closely with the RAC and the providers to ensure compliance with RAC and CMS requirements.

FINDINGS OF FACT:

The Department finds that the proposed changes as set forth in the December 2010 Register of Regulations should be adopted.

THEREFORE, IT IS ORDERED, that the proposed regulation to regarding the Medicaid Recovery Audit Contractor Program is adopted and shall be final effective February 10, 2011.

Rita M. Landgraf, Secretary, DHSS

DMMA FINAL ORDER REGULATION #11-04

REVISION: