DEPARTMENT OF HEALTH AND SOCIAL SERVICES

Division of Social Services

FINAL

ORDER

Delaware’s Temporary Assistance for Needy Families (TANF) State Plan Renewal

NATURE OF THE PROCEEDINGS:

Delaware Health and Social Services (“Department”) / Division of Social Services (DSS) initiated proceedings to renew Delaware's Temporary Assistance for Needy Families (TANF) State Plan as provided for in the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA), (P.L. 104-193). The Department’s proceedings to amend its regulations were initiated pursuant to 29 Delaware Code Section 10114 and its authority as prescribed by 31 Delaware Code Section 512.

The Department published its notice of proposed regulation changes pursuant to 29 Delaware Code Section 10115 in the November 2014 Delaware Register of Regulations and 42 United States Code 602(a)(4)(B) requiring written materials and suggestions from the public concerning the proposed regulations to be produced by December 15, 2014 at which time the Department would receive information, factual evidence and public comment to the said proposed changes to the regulations. Additionally, Delaware’s TANF State Plan may be viewed on the Division of Social Services’ website at: http://www.dhss.delaware.gov/dhss/dss/

NOTICE OF FORTY-FIVE-DAY COMMENT PERIOD FOR DRAFT TANF STATE PLAN

This notice is given to provide information of public interest with respect to Delaware’s eligibility status for the Temporary Assistance for Needy Families (TANF) Program, specifically, the TANF State Plan. The TANF State Plan describes the manner in which the State administers Delaware’s TANF Program, and sets forth the eligibility requirements for TANF-funded programs and services.

Statutory Authority

Title of Notice

Delaware Temporary Assistance for Needy Families (TANF) State Plan

Background

The Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996 (Public Law 104-193) provides funding to states through the Temporary Assistance for Needy Families (TANF) block grant. Section 402 of the Social Security Act requires that States periodically submit to the Secretary of the United States Department Health and Human Services a TANF state plan to maintain or renew their status as an “eligible State”. In general, the State plan describes the eligibility rules, the populations served, the programs offered, and the State maintenance of effort spending. States also provide certifications that they will maintain other services such as child support enforcement and foster care services. Delaware’s TANF State plan is due on December 31, 2014.

Delaware Health and Social Services/Division of Social Services administers the Temporary Assistance for Needy Families block grant program. The TANF program is delivered through a collaborative partnership among Delaware’s Department of Health and Social Services (DHSS), Department of Labor (DOL), and the Delaware Economic Development Office (DEDO). The Delaware Transit Corporation (DTC) is also a planning partner.

Summary of Notice of Comment Period for Draft TANF State Plan

In order to continue to receive Federal funding, Delaware must file for renewal of the Temporary Assistance for Needy Families (TANF) block grant with the Department of Health and Human Services (DHHS), Administration for Children and Families (ACF) by December 31, 2014. The State Plan outlines the provisions under which the State will administer the TANF program. The period of this renewal is from October 1, 2014 through December 31, 2016.

Prior to the submission of the plan, 42 United States Code Section 602(a) requires states to provide at least forty-five (45) days for the public to review and comment on the proposed plan and the design of services. The forty-five (45) day comment period begins on the date this notice is published in the Delaware Register of Regulations. Written comments received within the comment period will be reviewed and considered for any subsequent revision of the TANF State Plan.

Developed in accordance with the requirements of PRWORA, the updated State Plan incorporates changes identified through a collaborative process that included development of proposed regulation, distribution of the draft regulation to Delaware stakeholders and the public, review and incorporation of appropriate comments in the plan, and the ongoing review of the TANF program.

A link to the draft TANF State Plan may be accessed at the following Division of Social Services website:

http://www.dhss.delaware.gov/dhss/dss/

SUMMARY OF COMMENTS RECEIVED WITH AGENCY RESPONSE

The Governor’s Advisory Council for Exceptional Citizens (GACEC) and the State Council for Persons with Disabilities (SCPD) offered the following observations and recommendations summarized below. The Division of Social Services (DSS) considered each comment and responds as follows.

The Governor’s Advisory Council for Exceptional Citizens (GACEC) and the State Council for Persons with Disabilities (SCPD) have reviewed the Department of Health and Social Services/Division of Social Services’ (DSS) proposal to renew Delaware’s eligibility status for the TANF program covering the period from October 1, 2014 through December 31, 2016. The proposed regulation was published as 18 DE Reg. 354 in the November 1, 2014 issue of the Register of Regulations.

GACEC and SCPD endorse the proposed regulation.

Agency Response: DSS thanks the Councils for the endorsement.

FINDINGS OF FACT:

The Department finds that the proposed changes as set forth in the November 2014 Register of Regulations should be adopted.

THEREFORE, IT IS ORDERED, that the proposed regulation to renew Delaware's Temporary Assistance for Needy Families (TANF) State Plan for the period October 1, 2014 through December 31, 2016 is adopted and shall be final effective February 10, 2015.

Rita M. Landgraf, Secretary, DHSS

DELAWARE STATE PLAN FOR TANF

Effective October 1, 2014

In fulfillment of the state plan requirements of §402(a) of the Social Security Act, Delaware submits this state plan to renew its status as an eligible state.

This renewal is submitted to the Secretary of the Department of Health and Human Services, through the Director of the Administration for Children and Families.

Delaware‘s approved amended Work Verification Plan, dated April 20, 2009 describes in detail how TANF work activities are defined, verified, and documented.

The policy changes reflected in this Plan are the result of a process that included development of proposed regulations, distribution of the draft regulations to Delaware stakeholders and the public, and the review and incorporation of appropriate comments in the plan.

Delaware's TANF program requires immediate work activity from caretakers in time-limited families. Those who cannot secure unsubsidized employment immediately are required to participate in other work activities that foster the development of the skills necessary to secure unsubsidized employment and achieve long term self-sufficiency.

Attachment A includes certifications by Governor Jack Markell, Delaware’s Chief Executive Officer.

GOALS, RESULTS, AND PUBLIC INVOLVEMENT

Goals

The goal of Delaware's TANF program is to provide a welfare system based on a philosophy of mutual responsibility. In working toward that goal, the State will strive to place individuals in private or public sector unsubsidized employment that enables them to enter and maintain family sustaining employment. To that end, the TANF program provides individualized supports and programming to assist families to become employed, and expects families to accept responsibility to become self-supporting.

Five key principles form the foundation of TANF:

1. Work should pay more than welfare.

2. Welfare recipients must exercise personal responsibility in exchange for benefits.

3. Welfare should be transitional, not a way of life.

4. Both parents are responsible for supporting their children.

5. The formation and maintenance of two-parent families should be encouraged; and teenage pregnancy and unwed motherhood should be discouraged.

Involvement of Local Governments, the Public, and Private Sector Organizations

Welfare Reform in Delaware has a long history of active involvement and partnership between and among state and local governments and the private sector. Delaware has engaged government, the public and the private sector in dialog about the welfare system and ways to enhance it. Since its introduction in January of 1995, in the form of a waiver request, all sectors have had the opportunity to influence Delaware's welfare reform program in a series of public meetings and forums.

A collaborative partnership among the Department of Health and Social Services (DHSS), Department of Labor (DOL), and the Delaware Economic Development Office (DEDO) worked to develop Delaware's TANF program. The Delaware Transit Corporation (DTC) is also a planning partner. The Social Services Advisory Council consisting of educators, health professionals, religious leaders, representatives of community-based organizations, advocates, and government leaders, all appointed by the Governor, continues to provide advice on improving the delivery of Delaware's social programs including TANF.

The requirement for a 45-day public comment period was accomplished by making the plan available for public review and comment through the following means:

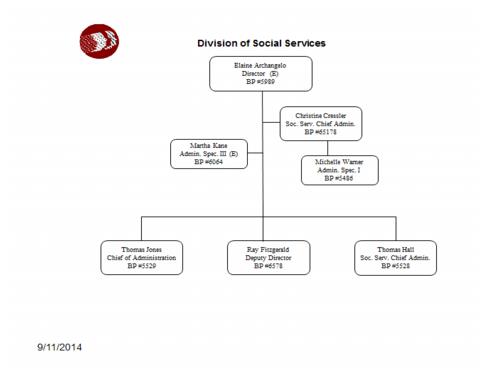

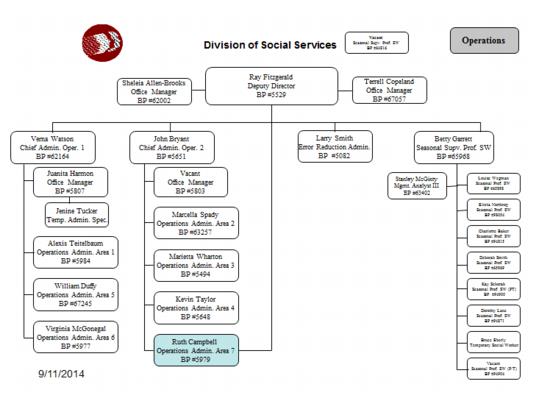

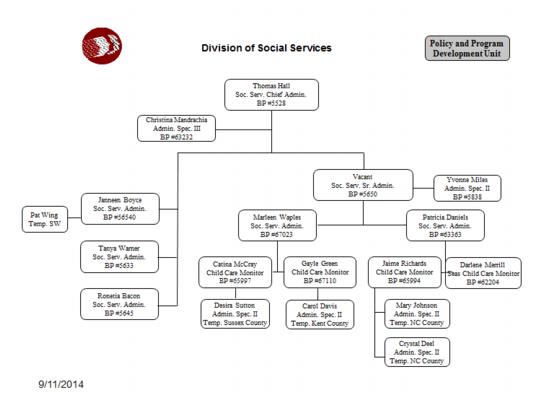

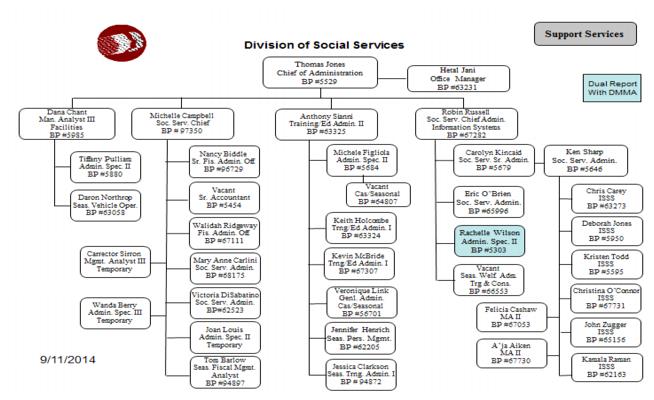

Ensuring Accountability

The Division of Social Services (DSS), a division of State of Delaware Department of Health and Social Services (DHSS), administers TANF. While DHSS is the lead agency, program administration is accomplished through a partnership of DSS, Department of Labor (DOL), Delaware Economic Development Office (DEDO), and the Delaware Transit Corp (DTC).

The Delaware Client Information System and Assist Worker Web (DCIS II/AWW) is a large scale, client/server, interactive eligibility determination and benefit issuance system. DCIS II/AWW automates: client registration, application entry, eligibility determination, benefit calculation, benefit issuance and work programs for more than 100 variations of cash, Medicaid, child care and food benefit programs, administered by the Delaware Division of Social Services. DCIS II/AWW provides automated program support and supports the information needs at the state and local office level. DCIS II/AWW also incorporates program changes required by P.L. 104-193.

Delaware is participating in the Income and Eligibility Verification System (IEVS) required by section 1137 of the Social Security Act.

In addition, the State operates a fraud control program and will disqualify individuals found to have committed an intentional program violation based on findings of administrative disqualification hearings and findings of prosecution or court actions. Delaware has adopted the penalties for intentional program violations used by the Food Supplement Program: 12 months for the first offense and 24 months for a second instance. An individual committing a third offense is permanently disqualified.

TANF Benefits Issued Via Electronic Benefit Transfer (EBT)

Section 4004 of the Middle Class Tax Relief and Job Creation Act of 2012 (P.L. 112-96) requires states receiving TANF grants to “maintain policies and practices as necessary to prevent assistance provided under the State program funded under this part from being used in any electronic benefit transfer transaction in any liquor store; any casino, gambling casino, or gaming establishment; or any retail establishment which provides adult-oriented entertainment in which performers disrobe or perform in an unclothed state for entertainment.” Furthermore, states are required to include in their state plans a statement outlining how they intend to implement policies and procedures to prevent access to assistance through electronic benefit transfer (EBT) transactions in an automated teller machine or point-of-sale device located in casinos, gaming establishments, liquor stores, and retail establishments which provide adult-oriented entertainment. The state plan must also include an explanation of how the state plans to ensure that (1) recipients of the assistance have adequate access to their cash assistance, and (2) recipients of assistance have access to using or withdrawing assistance with minimal fees or charges, including an opportunity to access assistance with no fee or charges, and are provided information on applicable fees and surcharges that apply to electronic fund transactions involving the assistance, and that such information is made publicly available.

Delaware does not issue TANF benefits through Electronic Benefit Transfer (EBT) and therefore has not established policies or procedures to address EBT access and use as they relate to TANF benefits. If in the future, Delaware begins to distribute benefits through EBT, it will establish policies and procedures that ensure compliance with the Middle Class Tax Relief and Job Creation Act of 2012. Prior to implementation of EBT distribution, these policies and procedures will be detailed in a State plan amendment and in a letter sent to the Secretary.

As noted, Delaware issues TANF benefits via check. Delaware has an agreement with PNC Bank, which has locations throughout the state, to cash the TANF checks of recipients. Recipients cashing their TANF check at a PNC Branch incur no fees for cashing the checks. There are no fees related to electronic fund transfer, since Delaware issues paper checks.

Fugitive Felons, Individuals Convicted of Drug Related Felonies

Fugitive felons and parole violators are ineligible for TANF assistance. In addition, as of August 22, 1996, individuals convicted of drug related felonies are permanently barred from the date of conviction.

Denial of Benefits for Fraudulent Misrepresentation to Obtain Assistance in Two States

Any individual who misrepresents residence to receive TANF, Medicaid, or Food Supplement benefits in two states shall be subject to a ten-year bar if convicted in a state or federal court.

NEEDY FAMILIES

Definition of Needy Families

For cash assistance program purposes, needy families are a child and or children living in the home of a parent, guardian, custodian, or specified relative whose combined income and financial resources are less than the standards established by the State.

The following sections describe these standards and how they are applied to applicants and recipients.

Income and Resource Rules for Determining Need

For purposes of determining need Delaware will continue to utilize the established income and resource rules of the TANF program. The following specific features of Delaware's TANF program continue to apply:

Funds in such accounts will not be considered as a resource. Withdrawals from such accounts must be for approved purposes, as defined in TANF. If funds are withdrawn for non-approved purposes, the money will be counted as a resource in the month received. Approved reasons for withdrawal of funds for self-sufficiency needs include, but are not limited to: dependent care expenses, security deposit for an apartment or house, or vehicle repair costs.

Income Tests to Determine Eligibility

There are two income tests to determine financial eligibility. The first test is a gross income test, and the second is a net income test.

Exhibit 1 contains the calculation steps for TANF applicants.

Exhibit 1: Determining Applicant Eligibility for TANF Benefits

Step 1) The gross income is compared to 185% of the applicable TANF standard of need. Assistance is denied if the income exceeds 185% of the applicable TANF standard of need.

Step 2) The standard work deduction ($90.00) and childcare expenses are subtracted from each wage earner's earnings. The applicant's net earned income is added to unearned income to determine the net family income. The net income is compared to the payment standard. Assistance is denied if the income exceeds the payment standard.

If the income is less than the payment standard,

Step 3) The standard work deduction ($90.00), childcare, and the $30 plus 1/3 disregard (if applicable) are subtracted from each earner's earned income. This net earned income is added to the unearned income to calculate the family's net income. The net income is subtracted from the applicable standard of need to obtain the deficit. The deficit is multiplied by 50%; the number calculated is the remainder. The grant is either the remainder or the payment standard, whichever is less.

Exhibit 2 provides the calculations for TANF recipients.

Exhibit 2: Determining Recipient Eligibility for TANF Benefits

Step 1) The gross income is compared to 185% of the applicable TANF standard of need. Assistance is denied if the income exceeds 185% of the applicable TANF standard of need.

Step 2) The standard work deduction ($90.00), childcare, and the $30 plus 1/3 disregard (if applicable) are subtracted from each earner's earned income. The net earned income is added to unearned income to calculate the family's net income. Assistance is denied if the income exceeds the standard of need.

If the income is less than the standard of need,

Step 3) The net income is subtracted from the applicable standard of need; the number calculated is the deficit. The deficit is multiplied by 50%; the number calculated is the remainder. The grant is either the remainder or the payment standard, whichever is less.

The TANF standards apply to all benefits and services provided to needy families except for those listed below, for which Delaware has established separate need standards.

Fill-the-Gap Budgeting

Fill the Gap budgeting will be used for recipient families to determine continued eligibility and the amount of TANF benefits so that families can retain more of their income. By having a standard of need which is greater than the payment standard a "gap" is created. The difference between the family's income and the need standard is called the deficit. The state pays a percentage of the deficit up to a maximum benefit level or payment standard.

Diversion Assistance Program

Delaware operates a Diversion Assistance program intended to help a family through a financial problem which jeopardizes employment and which, if not solved, could result in the family needing regular ongoing assistance. The Diversion Assistance payment will not exceed $1,500 or the financial need resulting from the crisis, whichever is less. Diversion Assistance, which is available to both applicant and recipient families, is not a supplement to regular assistance but is in place of it.

Eligibility requirements for Diversion Assistance are as follows:

The Diversion Assistance payment may be used for items and/or services, such as but not limited to:

Diversion Assistance payments will be made to a third party vendor, not the parent. When the parent receives Diversion Assistance (s)he agrees to forego TANF cash assistance as follows:

The once a year limitation on Diversion Assistance and the period of ineligibility can be eliminated when good cause exists. Good cause exists when circumstances beyond the client's control make re-application for Diversion Assistance or TANF necessary. Examples of good cause are the employer lays off the parent or a serious illness forces the parent to stop working.

The family is eligible for TANF related Medicaid in the month in which the Diversion Assistance payment is made. The family would remain eligible for Section 1931 Medicaid (TANF related Medicaid) until the family's income exceeds the standard of need. If the family's income exceeds the standard of need because of increased earnings or loss of the $30 plus 1/3 disregard and the parent is working, the family may be eligible for Transitional Medicaid.

Diversion Assistance does not count as income in the childcare program. Families receiving Diversion Assistance may also be eligible to receive childcare under Delaware's working poor childcare program if their income does not exceed 200 percent of the federal poverty level. Receipt of Diversion Assistance would not bar receipt of Food Supplement benefits, and food benefit applications will be actively solicited from individuals requesting Diversion Assistance.

Diversion Assistance does not count against the time limit on receipt of assistance.

The family will not have to assign child support to the state. Child support received by the parent or the Division of Child Support Enforcement (DCSE) will belong to the family. DCSE will not use child support to offset or reimburse the Diversion Assistance.

Diversion Assistance is not intended to replace TANF's Emergency Assistance Program or Supportive Services payments, which will continue. The TANF Emergency Assistance Program provides identical benefits that were provided under Delaware's State Plan in effect on August 21, 1996. (See Attachment B) Rather, Diversion Assistance expands the opportunities to access services to support employment.

Child Welfare Services to assist needy families in maintaining children in the home of their parent(s) or a relative caregiver

These services are provided when conditions exist requiring the intervention of the Division of Family Services (DFS). Services or payment for services for the child or family is provided to deal with the conditions that caused the need for the services and the child or family is not eligible for such services under Title IV-E. The services provided are those identified by DFS as needed to meet the needs of the child. These include investigation, case management, community and home based intervention services, foster care maintenance payments for short-term placement of less than 180 days outside of the home as well as foster care payments for temporary absence placements of up to 365 days (see below). Also included are case management services for preventive services, court-related activities, and foster care. Needy families whose combined earned and unearned income is at or below 900% of the federal poverty level during the year services are provided are eligible to receive these TANF or MOE funded services.

As described on page one of Attachment B, Federal funds may be used under the former Emergency Assistance provision (attached) that was in effect on August 21, 1996. In addition, paragraph two describes how State MOE funds may be used to pay for these benefits and services while the child remains in the home of a relative or during a period of temporary absence from the home of up to 12 months, as long as the child is expected to return home during that period of time or a good cause extension has been granted.

ELIGIBILITY FOR ASSISTANCE UNDER THE TANF PROGRAM

Conditions of Eligibility

If the income tests described above are met, a family is eligible to receive TANF assistance subject to the following conditions.

Relationship/Living Arrangements

Children must be living in the home of a parent, guardian, custodian, adult acting in loco parentis or a specified relative.

During 2013, the Delaware legislature passed the Civil Marriage Equality and Religious Freedom Act of 2013. The law was effective July 1, 2013. The TANF program affords partners in a same gender marriage the same program rights, benefits, responsibilities, obligations, and duties as afforded different gendered married partners. Married partners of the same gender are treated in the same manner as different gendered married partners for all components of the TANF program including but not limited to technical eligibility, child support cooperation, financial eligibility, case composition, grant determination, and work requirements

The caretaker of a teen parent who is not a parent must demonstrate valid circumstances why the teen is not living with a parent and must agree to be a party to the Contract of Mutual Responsibility and fulfill the same responsibilities as a parent.

Tribes

Delaware has no federally recognized tribes.

Individuals from Another State

All families meeting the status eligibility requirements set forth above are eligible for TANF benefits using Delaware rules, regardless of how long they have been residents of the State.

Family Cap Provision

No additional cash benefits will be issued due to the birth of a child, if the birth occurs more than ten (10) calendar months after the date of application for benefits under TANF. Children born to teen parent included in TANF grants are also subject to the family capped rules.

The family cap will not apply to:

The additional child(ren) is included in the standard of need for purposes of determining eligibility. The income and resources of the child, including child support, is included in determining the family's income and resources. However, the child(ren) is not included in determining the payment standard for the family.

Denial of Benefits to Babies Born To and Residing with Unmarried Teen Parents

Cash assistance is not provided to babies born on and after January 1, 1999 to unmarried minor teens. This applies to both applicants and recipients. For all other purposes, these babies will be considered TANF recipients. They may also be eligible to receive food benefits, Medicaid and child care as well as vouchers for the baby's needs. This provision applies as long as the teen parent resides in the home with the baby, is unmarried or less than eighteen (18) years of age.

Treatment of Eligible Non-Citizens

Qualified non-citizens who enter the United States before August 22, 1996 are eligible to receive the same benefits and services and are subject to the same conditions and requirements as all other applicants and recipients.

Qualified aliens entering the United States on or after August 22, 1996, who are exempt from benefit restrictions as specified in Federal law, are eligible to receive the same benefits and services and are subject to the same conditions and requirements as all other applicants and recipients.

Qualified non-citizens who enter the United States on or after August 22, 1996 are, after five years, eligible to receive the same benefits and services and are subject to the same conditions and requirements as all other applicants and recipients.

Statewideness

All definitions and determinations of need are applied on a statewide basis.

Program Type

Depending on circumstances, families are placed in either the Time-Limited TANF program or the Non Time-limited TANF program.

Delaware's Time-Limited TANF Program has an employment focus. Participants are expected to meet immediate work requirements in order to receive benefits.

Delaware uses State non-maintenance of effort funds to provide benefits to recipients in a solely state funded two-parent program.

TANF eligible families that include a parent or head of household who has presented approved documentation that they are unable to work because of a medical disability will be enrolled in the non-time limited program. These clients may receive benefits through either a solely state funded program or the TANF program. Delaware will use State non-maintenance of effort funds to provide benefits to recipients in the solely state funded medical disability program.

Time-limits for Delaware's Time-Limited TANF Program and the interactions between time-limits and work requirements are described in the sections entitled, Work: Time Limits and Work, and TANF Benefits to Needy Families: Time Limits.

Families with the following status will receive benefits in the Non Time-limited program:

Contract of Mutual Responsibility requirements and sanctions for noncompliance apply to families in the Non Time-limited TANF program. Delaware will provide benefits utilizing solely state funding (SSF) to families that include a head of household or a spouse of a head of household who have exceeded 60 cumulative months of federally funded TANF assistance and represent more than 20 percent of the TANF caseload.

Time Limits

Under TANF, cash benefits are time-limited for households headed by employable adults age 18 or older who are included in the grant. Prior to January 1, 2000, Delaware limited receipt of TANF, for families in the Time-Limited Program, to forty-eight (48) cumulative months. During the time-limited period, employable adults received full benefits if they met the requirements of their Contract of Mutual Responsibility, including employment-related activities.

Effective January 1, 2000 the time limit for receipt of TANF cash benefits is thirty-six (36) cumulative months.

During the time-limited period, employable adult recipients receive full cash benefits only as long as they meet the requirements of their Contract of Mutual Responsibility, including participation in employment-related activities detailed in their ISS. The ultimate goal of this time-limited period is to support the employable adult's search for, and placement in, an unsubsidized job.

Individuals found eligible for TANF prior to January 1, 2000 will still have a forty-eight (48) month time limit even if they reapply for benefits on or after January 1, 2000.

DSS will track the time remaining before a family's time limits expire and notify families on a quarterly basis of the time they have remaining before the time limits expire. At least two (2) months prior to the end of the 36 or 48 cumulative months in which a family has received assistance, DSS will remind the family that assistance will end and notify the family of the right to apply for an extension.

Extensions are provided only to those families who can demonstrate that:

Extensions may also be granted where other unique circumstances exist. Extensions will not be granted if the adult caretaker received and rejected offers of employment, quit a job without good cause, was fired for cause, or if the adult caretaker did not make a good faith effort to comply with the terms of the Contract of Mutual Responsibility and the ISS.

After the time limit has been reached, benefits will be provided to families that have been granted an extension only for a maximum period of 12 months. Thus, for Time-Limited families the maximum period for receipt of benefits to families enrolled in the Time-Limited TANF Program will be 60 cumulative months for families with a cumulative 48 month time limit and 48 months for families with a 36 month time limit. Delaware will comply with federal regulations regarding families receiving assistance in excess of 60 months of TANF paid through the federal TANF block grant.

CONTRACT OF MUTUAL RESPONSIBILITY/INDIVIDUAL SERVICE STRATEGY

The caretaker of children in the TANF program enters into a Contract of Mutual Responsibility with the Division of Social Services (DSS). Applicants and recipients have a face-to-face interview. During this interview, the DSS worker explains the Contract of Mutual Responsibility (CMR) and those elements specific to the client.

The CMR lists the responsibilities of the family and the supports the State will provide. The family's responsibilities include, but are not limited to: employment-related activities, school attendance and immunization requirements for children, family planning, parenting education classes, and substance abuse treatment requirements. The State provides supports to families including but not limited to: employment-related activities, training activities, child care, Medicaid, and other services identified during the development of the CMR by DSS workers and the Individual Services Strategy (ISS) developed by Employment Connections (EC) and Keep a Job (KAJ) contractors providing self-sufficiency services to work mandatory clients.

The CMR is designed to be individualized to the specific needs and situation of each family. Therefore, the exact requirements within the Contract may vary from family to family. This document can be revised as the needs and the situation of the family evolve.

Services related to these CMR requirements will be available to the participant. If the services specified in the CMR are not reasonably available to the individual, the participant will not be sanctioned for failure to comply and the CMR will be modified to reflect that the service is currently unavailable.

It is mandatory that all caretakers enter into a CMR. Contracts are completed for families in the Time Limited TANF program and the Non Time-limited TANF program as well as for teen parents. Both caretakers in an assistance unit and non-needy caretaker payees are required to develop and comply with CMRs. Other family members within the assistance unit may be required to comply with provisions of the Contract, and are subject to sanction for non-compliance.

If the caretaker is a non-needy caretaker, the individual would not be required to participate in employment-related activities but will be required to participate in other Contract activities.

If a caretaker objects to certain aspects of the CMR, the caretaker needs to present these objections up front, at the time of the initial CMR. If good cause can be demonstrated, the CMR can be amended to rectify the objections.

When staff has reason to believe that the family needs other services to become employed or to increase work hours and wages, these services will be identified and specified in the CMR. Needed services will also be identified on the caretaker’s ISS developed by EC and KAJ contractors.

The fiscal sanction for not cooperating, without good cause, in development of the CMR will be an initial $50.00 reduction in benefits. This reduction will increase each month by $50.00, either until there is compliance or the case is closed. The sanction will end with demonstrated compliance. Sanctions for failure to participate in CMR and ISS activities are described in subsequent sections.

Sanctions: Failure to Comply with the Contract and the Imposition of Sanctions

The Contract of Mutual Responsibility encompasses three broad categories of requirements: 1) enhanced family functioning; 2) self-sufficiency; and 3) teen responsibility requirements. In addition, caretakers required to participate in work activities create an Individual Service Strategy (ISS) with their employment and training program that details their expected weekly work activities.

1. Enhanced family functioning requirements of the CMR include, but are not limited to, acquiring family planning information, attending parenting education sessions, ensuring that children are immunized, and cooperation with specialized programming designed to assist parents with documented disabilities that impede or prevent employment. Sanction for non-compliance with these requirements is an initial $50, which will increase by $50 every month until there is compliance with the requirement. The initial $50 reduction is imposed whether the family fails to comply with one, or more than one requirement. Clients must to comply with all requirements before the sanction can end.

2. Self-sufficiency requirements of the Contract of Mutual Responsibility are employment and training, work-related activities, and ensuring school attendance requirements for dependent children under age 16.

2.1 The sanction for non-compliance with work-related activity requirements is, subject to adequate and timely notice, closure of the case due to imposition of an immediate full-family sanction.

2.2 Recipients, whose cases closed for failure to participate, must participate in work related activities for four consecutive weeks at the required hours per week for their case to be re-opened. Payments are not retroactive.

2.3 Households that have received a full family sanction must lose at least one month of cash assistance prior to the sanction being lifted.

2.4 The penalty for individuals who quit their jobs without good cause is an immediate full family sanction. The sanction will last at least one month. Recipients must participate in work related activities for four consecutive weeks at the required number of hours per week for their grant to be re-opened. Payments are not retroactive.

2.5 For dependent children under the age of 16 if the child does not maintain satisfactory attendance an initial $50 sanction is imposed. The sanction will increase by $50 every month until there is compliance. The sanction is not imposed if the parent of the child is working with school officials or other agencies to remediate the situation.

3. Teen responsibility requirements for dependent teens 16 and older include maintaining satisfactory school attendance, or participation in alternative activities such as training or employment. The sanction for non-compliance with these requirements is the removal of the teen from the TANF grant. The teen is removed from the TANF grant for at least one month. To cure the sanction the teen must participate in employment and training activities under the supervision of an Employment Connections program for four consecutive weeks, return to school, or work full time.

Failing to comply with both the enhanced family functioning and self-sufficiency requirements will result in combined penalties. For example, both a $50 reduction and a full family sanction could be assessed for failures to comply in two areas. Demonstrated compliance will not excuse penalties for the period of noncompliance. Sanctions will be imposed for the full period of noncompliance.

WORK

Goals for Work

Delaware's TANF program is based on the belief that assistance provided is transitional and should not become a way of life. The State maintains that the way for persons to avoid dependency on welfare is for them to find and maintain employment. Thus the primary goal of TANF is to help recipients find private sector work and to help them keep such work by providing them with necessary supports.

To assist families in obtaining and maintaining employment, the State will engage the efforts of the Departments of Health and Social Services, Labor, and Economic Development and Delaware's private sector to provide job readiness and placement opportunities, health and child care, and family services. In turn, TANF recipients who have the capacity to work will be required to accept work, to keep their children in school, to cooperate with child support, to bear the costs of additional children they conceive while on welfare, and to leave the welfare rolls after a defined time period.

State Agencies Involved

Delaware Health and Social Services, Labor, and Economic Development have a unique partnership. All three agencies are responsible for moving welfare clients to work. These three agencies have collaborated in developing Delaware's TANF program, in public information, in implementation, and continue to collaborate in managing the initiative.

The Delaware Transit Corporation (DTC) in the Department of Transportation has joined the TANF collaborative team, and has assisted to develop a statewide transportation system plan for TANF, using vans and other vehicle sources.

Involvement of Community, Education, Business, Religious, Local Government and Non-Profit Organizations to Provide Work

As noted in the discussion on page 2, every sector has been actively involved in the development of Delaware's TANF program and continues to be involved.

A TANF Employer Committee, consisting of representatives of both the public and private sector, assists in placing welfare recipients in unsubsidized jobs and provides advice on direction, policy, and implementation of welfare-to-work efforts. This committee was established through HB 251.

To further promote employer interest in hiring TANF recipients, the Departments of Labor and Economic Development meet with members of the business community at regularly scheduled events like monthly Chamber of Commerce meetings and at special events.

The Social Services Advisory Council was established by executive order. The Governor appoints council members to advise the directors of both the Division of Social Services and the Division of Child Support Enforcement on matters related to public assistance and child support services. Council members represent the community, advocates, non-profit providers, educators, and interested citizens.

DSS and DCSE management regularly meet with the Social Services Advisory Council to discuss TANF and other Social Services and Child Support programs.

Role of Public and Private Contractors in Delivery of Services

Delaware has contracted with private for-profit and non-profit providers and the local community college network to provide job readiness, job placement, and retention services to welfare clients since 1986. These contractual arrangements continue under TANF. Contractors include community and faith-based social services agencies and organizations offering specialized services.

A number of community providers across the state provide academic remediation to TANF recipients.

Who Must Participate

All adult caretakers and other adults in the time-limited assistance unit who are not exempt must participate in TANF employment and training related activities. The three exemptions are: 1) a single custodial parent caring for a child under 12 months of age; 2) an individual determined unemployable by a health care professional; and 3) a parent caring for his or her child or spouse who is disabled.

Services to Move Families to Work

Delaware's goal is to place the adult recipient in unsubsidized employment as quickly as possible. To accomplish this goal, the current menu of potential services includes all the federally acceptable categories of work activities, as shown below. In addition, Delaware offers ongoing case management, work retention, and job enhancement services provided by our Employment Connections (EC) and Keep-A-Job (KAJ) contractors:

Non-exempt TANF participants will participate in the job search program, consisting of job readiness classes and supervised job search activity. Unsuccessful job search participants can be placed in another job search sequence or another work-related activity such as work experience, community service, OJT, or a skills training program.

Clients must keep appointments with the Employment and Training programs, cooperate in the development of the employment activities included in their Contract of Mutual Responsibility and Individual Service Strategy (ISS), and participate in employment and training activities. Individuals who are not in compliance with any of the above client responsibilities will be subject to sanctions as described in "Sanctions: Failure to Comply with the Contract and Imposition of Sanctions" described in a subsequent section of the State Plan.

The State implemented an Employment and Training Management Information System (ETMIS) in July 2005. ETMIS was incorporated into the existing Delaware Client Information System (DCIS). The ETMIS tracks referrals to employment and training programs, hours of participation, work activities, and sanctions. The ETMIS enhances contractor and participant accountability. Additionally it is a valuable tool for the collection and dissemination of statewide program data used for determining program effectiveness and making program design changes. The system is being updated to a web-based system in 2015.

Employment and Training Hours and Work Activities

Families are required to participate in a minimum number of hours of approved employment and training activities each week. The chart below specifies the number of hours required each week by family type. For families with work mandatory individuals, participation in either employment or other activities related to finding work for at least their required hours a week for two consecutive weeks is a condition of eligibility for TANF benefits. Once this condition and other eligibility requirements are met, benefits are retroactive to the first day of the two-week up-front participation period.

|

Family Type

|

Required Employment and

Training Hours Per Week

|

|

One Parent Home

|

30

|

|

One Parent Home with Child(ren)

under 6 years old

|

20

|

|

Two Parent Home

|

40

|

Job search and structured job readiness activities continue for another two weeks for individuals who do not find unsubsidized employment for at least the required hours. Individuals who do not find employment within the first four weeks of job search are assigned to work experience activities, and/or other employment and training activities.

Single parent households that are participating in work experience are required to participate up to 30 (or 20) hours per week. Work experience hours are determined by dividing TANF and Food Supplement benefits by the Delaware minimum wage. If the hours determined by dividing the grants by the minimum wage exceed 30 hours per week, participants are to complete no more than 30 participation hours. If the maximum allowable hours are less than 30 hours per week, participants are to complete the FLSA allowed number of work experience hours, but must make up the difference needed to meet their hours of participation requirement with other countable activities.

Two-parent families assigned to work experience must engage in up to 40 hours per week, determined by dividing TANF and Food Supplement benefits by the Delaware minimum wage. If the hours determined by dividing the grants by the minimum wage exceed 40 hours per week, participants are to complete no more than 40 participation hours. If the maximum allowable hours are less than 40 hours per week, participants are to complete the FLSA allowed number of work experience hours, but must make up the difference needed to meet the 40 hour participation requirement with other countable activities.

An individual in a one-parent household enrolled in the TANF Time-Limited Program who, in accordance with the requirements in their Contract of Mutual Responsibility and ISS, participates in unsubsidized employment of at least 30 hours per week is not required to participate in other work-related activities. Two-parent families who, in accordance with the requirements in their Contract of Mutual Responsibility and ISS, participate in unsubsidized employment of at least 40 hours per week are not required to participate in other work-related activities. All families who are meeting their required hours through unsubsidized employment are required to continue providing their employment and training program with verification of their employment.

Delaware law expands the opportunity for TANF recipients to engage in educational activities beyond the federal limits of countable hours for State participation rate purposes. To take advantage of this state regulation individuals participating full-time in educational activities, based on the standards established by the institution, must participate in additional work-related activities, to equal twenty (20) actual participation hours. For most recipients their remaining non-core hours are met through homework time. Homework time for federal participation rate purposes is not to exceed the rate of 1 hour of unsupervised homework time per credit hour or class hour if the educational program requires homework.

Recognizing that Delaware's hourly requirements for participation in work and work-related activities are broader than those prescribed by the current TANF legislation, Delaware may provide some benefits through a solely state funded (SSF) program.

Time limits for Delaware's Time-Limited TANF Program are described in the section entitled, Time Limits (page 13).

Eldercare Workforce Development

Delaware does not intend at this time to assist individuals to train for, seek, and maintain employment in the following specific activities:

I. Providing direct care in a long-term care facility (as such terms are defined in §2011 of the Social Security Act; or

II. In other occupations related to elder care determined appropriate by the State for which the State identifies an unmet need for service personnel.

Protecting Current Workers from Displacement

DSS conforms to Section (a)(5) of the Federal Unemployment Tax Act which requires that a job offered cannot be available as a result of a strike or labor dispute, that the job cannot require the employee to join or prohibit the employee from joining a labor organization, and that program participants are not used to displace regular workers.

In addition, DSS ensures that no participants, including but not limited to those placed in a work experience placement, displace regular paid employees of any of the organizations providing the work experience placement. Such assurance complies with State law contained in 31 Delaware Code, Chapter 9, Section 905(b). This assurance also complies with Section 407(f) of the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA), which requires that DSS will not use federal funds under TANF to place individuals in a work activity when:

In addition, DSS has established a grievance procedure, in conformance with Section 407(f)(3) of PRWORA, for resolving complaints for any alleged violation of nondisplacement requirements. Employees or their representatives who believe that their jobs are being displaced or infringed upon shall present their complaint to the employment contractor with authority over the placement. If the contractor is unable to resolve the problem within 15 days, the employee or representative may file a formal grievance in writing to the DSS Director's Office, who will hear a formal grievance. The employee will have an opportunity to: present his/her grievance on the record; present evidence; bring witnesses and cross-examine witnesses; be represented by counsel; and receive a written decision.

Grievance hearings will be scheduled within 30 calendar days of receipt of the formal grievance, and a written decision will be issued within 30 days of the hearing. If either party is dissatisfied with the State's written decision, they may appeal the decision to the U.S. Department of Labor within 20 days of receipt of the written decision. The procedures for appeal, which must be sent to the Office of Administrative Law Judges, in the U.S. Department of Labor, will be provided in writing with the decision.

PARENTAL RESPONSIBILITY

Adults and minor parent(s) are required to comply with parenting expectations outlined in the Contract of Mutual Responsibility.

Cooperation with The Division of Child Support Enforcement (DCSE)

Participants in TANF must cooperate with the Division of Child Support Enforcement (DCSE) as a condition of eligibility. In addition, all families are required to provide sufficient information to permit Delaware to obtain child support on behalf of the family. Exceptions can be made when the caretaker demonstrates that pursuit of child support would create a danger to the caretaker or the child(ren). It is the responsibility of the client to provide documentation to verify such a good cause claim.

Failure of a caretaker, without good cause, to cooperate with and provide information to the DCSE to permit the State to pursue the collection of child support on behalf of dependent children will result in a full family sanction, until compliance. Applicants who fail to provide information so that Delaware may pursue child support collections will be denied or closed. To cure the child support sanction, the caretaker will provide sufficient information to permit Delaware to pursue child support collections on behalf of the needy children in the family.

When a child lives with both the natural father and the mother but paternity has not been legally established, the parents will be referred to the DCSE for a voluntary acknowledgment of paternity.

When a child lives with the natural father but paternity has not been legally established, the father will complete a declaration of natural relationship document and will provide acceptable verification of relationship.

When a child lives with a relative of the natural father but paternity has not been legally established, the relative must complete a declaration of natural relationship document and provide acceptable verification of relationship.

In Delaware, DCSE determines non-cooperation with child support requirements. In addition, effective January 1, 1999 DCSE began making the determination of good faith efforts to comply.

Distribution of Child Support Collections to TANF Recipients

Delaware is a fill-the-gap state in 1975, uses fill-the-gap to make sure that families do not experience a net loss of income due to the State retaining Child Support paid by absent parents.

SUPPORTIVE SERVICES

Supportive services, such as child care, and TANF provided assistance with other work-related expenses, such as eye examinations and corrective lenses, dental, and physicals not covered by Medicaid, transportation, fees, training, and work-related equipment, uniforms, shoes, and supplies will be available where possible. Services are provided by voucher or directly. In addition, TANF will, on a case-by-case basis, pay fees to purchase certificates, licenses, or testing needed to obtain employment. Medical services are not part of these supportive services. DSS will determine when such services are necessary for a TANF recipient to participate. The services shall include:

Assessment of Barriers related to Mental Health, Substance Use, and Domestic Violence

A standardized screening tool is used by Delaware to identify possible issues related to mental health, substance abuse, and domestic violence. Participants who complete the screening answer questions designed to reveal potential problems related to domestic violence, depression, mania, anxiety, substance use, PTSD, and thoughts of self-harm.

Screening occurs during the TANF intake and at redetermination. Additional screening occurs once a client begins participating with the employment and training programs. This process of multiple screenings allows clients the opportunity to reveal difficulties at the time and place they are most ready to do so.

DSS workers report that the screening frequently reveals significant domestic issues that participants need to resolve. By utilizing the screening, workers are able to refer participants for assistance. Further efforts to assist individuals to resolve domestic violence and other abuse situations are described in a later section: Parental Responsibility: Addressing Problems of Statutory Rape and Domestic Violence.

Addressing Barriers Related to Parental Mental Health and Substance Abuse Problems

The Bridge Program

The Bridge Program assists clients suspected of having problems related to substance abuse, mental health, or domestic violence through screening, assessment, and case management services. The primary role of the Bridge program is to assist clients in accessing appropriate treatment services. The Bridge provider develops a plan with each client that identifies the needed services and develops strategies to ensure compliance with treatment recommendations. The bridge provider may transport clients to appointments and will coordinate with the employment and training vendors to ensure that the client receives credit for their participation in treatment. In their role as case managers and client advocates the Bridge vendor will often assist clients who are facing homelessness or other emergency events resolve these situations.

All adult TANF recipients suspected of having problems related to substance abuse and/or mental health are referred to the Bridge Program. Additionally, Bridge screens all adults for problems related to substance abuse, mental health, and domestic violence as a routine process for adults entering the employment and training programs. A contracted vendor provides the services offered by the Bridge Program. The Bridge vendor is contracted through the Division of Substance Abuse and Mental Health who has collaborated with DSS to provide the Bridge services. The program was modified in 2008 to make the program more accessible to TANF recipients by locating the Bridge services at the Employment Connections sites. The goal of co-locating the Bridge and Employment Connections (EC) vendors is to ensure that case managers from the Bridge Program and the EC vendors engage in on-going joint case planning and case collaboration. This integration of services ensures a long-term focus on self-sufficiency while being responsive to the need for immediate referral and access to treatment services.

Supporting Teens

Delaware is targeting youth by providing special services. Through the Department of Education, Delaware provides a family literacy program which includes parenting skills training and other services to teen parents and their children to prevent repeat pregnancies. Funds are allocated to Delaware’s Teen Pregnancy Prevention Initiative to support activities for at-risk teens primarily in School Based Health Centers (SBHCs). In addition, wellness centers located in 27 high schools provide medical, health and counseling services to high school students.

The Division of Public Heath directs the abstinence education programming through Section 510, Title V Abstinence Education federal funding which is intended to promote the postponement of sexual involvement by teens by changing norms and teaching teens needed skills. The goals of abstinence education funding are to:

Delaware has undertaken, through the Alliance on Adolescent Pregnancy Prevention (AAPP), a grassroots community and media outreach campaign to convince teenagers to postpone sexual activity and to avoid becoming or making someone else pregnant. AAPP works directly with parents in this initiative to improve communication between parents and children around sexuality and pregnancy prevention. In addition, AAPP provides preventive education and distributes information on preventing teen pregnancy, utilizing a number of kinds of interventions. For example, two full-time community educators visit schools, community centers, churches, and camps and provide workshops/training to parents and children around sexuality and teen pregnancy prevention. AAPP also maintains a resource center for the community and lends or gives away brochures, videos, curriculum, posters, books, and other communications about teen pregnancy prevention and sexuality.

The Wise Guys initiative is an adolescent male responsibility program that uses an established Wise Guys curriculum over a ten-week period. The program, operating in some high school based health centers, promotes character development and prevention of adolescent pregnancy by teaching young males self-responsibility in several areas.

Delaware's teen pregnancy prevention campaign also uses billboards to convey the message, and statewide conferences to provide assistance implementing prevention activities.

Delaware's TANF program provides a positive incentive to teenagers to graduate high school by age 19 by awarding a one-time $50 bonus. Additionally, TANF requires teenage mothers currently on welfare to live with their parent(s) or a responsible adult, stay in school, immunize their children and participate in parenting education.

Services to teens are also discussed in the Section entitled: Efforts to Reduce Out-Of-Wedlock Births. (See Page 30)

Early Childhood Intervention

The Delaware Department of Education is the Lead Agency for the state funded Early Childhood Assistance Program (ECAP). ECAPs are designed on the Federal Head Start model. All programs follow Head Start Performance Standards as the foundation for developing their program’s systems and services. ECAP services are comprehensive and include: developmentally appropriate early childhood education, health and nutritional services, parent involvement, family partnerships/services, transportation, services for children with special needs, and transition services.

There are ECAP programs located throughout the state, with multiple grantees in each county. Grantees include Federal Head Start programs, school districts, community early care and education organizations, and a for-profit early care and education program. Services are typically provided following the local school calendars, with some programs operating through the summer. Most of the ECAPs provide full day or wrap-around services to enrolled children. These programs collaborate with CCDF funded subsidized child care or use their own CCDF funds to provide this service to children and their families.

Non-Citizen Households

Families that include legal documented aliens participate in Delaware’s TANF program. While these qualified aliens do not receive federal funded assistance, Delaware supports these families in attaining self-sufficiency thus enabling the family to no longer require assistance. Delaware provides State funded medical assistance for these families as well as employment and training assistance. These interventions, in addition to supporting self-sufficiency, have additionally been found to reduce the likelihood of out of wedlock and teen pregnancies.

Low Income Households

Eligible families who owe Delaware State income taxes may claim the State Earned income credit. Eligible tax payers may be forgiven up to an amount that equals 20 percent of the federal EITC. The State credit, unlike the federal credit, is non-refundable meaning the credit can only be applied to State taxes due.

Services for Working Families in Financial Crisis

Because of the ongoing, pressures on the cost of housing, fuel, and food, many families face temporary crises that place them at risk of displacement from their homes and/or at risk of dissolution of their family units. These working families receive a wide range of one time and on going supports in an effort to maintain the family unit and avoid episodes of TANF assistance. Working families at or below 600% FPL are eligible for supportive services and financial assistance determined to reduce the likelihood of dissolution of the family unit or the need for TANF assistance.

Solely State Funded Programming

Delaware places select groups of TANF eligible families in solely state funded programs. Funding the services these families receive in this way allows the State to provide services that are individualized to the needs of these families and does not subject the family to limitations imposed by federal TANF funding. For example, families in which the parent is unable to work due to a disabling condition are placed in a solely state funded program. This allows the state waive the TANF time limit requirements and place the parent in employment and training activities which are determined based solely on the needs and abilities of the parent as opposed to federally mandated activities which may be inappropriate for the parent. Delaware will continue to explore the opportunities afforded through solely state funded programs and may move all or sub-populations of families with a work eligible adult into solely state funding programs.

TANF BENEFITS TO NEEDY FAMILIES

Computing the Benefit

Eligibility will be determined prospectively. After establishing eligibility, benefits will be computed prospectively. Income per time period will be converted to a monthly income figure by utilizing the following conversion factors:

|

Example: Given a weekly income of $85, multiply by 4.33 to arrive at a monthly income of $368.05.

|

The benefit amount will be determined by using prospective budgeting and the best estimate of earned and unearned income for the assistance unit. The payment will not be changed until the next eligibility determination, unless the recipient reports a change that would result in an increase in the benefit or there is a significant change in circumstances as defined below.

A significant change is defined as any of the following:

The recipient needs to verify all changes in circumstances.

|

EXAMPLE:

An applicant applies in May. The applicant is employed. The applicant is working 20 hours per week and earns $7.25 per hour. The best estimate of wages is calculated by multiplying 20 hours times $7.25 ($145.00 per week), then multiplying the weekly figure by 4.33 to determine the monthly income of $627.85.

|

Delivery of Services Across State

Delivery of services will be consistent across the State.

Redeterminations

At least one redetermination is required every twelve (12) months. TANF emphasizes work and work related activity. Mandating face-to-face redeterminations might undermine that goal. Therefore, mail-in redeterminations with a telephone interview are used as an option to encourage recipients to continue participating in employment and training activities or to keep working.

When a redetermination is due, the recipient must complete a new DSS application form or a DSS renewal form. The redetermination could be completing a paper form or participating in an automated interactive interview. A redetermination is complete when all eligibility factors are examined and a decision regarding continuing eligibility is reached.

The assistance case will be closed if a recipient fails, without good cause, to complete the redetermination review. Likewise, the assistance case of a recipient who fails, without good cause, to provide requested information necessary to establish continued eligibility will be closed.

As part of the verification process for continuing eligibility, the person will provide verification that (s)he has carried out the elements of the individual Contract of Mutual Responsibility.

Benefit Delivery: Direct Payments and Vouchers

Currently, Delaware uses check issuance as the payment method for TANF. Delaware is exploring other options including direct deposit, debit cards, and electronic benefit transfer. Any or all of these methods will be utilized for the issuance of TANF benefits if they become fiscally and technically viable.

Delaware directly pays for center-based childcare authorized for TANF participants, when the center agrees to accept the Delaware childcare reimbursement rate. Some caretakers, however, receive vouchers to self-arrange and pay for their child care. Delaware will reimburse these caretakers, up to the rates published in the Child Care and Development Fund (CCDF) plan, for the cost of childcare provided by licensed and license-exempt childcare providers.

EFFORTS TO REDUCE OUT-OF-WEDLOCK BIRTHS

Jobs for Delaware Graduates

The Jobs for Delaware Graduates (JDG) program provide services to needy children attending middle schools in Delaware with the goal of reducing school dropout rates, keeping children in their homes and the community, and reducing out of wedlock/teen pregnancies. Delaware uses Federal TANF funds and/or State MOE funds to fund the program. The JDG program provides a nationally recognized curriculum. The curriculum supports short and long-term goal setting, academic achievement, acquisition of life skills, and work skill development.

Other Initiatives

Delaware believes that the number of out-of-wedlock births to teens must be reduced significantly to eliminate poverty and dependency. A study by Doble Research Associates commissioned by the Governor's Family Council, in June, 1998, concluded that Delaware's efforts to reduce teen pregnancy, including establishing more after-school programs, strongly enforcing child-support enforcement and the Sexual Predator Act, and making teen mothers ineligible for cash assistance, are solidly supported by public opinion. We are undertaking a number of statewide initiatives to reduce adolescent pregnancy. Many of these initiatives are coordinated through the activities of the Alliance for Adolescent Pregnancy Prevention (AAPP). Ventures include the provision of adolescent health services through school-based health centers and improving teen utilization of our family planning centers.

The AAPP is a statewide public and private partnership charged with the development and implementation of a comprehensive plan to prevent adolescent pregnancy in Delaware. The organizational structure of the Alliance includes a 12 member advisory board appointed by the Governor and a statewide membership of over 200 schools, agencies, organizations, churches, and individuals concerned with teen pregnancy. Staff and program support for the Alliance is provided through a contract from the Division of Public Health (DPH) to Christiana Care.

Since its inception, the AAPP has awarded mini-grants to non-profit youth organizations to provide community based teen pregnancy programs; implemented a statewide media campaign to increase community awareness; and worked with existing coalitions to establish teen pregnancy prevention programs. AAPP plans and activities include:

The Division of Public Health has the lead responsibility in Delaware to implement initiatives to reduce teen pregnancy. Using the strategies and recommendations presented by AAPP, DPH activities include school based health centers, family planning clinics, parenting education, and the peer leadership program. The "teen friendly" services provided at Department of Public Health Units located at State Service Centers have resulted in a significant increase in use. In addition, all clients seen in Sexually Transmitted Disease Clinic sites receive counseling on family planning, as well as pregnancy prevention supplies.

Based on a report by Adolescent Health Survey Research (AHSR), which used a survey and focus groups with youth and their parents conducted early in 1999 to identify top strategies in pregnancy prevention, Delaware implemented a number of initiatives to prevent subsequent births, including:

In addition, family planning and reproductive health services are provided to adults in eight public health locations in Delaware and similar services are provided to adults by Planned Parenthood of Delaware in five locations in the state. Minority populations are targeted through family planning and reproductive health services available at three Federally Qualified Health Centers in Delaware. In addition, family planning and reproductive health services are available to Delaware State University students through the DSU health center.

These Delaware initiatives to reduce out-of-wedlock births are complemented and strengthened by the policies of TANF which:

The goals for the Division of Public Health teen pregnancy prevention are mirrored in the 'Responsible Sexual Behavior' section of the Healthy Delaware 2010 guidebook. They include:

a. By 2010, increase the proportion of teens who abstain from sexual intercourse or use condoms if currently sexually active from 79% to 85%.

b. By 2004, implement an evidence-based media campaign to promote responsible sexual behavior.

c. By 2010, maintain the proportion of youth that report remaining abstinent before age 13 at 90%.

d. By 2005, reduce the birth rate for teenagers aged 15 through 17 from 39.2 to 33.3 per 1,000.

Goals a. and c. are measured through the Youth Risk Behavior Survey administered every two years by the Department of Education. Goal b. has been satisfied by the implementation of an ongoing teen pregnancy prevention media campaign managed by the Alliance for Adolescent Pregnancy Prevention through Christiana Health Care under contract by DPH. Goal d. is measured by the Delaware Health Statistics Center.

Families participate in educational activities that discuss the benefits of marriage and planning to have children when they can be best supported by both parents within the financial management component of employment and training. Our goal is to reduce the out of wedlock birth rate by 1% each year beginning with FFY 2004.

INITIATIVES TO PROMOTE TWO-PARENT FAMILIES

To provide broad-based support for working families, Delaware was one of the first states to recognize that the special eligibility requirements that applied to two-parent families contributed to both the non-formation and the break-up of two-parent households. The six-quarter work history requirement was particularly responsible for non-marriage of teen parents, who had not yet worked enough to meet this qualification. The denial of benefits to two-parent families if one of the parents was working at least 100 hours a month also contributed to the low work rate of two-parent families that were receiving AFDC.

When Delaware eliminated these special deprivation requirements as part of our welfare reform waiver, the numbers of two-parent families receiving TANF soared, and we believe that, without the TANF change, many of these households would have applied for and been found eligible for benefits as single mother families. These never formed two-parent households would have had profound effects on the ability of the family to exit welfare and on the future success of the children. We have found that the average length of stay on TANF is much lower for two-parent families, reflecting the greater incidence of retained employment when two adults are able to engage in work and share child care duties.

Delaware has always allowed taxpayers to file separately and applied the progressive rate structure to each spouse's income separately, which avoided most tax increases resulting from marriage. However, a marriage penalty could still result from uneven standard deduction amounts. By increasing the standard deduction amount for married taxpayers to exactly twice the single standard deduction beginning January 1, 2000, enactment of HB 411 has effectively eliminated the income tax "marriage penalty" in the State of Delaware.

ADDRESSING PROBLEMS OF STATUTORY RAPE AND DOMESTIC VIOLENCE

Statutory Rape

The Sexual Predator Act of 1996 imposes more severe criminal sanctions on adult males who are significantly older than their victims and holds them financially accountable when children are born as a result of violations of this law. Each year an administrative notice regarding the act, ways in which DSS staff can identify appropriate referrals to the Division of Family Services is published

The legislation requires a cooperative agreement as part of a multi-faceted effort to combat teenage pregnancy and reform welfare. Specifically, the law requires the Attorney General's Office, the Department of Health and Social Services, the Department of Services to Children Youth and Their Families, the Department of Public Instruction and law enforcement agencies statewide to establish a cooperative agreement specifying the various roles of the agencies involved. As a result of this legislation the Department of Health and Social Services and the Department of Public Instruction conducts programs designed to reach state and local law enforcement officials, the educational system, and relevant counseling services on the problem of statutory rape.

A new initiative is a partnership with the Delaware Fatherhood and Family Coalition (DFFC). DSS is negotiating with the DFFC to develop programming that will address statutory rape through community presentations and the distribution of literature. The program will provide- education and training on the problem of statutory rape so that teenage pregnancy prevention programs may be expanded in scope to include men.

Victims of Domestic Violence

As required under the optional Certification of Standards and Procedures to Ensure that a State will screen for and identify domestic violence, DSS will refer identified victims of domestic violence to appropriate services such as shelters and counseling and to Family Court. Under the Protection from Abuse Act (PFA), 10 Delaware Code, Chapter 9, Sections 1041-1048 (Attachment D), Family Court has the power and authority to expeditiously adjudicate all matters related to domestic violence including court ordered restraints, custody, property and financial resources.

Through this strong domestic violence law, Delaware is clearly committed to assisting victims of domestic violence to overcome circumstances which put them in physical, emotional and/or financial jeopardy, and to assist them in seeking redress and a safe environment for themselves and their families. The law is a strong deterrent to domestic violence, according to a study by the National Center for State Courts, released on December 2, 1996. The study reported that 86 percent of those who sought protection under the law, which permits individuals in danger of serious physical abuse to obtain a protection order, were no longer being physically abused.

As a part of barrier screening process, DSS caseworkers and Bridge case management staff use standardized instruments to identify victims of domestic violence. Every worker is trained on administering the standardized instrument. As part of this training, staff learns how to recognize and assist women who are victims of domestic violence. The Division of Social Services (DSS) also has trained domestic violence resource workers at every DSS site. The DV Resource worker supports the local office by assisting clients and staff in accessing domestic violence services, applying the domestic violence waiver to the TANF case, and promoting understanding and awareness of the challenges faced by clients. The DV resource worker receives training on domestic violence through an intensive two-day training called Domestic Violence 101. The DV resource workers also meet as a group at regularly scheduled meetings to learn about community resources and to discuss issues in accessing community supports. Community Domestic Violence agencies also attend these meetings to foster networking between DSS and the treatment community. Additional resources and workshops are also provided for the DV resource worker to ensure they have the most relevant and up to date information.

We believe that our methodology of resolving domestic violence situations as quickly as possible, as provided for under a strong statute, is the most appropriate and best course of action to assist current victims and to prevent future violence where possible.