department of insurance

PUBLIC NOTICE

PROPOSED

1501 Medicare Supplement Insurance Minimum Standards

INSURANCE COMMISSIONER MATTHEW DENN hereby gives notice of a proposed change to Department of Insurance Regulation 1501 relating to producer continuing education. The Commissioner proposes to amend Regulation 1501 relating to MEDICARE SUPPLEMENT INSURANCE MINIMUM STANDARDS. The docket number for this proposed amendment is 291.

The proposed change to the regulation appears only in section 17.4.4 of the regulation and is intended to correct the inadvertent omission of certain language designed to clearly indicate that any insurer offering Medicare Supplement Insurance in the State of Delaware is required to offer Plans A, B, C and F to all eligible consumers. This amendment corrects that omission and is the only proposed change to the regulation.

The proposed amendment can also be viewed at the Delaware Insurance Commissioner’s website at: http://www.state.de.us/inscom/departments/documents/ProposedRegs/ProposedRegs.shtml.

The Department of Insurance does not plan to hold a public hearing on the proposed changes. Any person can file written comments, suggestions, briefs, and compilations of data or other materials concerning the proposed amendment. Any written submission in response to this notice and relevant to the proposed change must be received by the Department of Insurance no later than 4:30 p.m., Wednesday, December 3, 2006, and should be addressed to Deputy Attorney General Michael J. Rich, c/o Delaware Department of Insurance, 841 Silver Lake Boulevard, Dover, DE 19904, or sent by fax to 302.739.5566 or email to michael.rich@state.de.us.

1501 Medicare Supplement Insurance Minimum Standards

The purpose of this regulation is to provide for the reasonable standardization of coverage and simplification of terms and benefits of Medicare supplement policies or contracts; to facilitate public understanding and comparison of such policies; to eliminate provisions contained in such policies which may be misleading or confusing in connection with the purchase of such policies or with the settlement of claims; and to provide for full disclosures in the sale of accident and sickness insurance coverages to persons eligible for Medicare.

This regulation is issued pursuant to the authority vested in the Commissioner under 18 Del.C. §§311 and 3403.

3.1 Except as otherwise specifically provided in Sections 7, 13, 14, 17 and 22, this regulation shall apply to:

3.1.1 All Medicare supplement policies delivered or issued for delivery in this State on or after the effective date of this regulation, and

3.1.2 All certificates issued under group Medicare supplement policies which certificates have been delivered or issued for delivery in this State.

3.2 This regulation shall not apply to a policy or contract of one or more employers or labor organizations, or of the trustees of a fund established by one or more employers or labor organizations, or combination thereof, for employees or former employees, or a combination thereof, or for members or former members, or a combination thereof, of the labor organizations.

For purposes of this regulation:

4.1 “Applicant” means:

4.1.1 In the case of an individual Medicare supplement policy, the person who seeks to contract for insurance benefits, and

4.1.2 In the case of a group Medicare supplement policy, the proposed certificateholder.

4.2 “Bankruptcy” means when a Medicare Advantage organization that is not an issuer has filed, or has had filed against it, a petition for declaration of bankruptcy and has ceased doing business in the state.

4.3 “Certificate” means any certificate delivered or issued for delivery in this state under a group Medicare supplement policy.

4.4 “Certificate Form” means the form on which the certificate is delivered or issued for delivery by the issuer.

4.5 “Continuous Period of Creditable Coverage” means the period during which an individual was covered by creditable coverage, if during the period of the coverage the individual had no breaks in coverage greater than sixty-three (63) days.

4.6 “Creditable Coverage”

4.6.1 “Creditable Coverage” means, with respect to an individual, coverage of the individual provided under any of the following:

4.6.1.1 A group health plan;

4.6.1.2 Health insurance coverage;

4.6.1.3 Part A or Part B of Title XVIII of the Social Security Act (Medicare);

4.6.1.4 Title XIX of the Social Security Act (Medicaid), other than coverage consisting solely of benefits under section 1928;

4.6.1.5 Chapter 55 of Title 10 United States Code (CHAMPUS)

4.6.1.6 A medical care program of the Indian Health Service or of a tribal organization;

4.6.1.7 A State health benefits risk pool;

4.6.1.8 A health plan offered under Chapter 89 of Title 5 United States Code (Federal Employees Health Benefits Program);

4.6.1.9 A public health plan as defined in federal regulation; and

4.6.1.10 A health benefit plan under section 5(e) of the Pace Corps Act (22 United States Code 2504(e)).

4.6.2 “Creditable Coverage” shall not include one or more, or any combination of, the following:

4.6.2.1 Coverage only for accident or disability income insurance, or any combination thereof;

4.6.2.2 Coverage issued as a supplement to liability insurance;

4.6.2.3 Liability insurance, including general liability insurance and automobile liability insurance;

4.6.2.4 Workers’ compensation or similar insurance;

4.6.2.5 Automobile medical payment insurance;

4.6.2.6 Credit-only insurance;

4.6.2.7 Coverage for on-site medical clinics; and

4.6.2.8 Other similar insurance coverage, specified in federal regulations, under which benefits for medical care are secondary or incidental to other insurance benefits.

4.6.3 “Creditable Coverage” shall not include the following benefits if they are provided under a separate policy, certificate, or contract of insurance or are otherwise not an integral part of the plan:

4.6.3.1 Limited scope dental or vision benefits;

4.6.3.2 Benefits for long-term care, nursing home care, home health care, community-based care, or any combination thereof; and

4.6.3.3 Such other similar, limited benefits as are specified in federal regulations.

4.6.4 “Creditable coverage: shall not include the following benefits if offered as independent, noncoordinated benefits:

4.6.3.1 Coverage only for a specified disease or illness; and

4.6.3.2 Hospital indemnity or other fixed indemnity insurance.

4.6.5 “Creditable Coverage” shall not include the following if it is offered as a separate policy, certificate of contract of insurance:

4.6.5.1 Medicare supplemental health insurance as defined under section 1882(g)(1) of the Social Security Act;

4.6.5.2 Coverage supplemental to the coverage provided under Chapter 55 of Title 10, United States Code; and

4.6.5.3 Similar supplemental coverage provided to coverage under a group health plan.

4.7 “Employee Welfare Benefit Plan” means a plan, fund or program of employee benefits as defined in 29 U.S.C. section 1002 (Employee Retirement Income Security Act).

4.8 “Insolvency” means when an issuer, licensed to transact the business of insurance in this state, has had a final order of liquidation entered against it with a finding of insolvency by a court of competent jurisdiction in the issuer’s state of domicile.

4.9 “Issuer” includes insurance companies, fraternal benefit societies, health care service plans, health maintenance organizations, and any other entity delivering or issuing for delivery in this state Medicare supplement policies or certificates.

4.10 “Medicare” means the “Health Insurance for the Aged Act,” Title XVIII of the Social Security Amendments of 1965, as then constituted or later amended.

4.11 “Medicare Advantage Plan” means a plan of coverage for health benefits under Medicare Part C as defined in [refer to definition of Medicare Advantage plan in 42 U.S.C. §1395w-28(b)(1)], and includes:

4.11.1 Coordinated care plans which provide health care services, including but not limited to health maintenance organization plans (with or without a point-of-service option), plans offered by provider-sponsored organizations, and preferred provider organization plans;

4.11.2 Medical savings account plans coupled with a contribution into a Medicare Advantage plan medical savings account; and

4.11.3 Medicare Advantage private fee-for-service plans.

4.12 “Medicare Supplement Policy” means a group or individual policy of accident and sickness insurance or a subscriber contract other than a policy issued pursuant to a contract of hospital and medical service associations or health maintenance organizations, under section 1876 of the Federal Social Security Act (42 U.S.C. section 1395 et seq.) or an issued policy under a demonstration project specified in 42 U.S.C. §1395ss(g)(1), which is advertised, marketed or designed primarily as a supplement to reimbursements under Medicare for the hospital, medical or surgical expenses of persons eligible for Medicare. "Medicare supplement policy" does not include Medicare Advantage plans established under Medicare Part C, Outpatient Prescription Drug plans established under Medicare Part D, or any Health Care Prepayment Plan (HCPP) that provides benefits pursuant to an agreement under §1833(a)(1)(A) of the Social Security Act.

4.13 “Policy Form” means the form on which the policy is delivered or issued for delivery by the issuer.

4.14 “Secretary” means the Secretary of the United States Department of Health and Human Services.

No policy or certificate may be advertised, solicited or issued for delivery in this state as a Medicare supplement policy or certificate unless such policy or certificate contains definitions or terms which conform to the requirements of this section.

5.1 “Accident,” “Accidental Injury,” or “Accidental Means” shall be defined to employ “result” language and shall not include words which establish an accidental means test or use words such as “external, violent, visible wounds” or similar words of description or characterization.

5.1.1 The definition shall not be more restrictive than the following: “Injury or injuries for which benefits are provided means accidental bodily injury sustained by the insured person which is the direct result of an accident, independent of disease or bodily infirmity or any other cause, and occurs while insurance coverage is in force.”

5.1.2 The definition may provide that injuries shall not include injuries for which benefits are provided or available under any workers’ compensation, employer’s liability or similar law, or motor vehicle no-fault plan, unless prohibited by law.

5.2 “Benefit Period” or “Medicare Benefit Period” shall not be defined more restrictively than as defined in the Medicare program.

5.3 “Convalescent Nursing Home,” “Extended Care Facility,” or “Skilled Nursing Facility” shall not be defined more restrictively than as defined in the Medicare program.

5.4 “Health Care Expenses” means, for purposes of Section 14, expenses of health maintenance organizations associated with the delivery of health care services, which expenses are analogous to incurred losses of insurers.

5.5 “Hospital” may be defined in relation to its status, facilities and available services or to reflect its accreditation by the Joint Commission on Accreditation of Hospitals, but not more restrictively than as defined in the Medicare program.

5.6 “Medicare” shall be defined in the policy and certificate. Medicare may be substantially defined as “The Health Insurance for the Aged Act, Title XVIII of the Social Security Amendments of 1965 as then constituted or later amended,” or “Title I, Part I of Public Law 89-97, as Enacted by the Eighty-Ninth Congress of the United States of America and popularly known as the Health Insurance for the Aged Act, as then constituted and any later amendments or substitutes thereof,” or words of similar import.

5.7 “Medicare Eligible Expenses” shall mean expenses of the kinds covered by Medicare Parts A and B, to the extent recognized as reasonable and medically necessary by Medicare.

5.8 “Physician” shall not be defined more restrictively than as defined in the Medicare program.

5.9 “Sickness” shall not be defined to be more restrictive than the following:

“Sickness means illness or disease of an insured person which first manifests itself after the effective date of insurance and while the insurance is in force.”

The definition may be further modified to exclude sicknesses or diseases for which benefits are provided under any workers’ compensation, occupational disease, employer’s liability or similar law.

6.1 Except for permitted preexisting condition clauses as described in section 7.1.1 and section 8.1.1 of this Regulation, no policy or certificate may be advertised, solicited or issued for delivery in this state as a Medicare supplement policy if the policy or certificate contains limitations or exclusions on coverage that are more restrictive than those of Medicare.

6.2 No Medicare supplement policy or certificate may use waivers to exclude, limit or reduce coverage or benefits for specifically named or described preexisting diseases or physical conditions.

6.3 No Medicare supplement policy or certificate in force in the State shall contain benefits which duplicate benefits provided by Medicare.

6.4 Issuance and renewal

6.4.1 Subject to sections 7.1.4, 5 and 7, and 8.1.4 and 5, a Medicare supplement policy with benefits for outpatient prescription drugs in existence prior to January 1, 2006 shall be renewed for current policyholders who do not enroll in Part D at the option of the policyholder.

6.4.2 A Medicare supplement policy with benefits for outpatient prescription drugs shall not be issued after December 31, 2005.

6.4.3 After December 31, 2005, a Medicare supplement policy with benefits for outpatient prescription drugs may not be renewed after the policyholder enrolls in Medicare Part D unless:

6.4.3.1 The policy is modified to eliminate outpatient prescription coverage for expenses of outpatient prescription drugs incurred after the effective date of the individual's coverage under a Part D plan and;

6.4.3.2 Premiums are adjusted to reflect the elimination of outpatient prescription drug coverage at the time of Medicare Part D enrollment, accounting for any claims paid, if applicable.

Drafting Note: After December 31, 2005, MMA prohibits issuers of Medicare supplement policies from renewing outpatient prescription drug benefits for both pre-standardized and standardized Medicare supplement policyholders who enroll in Medicare Part D. Before May 15, 2006, these beneficiaries have two options: retain their current plan with outpatient prescription drug coverage removed and premiums adjusted appropriately; or enroll in a different policy as guaranteed for beneficiaries affected by these changes mandated by MMA and outlined in Section 12, "Guaranteed Issue for Eligible Persons." After May 15, 2006 however, these beneficiaries will only retain a right to keep their original policies, stripped of outpatient prescription drug coverage, and lose the right to guaranteed issue of the plans described in Section 12.

No policy or certificate may be advertised, solicited or issued for delivery in this State as a Medicare supplement policy or certificate unless it meets or exceeds the following minimum standards. These are minimum standards and do not preclude the inclusion of other provisions or benefits which are not inconsistent with these standards.

7.1 General Standards. The following standards apply to Medicare supplement policies and certificates and are in addition to all other requirements of this regulation.

7.1.1 A Medicare supplement policy or certificate shall not exclude or limit benefits for losses incurred more than six (6) months from the effective date of coverage because it involved a preexisting condition. The policy or certificate shall not define a preexisting condition more restrictively than a condition for which medical advice was given or treatment was recommended by or received from a physician within six (6) months before the effective date of coverage.

7.1.2 A Medicare supplement policy or certificate shall not indemnify against losses resulting from sickness on a different basis than losses resulting from accidents.

7.1.3 A Medicare supplement policy or certificate shall provide that benefits designed to cover cost sharing amounts under Medicare will be changed automatically to coincide with any changes in the applicable Medicare deductible amount and co-payment percentage factors. Premiums may be modified to correspond with such changes.

7.1.4 A “noncancellable,” “guaranteed renewable,” or “noncancellable and guaranteed renewable” Medicare supplement policy shall not:

7.1.4.1 Provide for termination of coverage of a spouse solely because of the occurrence of an event specified for termination of coverage of the insured, other than the nonpayment of premium; or

7.1.4.2 Be cancelled or nonrenewed by the insurer solely on the grounds of deterioration of health.

7.1.5 Except as authorized by the Commissioner of this state, an issuer Shall neither cancel nor nonrenew a Medicare supplement policy or certificate for any reason other than nonpayment of premium or material misrepresentation. If a group Medicare supplement insurance policy is terminated by the group policyholder and not replaced as provided in Paragraph 7.1.5.4, the issuer shall offer certificateholders an individual Medicare supplement policy. The issuer shall offer the certificateholder at least the following choices:

7.1.5.1 An individual Medicare supplement policy currently offered by the issuer having comparable benefits to those contained in the terminated group Medicare supplement policy; and

7.1.5.2 An individual Medicare supplement policy which provides only such benefits as are required to meet the minimum standards as defined in section 8.2 of this regulation.

7.1.5.3 If membership in a group is terminated, the issuer shall:

7.1.5.3.1 Offer the certificateholder the conversion opportunities as are described in section 7.1.5; or

7.1.5.3.2 At the option of the group policyholder, offer the certificateholder continuation of coverage under the group policy.

7.1.5.4 If a group Medicare supplement policy is replaced by another group Medicare supplement policy purchased by the same policyholder, the issuer of the replacement policy shall offer coverage to all persons covered under the old group policy on its date of termination. Coverage under the new group policy shall not result in any exclusion for preexisting conditions that would have been covered under the group policy being replaced.

7.1.6 Termination of a Medicare supplement policy or certificate shall be without prejudice to any continuous loss which commenced while the policy was in force, but the extension of benefits beyond the period during which the policy was in force may be predicated upon the continuous total disability of the insured, limited to the duration of the policy benefit period, if any, or to payment of the maximum benefits. Receipt of Medicare Part D benefits will not be considered in determining a continuous loss.

7.1.7 If a Medicare supplement policy eliminates an outpatient prescription drug benefit as a result of requirements imposed by the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, the modified policy shall be deemed to satisfy the guaranteed renewal requirements of this subsection.

7.2 Minimum Benefit Standards.

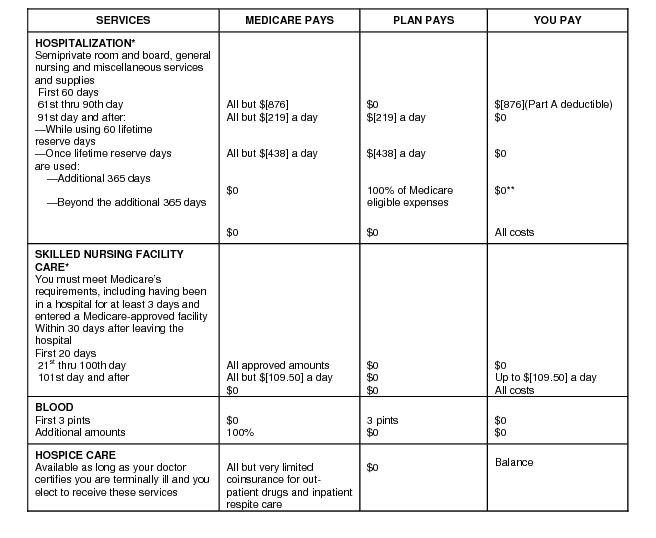

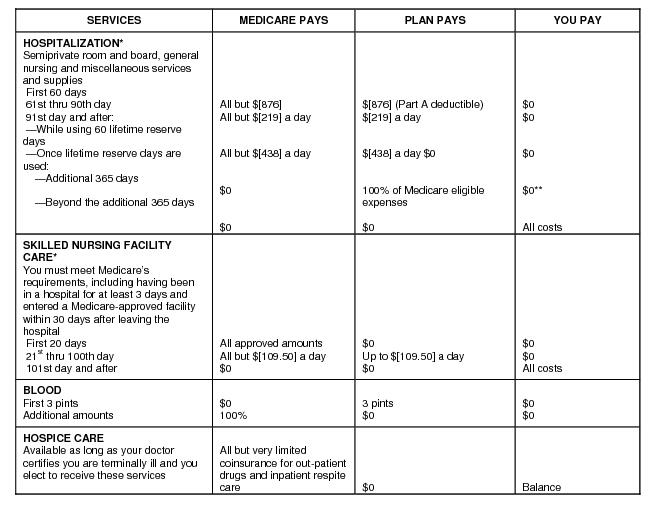

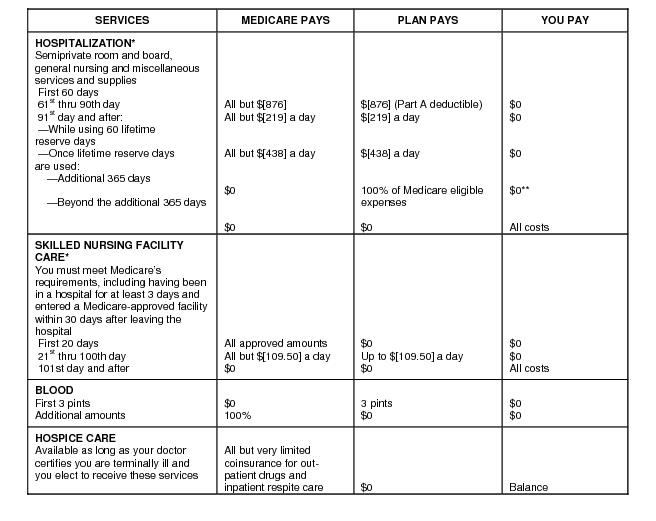

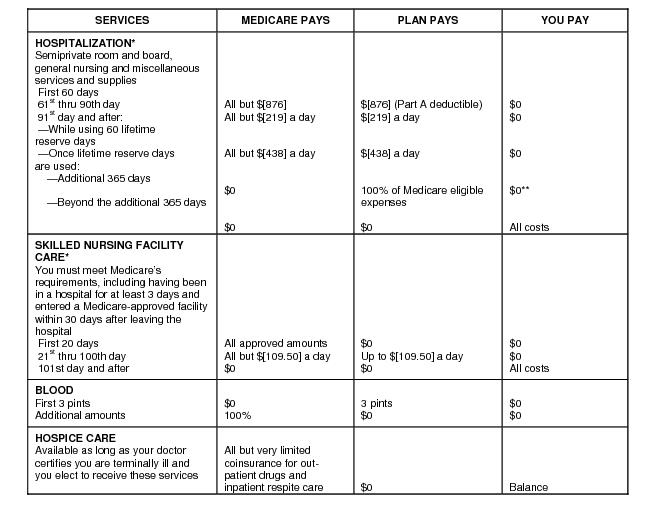

7.2.1 Coverage of Part A Medicare eligible expenses for hospitalization to the extent not covered by Medicare from the 61st day through the 90th day in any Medicare benefit period;

7.2.2 Coverage for either all or none of the Medicare Part A inpatient hospital deductible amount;

7.2.3 Coverage of Part A Medicare eligible expenses incurred as daily hospital charges during use of Medicare’s lifetime hospital inpatient reserve days;

7.2.4 Upon exhaustion of all Medicare hospital inpatient coverage including the lifetime reserve days, coverage of ninety percent (90%) of all Medicare Part A eligible expenses for hospitalization not covered by Medicare subject to a lifetime maximum benefit of an additional 365 days;

7.2.5 Coverage under Medicare Part A for the reasonable cost of the first three (3) pints of blood (or equivalent quantities of packed red blood cells, as defined under federal regulations) unless replaced in accordance with federal regulations or already paid for under Part B;

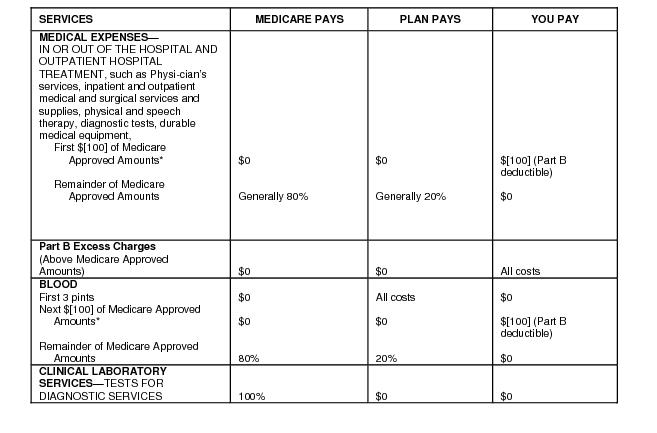

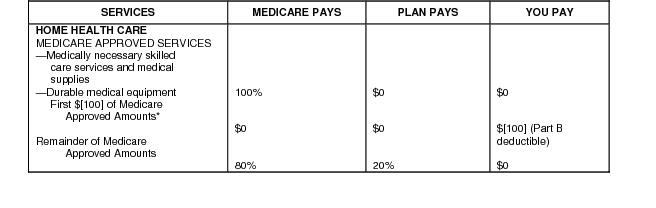

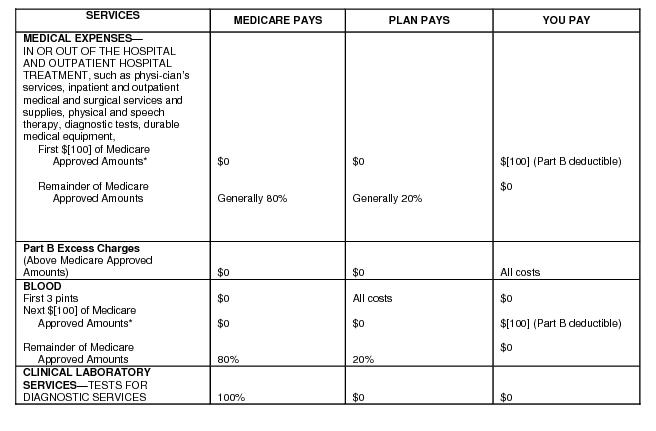

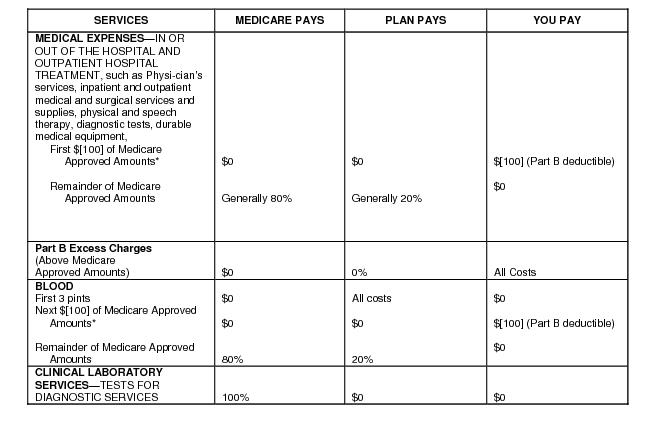

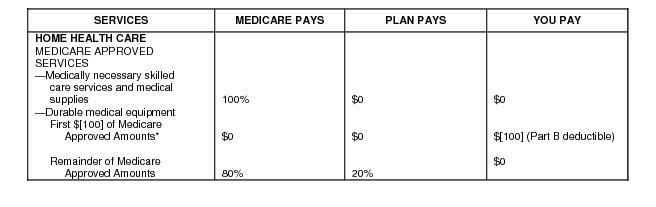

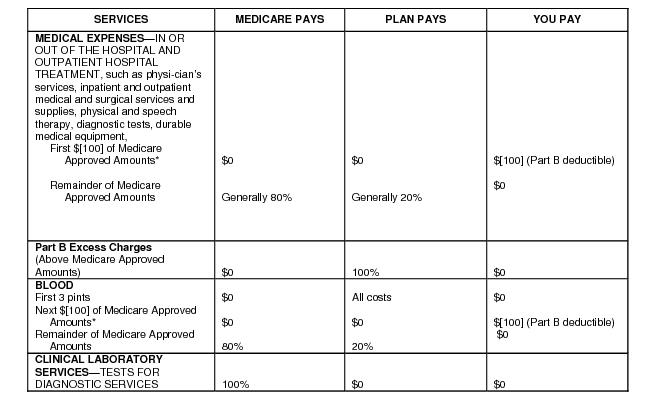

7.2.6 Coverage for the coinsurance amount, or in the case of hospital outpatient department services paid under a prospective payment system, the copayment amount of Medicare eligible expenses under Part B regardless of hospital confinement, subject to a maximum calendar year out-of-pocket amount equal to the Medicare Part B deductible [$100];

7.2.7 Effective January 1, 1990, coverage under Medicare Part B for the reasonable cost of the first three (3) pints of blood (or equivalent quantities of packed red blood cells, as defined under federal regulations), unless replaced in accordance with federal regulations or already paid for under Part A, subject to the Medicare deductible amount.

7.2.8 Cancer Screening every other year for both men and women as recommended by the U.S. Department of Health and Human Services, Office of Disease Prevention and Health Promotion, except that nothing in this section shall contravene section 7.1 of this regulation.

7.2.9 Annual influenza immunizations.

The following standards are applicable to all Medicare supplement policies of certificates delivered or issued for delivery in this State on or after January 1, 1992. No policy or certificate may be advertised, solicited, delivered or issued for delivery in this State as a Medicare supplement policy or certificate unless it complies with these benefit standards.

8.1 General Standards. The following standards apply to Medicare supplement policies and certificates and are in addition to all other requirements of this regulation.

8.1.1 A Medicare supplement policy or certificate shall not exclude or limit benefits for losses incurred more than six (6) months from the effective date of coverage because it involved a preexisting condition. The policy or certificate may not define a preexisting condition more restrictively than a condition for which medical advice was given or treatment was recommended by or received from a physician within six (6) months before the effective date of coverage.

8.1.2 A Medicare supplement policy or certificate shall not indemnify against losses resulting from sickness on a different basis than losses resulting from accident.

8.1.3. A Medicare supplement policy or certificate shall provide that benefits designed to cover cost sharing amounts under Medicare will be changed automatically to coincide with any changes in the applicable Medicare deductible amount and co-payment percentage factors. Premiums may be modified to correspond with such changes.

8.1.4 No Medicare supplement policy or certificate shall provide for termination of coverage of a spouse solely because of the occurrence of an event specified for termination of coverages of the insured, other than the nonpayment of premium.

8.1.5. Each Medicare supplement policy shall be guaranteed renewable and

8.1.5.1 The issuer shall not cancel or nonrenew the policy solely on the ground of health status of the individual.

8.1.5.2 The issuer shall not cancel or nonrenew the policy for any reason other than nonpayment of premium or materials misrepresentation.

8.1.5.3 If the Medicare supplement policy is terminated by the group policyholder and is not replaced as provided under section 8.1.5.5, the issuer shall offer certificateholders an individual Medicare supplement policy which (at the option of the certificate holder):

8.1.5.3.1 Provides for continuation of the benefits contained

in the group policy; or

8.1.5.3.2 Provides for such benefits that otherwise meet the requirements of this subsection.

8.1.5.4 If an individual is a certificateholder in a group Medicare supplement policy and the individual terminates membership in the group, the issuer shall:

8.1.5.4.1 Offer the certificateholder the conversion opportunity described in section 8.1.5.3; or

8.1.5.4.2 At the option of the group policyholder, offer the certificateholder continuation of coverage under the group policy.

8.1.5.5 If a group Medicare supplement policy is replaced by another group Medicare supplement policy purchased by the same policyholder, the issuer of the replacement policy shall offer coverage to all persons covered under the old group policy on its date of termination. Coverage under the new policy shall not result in any exclusion for preexisting conditions that would have been covered under the group policy being replaced.

8.1.5.6 If a Medicare supplement policy eliminates an outpatient prescription drug benefit as a result of requirements imposed by the Medicare Prescription Drug, Improvement and Modernization Act of 2003, the modified policy shall be deemed to satisfy the guaranteed renewal requirements of this paragraph.

8.1.6 Termination of a Medicare supplement policy or certificate shall be without prejudice to any continuous loss which commenced while the policy was in force, but the extension of benefits beyond the period during which the policy was in force may be conditioned upon the continuous total disability of the insured, limited to the duration of the policy benefit period, if any, or payment of the maximum benefits. Receipt of Medicare Part D benefits will not be considered in determining a continuous loss.

8.1.7 Policy or Certificate Suspension

8.1.7.1 A Medicare supplement policy or certificate shall provide that benefits and premiums under the policy or certificate shall be suspended at the request of the policyholder or certificateholder for the period (not to exceed twenty-four (24) months) in which the policyholder or certificateholder has applied for and is determined to be entitled to medical assistance under Title XIX of the Social Security Act, but only if the policyholder or certificateholder notifies the issuer of such policy or certificate within ninety (90) days after the date the individual becomes entitled to such assistance. Upon receipt of timely notice, the issuer shall return to the policyholder or certificateholder that portion of the premium attributable to the period of Medicaid eligibility, subject to adjustment for paid claims.

8.1.7.2 If such suspension occurs and if the policyholder or certificateholder loses entitlement to such medical assistance, such policy or certificate shall be automatically reinstituted (effective as of the date of termination of such entitlement) as of the termination of such entitlement, if the policyholder or certificate holder provides notice of loss of such entitlement within ninety (90) days after the date of such loss and pays the premium attributable to the period, effective as of the date of termination of such entitlement.

8.1.7.3 Each Medicare supplement policy shall provide that benefits and premiums under the policy shall be suspended (for any period that may be provided by federal regulation) at the request of the policyholder if the policyholder is entitled to benefits under section 226(b) of the Social Security Act and is covered under a group health plan (as defined in section 1862(b)(1)(A)(v) of the Social Security Act.). If suspension occurs and if the policyholder or certificate holder loses coverage under the group health plan, the policy shall be automatically reinstituted (effective as of the date of loss of coverage) if the policyholder provides notice of loss of coverage within 90 days after the date of the loss and pays the premium attributable to the period, effective as of the date of termination of enrollment in the group health plan.

8.1.7.4 Reinstitution of coverages as described in sections 8.1.7.2 and 8.1.7.3:

8.1.7.4.1 Shall not provide for any waiting period with respect to treatment of preexisting conditions;

8.1.7.4.2 Shall provide for resumption of coverage that is substantially equivalent to coverage in effect before the date of such suspension. If the suspended Medicare supplement policy provided coverage for outpatient prescription drugs, reinstitution of the policy for Medicare Part D enrollees shall be without coverage for outpatient prescription drugs and shall otherwise provide substantially equivalent coverage to the coverage in effect before the date of suspension; and

8.1.7.4.3 Shall provide for classification of premiums on terms as favorable to the policyholder or certificateholder as the premium classification terms that would have applied to the policyholder or certificateholder had the coverage not been suspended.

8.2 Standards for Basic (“Core”) Benefits Common to Benefit Plans A-J.

Every issuer shall make available a policy or certificate including only the following basic “core” package of benefits to each prospective insured. An issuer may make available to prospective insureds any of the other Medicare Supplement Insurance Benefit Plans in addition to the basic “core” package, but not in lieu of it:

8.2.1 Coverage of Part A Medicare Eligible Expenses for hospitalization to the extent not covered by Medicare from the 61st day through the 90th day in any Medicare benefit period;

8.2.2 Coverage of Part A Medicare Eligible Expenses incurred for hospitalization to the extent not covered by Medicare for each Medicare lifetime inpatient reserve day used;

8.2.3 Upon exhaustion of the Medicare hospital inpatient coverage including the lifetime reserve days, coverage of 100% of the Medicare Part A eligible expenses for hospitalization paid at the applicable prospective payment system (PPS) rate, or other appropriate Medicare standard of payment, subject to a lifetime maximum benefit of an additional 365 days. The provider must accept the issuer’s payment as payment in full and may not bill the insured for any balance;

8.2.4 Coverage under Medicare Parts A and B for the reasonable cost of the first three (3) pints of blood (or equivalent quantities of packaged red blood cells as defined under federal regulations) unless replaced in accordance with federal regulations.

8.2.5 Coverage for the coinsurance amount, or in the case of hospital outpatient department services paid under a prospective payment system, the copayment amount, of Medicare eligible expenses under Part B regardless of hospital confinement, subject to the Medicare Part B deductible.

8.3 Standards for Additional Benefits. The following additional benefits shall be included in Medicare Supplement Benefit Plans “B” through “J” only as provided by section 9 of this Regulation.

8.3.1 Medicare Part A Deductible: Coverage for all of the Medicare Part A inpatient hospital deductible amount per benefit period.

8.3.2 Skilled Nursing Facility Care: Coverage for the actual billed charges up to the coinsurance amount from the 21st day through the 100th day in a Medicare benefit period for post-hospital skilled nursing facility care eligible under Medicare Part A.

8.3.3 Medicare Part B Deductible: Coverage for all of the Medicare Part B deductible amount per calendar year regardless of hospital confinement.

8.3.4 Eighty Percent (80%) of the Medicare Part B Excess Charges: Coverage for eighty percent (80%) of the difference between the actual Medicare Part B charge as billed, not to exceed any charge limitation established by the Medicare program or state law, and the Medicare-approved Part B charge.

8.3.5 One Hundred Percent (100%) of the Medicare Part B Excess Charges: Coverage for all of the difference between the actual Medicare Part B charge as billed, not to exceed any charge limitation established by the Medicare program or state law, and the Medicare-approved Part B charge.

8.3.6 Basic Outpatient Prescription Drug Benefit: Coverage for fifty percent (50%) of outpatient prescription drug charges, after a two hundred fifty dollar ($250) calendar year deductible, to a maximum of one thousand two hundred fifty dollars ($1,250) in benefits received by the insured per calendar year, to the extent not covered by Medicare. The outpatient prescription drug benefit may be included for sale or issuance in a Medicare supplement policy until January 1, 2006.

8.3.7 Extended Outpatient Prescription Drug Benefit: Coverage for fifty percent (50%) of outpatient prescription drug charges, after a two hundred fifty dollar ($250) calendar year deductible to a maximum of three thousand dollars ($3,000) in benefits received by the insured per calendar year, to the extent no coverage by Medicare. The outpatient prescription drug benefit may be included for sale or issuance in a Medicare supplement policy until January 1, 2006.

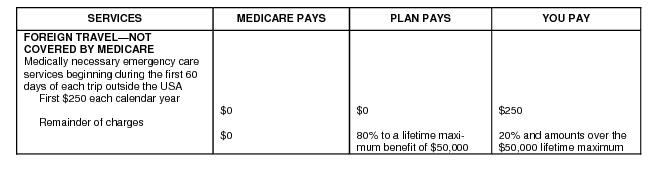

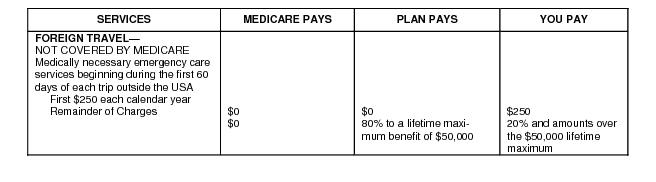

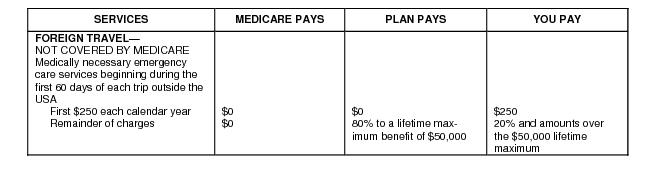

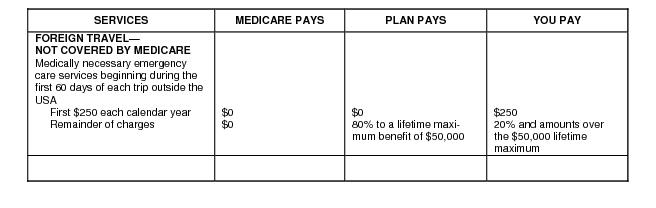

8.3.8 Medically Necessary Emergency Care in a Foreign Country: Coverage to the extent not covered by Medicare for eighty percent (80%) of the billed charges for Medicare-eligible expenses for medically necessary emergency hospital, physician and medical care received in a foreign country, which care would have been covered by Medicare if provided in the United States and which care began during the first sixty (60) consecutive days of each trip outside the United States, subject to a calendar year deductible of two hundred fifty dollars ($250), and a lifetime maximum benefit of fifty thousand dollars ($50,000). For purposes of this benefit, “emergency care” shall mean care needed immediately because of an injury or an illness of sudden and unexpected onset.

8.3.9 Preventive Medical Care Benefit: Reimbursement shall be for the actual charges up to one hundred (100) percent of the Medicare-approved amount for each service, as if Medicare were to cover the service as identified in American Medical Association Current Procedural Terminology (AMA CPT) codes, to a maximum of one hundred twenty dollars ($120) annually under this benefit. This benefit shall not include payment for any procedure covered by Medicare. Coverage shall be provided for the following preventive health services not covered by Medicare:

8.3.9.1 An annual clinical preventive medical history and physical examination that may include tests and services from subsection (b) and patient education to address preventive health care measures.

8.3.9.2 Preventive screening tests or preventive services, the selection and frequency of which is determined to be medically appropriate by the attending physician.

8.3.10 At-Home Recovery Benefit: Coverage for services to provide short term, at-home assistance with activities of daily living for those recovering from an illness, injury or surgery.

8.3.10.1 For purposes of this benefit, the following definitions shall apply:

8.3.10.1.1 “Activities of Daily Living” include, but are not limited to bathing, dressing, personal hygiene, transferring, eating, ambulating, assistance with drugs that are normally self-administered, and changing bandages or other dressings.

8.3.10.1.2 “Care Provider” means a duly qualified or licensed home health aide or homemaker, personal care aide or nurse provided through a licensed home health care agency or referred by a licensed referral agency or licensed nurses registry.

8.3.10.1.3 “Home” shall mean any place used by the insured as a place of residence, provided that such place would qualify as a residence for home health care services covered by Medicare. A hospital or skilled nursing facility shall not be considered the insured’s place of residence.

8.3.10.1.4 “At-home Recovery Visit” means the period of a visit required to provide at home recovery care, without limit on the duration of the visit, except each consecutive 4 hours in a 24-hour period of services provided by a care provider is one visit.

8.3.10.2 Coverage Requirements and Limitations

8.3.10.2.1 At-home recovery services provided must be primarily services which assist in activities of daily living.

8.3.10.2.2 The insured’s attending physician must certify that the specific type and frequency of at-home recovery services are necessary because of a conditioner for which a home care plan of treatment was approved by Medicare.

8.3.10.3 Coverage is limited to:

8.3.10.3.1 No more than the number and type

of at-home recovery visits certified as necessary by the insured’s attending physician. The total number of at-home recovery visits shall not exceed the number of Medicare approved home health care visits under a Medicare approved Home Care Plan of Treatment.

8.3.10.3.2 The actual charges for each visit up to a maximum reimbursement of forty dollars ($40) per visit.

8.3.10.3.3 One thousand six hundred dollars ($1,600) per calendar year.

8.3.10.3.4 Seven (7) visits in any one week.

8.3.10.3.5 Care furnished on a visiting basis in the insured’s home.

8.3.10.3.6 Services provided by a care provider as defined in this section.

8.3.10.3.7 At-home recovery visits while the insured is covered under the policy or certificate and not otherwise excluded.

8.3.10.3.8 At-home recovery visits received during the period the insured is receiving Medicare approved home care services or no more than eight (8) weeks after the service date of the last Medicare approved home health care visit.

8.3.10.4 Coverage is excluded for:

8.3.10.4.1 Home care visits paid for Medicare or other government programs; an

8.3.10.4.2 Care provided by family members, unpaid volunteers or providers who are not care providers.

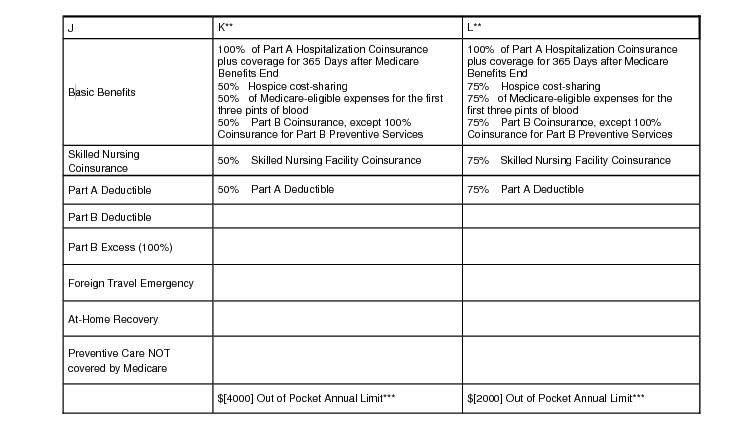

8.4 Standards for Plans K and L

8.4.1 Standardized Medicare supplement benefit plan "K" shall consist of the following:

8.4.1.1 Coverage of 100% of the Part A hospital coinsurance amount for each day used from the 61st through the 90th day in any Medicare benefit period;

8.4.1.2 Coverage of 100% of the Part A hospital coinsurance amount for each Medicare lifetime inpatient reserve day used from the 91st through the 150th day in any Medicare benefit period;

8.4.1.3 Upon exhaustion of the Medicare hospital inpatient coverage, including the lifetime reserve days, coverage of 100% of the Medicare Part A eligible expenses for hospitalization paid at the applicable prospective payment system (PPS) rate, or other appropriate Medicare standard of payment, subject to a lifetime maximum benefit of an additional 365 days. The provider shall accept the issuer's payment as payment in full and may not bill the insured for any balance;

8.4.1.4 Medicare Part A Deductible: Coverage for 50% of the Medicare Part A inpatient hospital deductible amount per benefit period until the out-of-pocket limitation is met as described in section 8.4.1.10;

8.4.1.5 Skilled Nursing Facility Care: Coverage for 50% of the coinsurance amount for each day used from the 21st day through the 100th day in a Medicare benefit period for post-hospital skilled nursing facility care eligible under Medicare Part A until the out-of-pocket limitation is met as described in section 8.4.1.10;

8.4.1.6 Hospice Care: Coverage for 50% of cost sharing for all Part A Medicare eligible expenses and respite care until the out-of-pocket limitation is met as described in section 8.4.1.10;

8.4.1.7 Coverage for 50%, under Medicare Part A or B, of the reasonable cost of the first three (3) pints of blood (or equivalent quantities of packed red blood cells, as defined under federal regulations) unless replaced in accordance with federal regulations until the out-of-pocket limitation is met as described in section 8.4.1.10;

8.4.1.8 Except for coverage provided in subparagraph (i) below, coverage for 50% of the cost sharing otherwise applicable under Medicare Part B after the policyholder pays the Part B deductible until the out-of-pocket limitation is met as described in section 8.4.1.10;

8.4.1.9 Coverage of 100% of the cost sharing for Medicare Part B preventive services after the policyholder pays the Part B deductible; and

8.4.1.10 Coverage of 100% of all cost sharing under Medicare Parts A and B for the balance of the calendar year after the individual has reached the out-of-pocket limitation on annual expenditures under Medicare Parts A and B of $4000 in 2006, indexed each year by the appropriate inflation adjustment specified by the Secretary of the U.S. Department of Health and Human Services.

8.4.2 Standardized Medicare supplement benefit plan "L" shall consist of the following:

8.4.2.1 The benefits described in sections 8.4.1.1, 2, 3, and 9;

8.4.2.2 The benefit described in sections 8.1.4.4, 5, 6, 7, and 8, but substituting 75% for 50%; and

8.4.2.3 The benefit described in Paragraph 8.4.1.10, but substituting $2000 for $4000.

9.1 An issuer shall make available to each prospective policyholder and certificateholder a policy form or certificate form containing only the basic “core” benefits, as defined in sections 8.2 of this regulation.

9.2 No groups, packages or combinations of Medicare supplement benefits other than those listed in this section shall be offered for sale in this state, except as may be permitted in section 9.7 and in section 10 of this regulation.

9.3 Benefit plans shall be uniform in structure, language, designation and format to the standard benefit plans “A” through “L” listed in this subsection and conform to the definitions in section 4 of this regulation. Each benefit shall be structured in accordance with the format provided in sections 8.2 and 8.3, or 8.4 and list the benefits in the order shown in this subsection. For purposes of this section, “structure, language and format” means style, arrangement and overall content of a benefit.

9.4 An issuer may use, in addition to the benefit plan designations required in section 9.3, other designations to the extent permitted by law.

9.5 Make-up of Benefit Plans:

9.5.1 Standardized Medicare supplement benefit plan “A” shall be limited to the basic (“core”) benefits common to all benefit plans, as defined in section 8.2 of this regulation.

9.5.2 Standardized Medicare supplement benefit plan “B” shall include only the following: the core benefit as defined in section 8.2 of this regulation, plus the Medicare Part A deductible as defined in section 8.3.1.

9.5.3 Standardized Medicare supplement benefit plan “C” shall include only the following: The core benefit as defined in section 8.2 of this regulation, plus the Medicare Part A deductible, skilled nursing facility care, Medicare Part B deductible and medically necessary emergency care in a foreign country as defined in sections 8.3.1, 2, 3 and 8 respectively.

9.5.4 Standardized Medicare supplement benefit plan “D” shall include only the following: the core benefit as defined in section 8.2 of this regulation, plus the Medicare Part A deductible, skilled nursing facility care, medically necessary emergency care in a foreign country and the at-home recovery benefit as defined in sections 8.3.1, 2, 8 and 10 respectively.

9.5.5 Standardized Medicare supplement benefit plan “E” shall include only the following: the core benefit as defined in section 8.2 of this regulation, plus the Medicare Part A deductible, skilled nursing facility care, medically necessary emergency care in a foreign country and preventive medical Care as defined in sections 8.3.1, 2, 8 and 9 respectively.

9.5.6 Standardized Medicare supplement benefit plan “F” shall include only the following: the core benefit as described in section 8.2 of this regulation plus the Medicare Part A deductible, the skilled nursing facility care, the Part B deductible, one hundred (100%) of the Medicare Part B excess charges, and the medically necessary emergency care in a foreign country as defined in sections 8.3.1, 2, 3, 5 and 8 respectively.

9.5.7 Standardized Medicare supplement benefit high deductible plan “F” shall include only the following: 100% of covered expenses following the payment of the annual high deductible plan “F” deductible. The covered expenses include the core benefit as defined in section 8.2 of this regulation, plus the Medicare Part A deductible, skilled nursing facility care, the Medicare Part B deductible, one hundred percent (100%) of the Medicare Part B excess charges, and medically necessary emergency care in a foreign country as defined in sections 8.3.1, 2, 3, 5 and 8 respectively. The annual high deductible plan “F” deductible shall consist of out-of-pocket expenses, other than premiums, and shall be in addition to any other specific benefit deductibles. The annual high deductible plan “F” deductible shall be $1500 for 1998 and 1999, and shall be based on the calendar year. It shall be adjusted annually thereafter by the Secretary to reflect the change in the Consumer Price Index for all urban consumers for the twelve-month period ending with August of the preceding year, and rounded to the nearest multiple of $10.

9.5.8 Standardized Medicare supplement benefit plan “G” shall include only the following: The core benefit as defined in section 8.2 of this regulation, plus the Medicare Part A deductible, skilled nursing facility care, eighty percent (80%) of the Medicare Part B excess charges, medically necessary emergency care in a foreign country and the at-home recovery benefit as defined in sections 8.3.1, 2, 4, 8 and 10 respectively.

9.5.9 Standardized Medicare supplement benefit plan “H” shall include only the following: the core benefit as defined in section 8.2 of this regulation, plus the Medicare Part A deductible, skilled nursing facility care, basic prescription drug benefit and medically necessary emergency care in a foreign country as defined in sections 8.3.1, 2, 6 and 8 respectively. The outpatient prescription drug benefit shall not be included in a Medicare supplement policy sold after December 31, 2005.

9.5.10 Standardized Medicare supplement benefit plan “I” shall consist of only the following: the core benefit as defined in section 8.2 of this regulation, plus the Medicare Part A deductible, skilled nursing facility care, one hundred percent (100%) of the Medicare Part B excess charges, basic prescription drug benefit, medically necessary emergency care in a foreign country and at-home recovery benefit as defined in sections 8.3.1, 2, 5, 6, 8 and 10 respectively. The outpatient prescription drug benefit shall not be included in a Medicare supplement policy sold after December 31, 2005.

9.5.11 Standardized Medicare supplement benefit plan “J” shall consist of only the following: the core benefit as defined in section 8.2 of this regulation, plus the Medicare Part A deductible, skilled nursing facility care, Medicare Part B deductible, one hundred percent (100%) of the Medicare Part B excess charges, extended prescription drug benefit, medically necessary emergency care in a foreign country, preventive medical care and at-home recovery benefit as defined in sections 8.3.1, 2, 3, 5, 7, 8, 9 and 10 respectively. The outpatient prescription drug benefit shall not be included in a Medicare supplement policy sold after December 31, 2005.

9.5.12 Standardized Medicare supplement benefit high deductible plan “J” shall consist of only the following: 100% of covered expenses following the payment of the annual high deductible plan “J” deductible. The covered expenses include the core benefit as defined in section 8.2 of this regulation, plus the Medicare Part A deductible, skilled nursing facility care, the Medicare Part B deductible, one hundred percent (100%) of the Medicare Part B excess charges, extended outpatient drug benefit, medically necessary emergency care in a foreign country, preventive medical care benefit and at-home recovery benefit as defined in sections 8.3.1, 2, 3, 5, 7, 8, 9, and 10 respectively. The annual high deductible plan “J” deductible shall consist of out-of-pocket expenses, other than premiums, for services covered by the Medicare supplement plan “J” policy, and shall be in addition to any other specific benefit deductibles. The annual high deductible plan “J” deductible shall be $1500 for 1998 and 1999, and shall be based on the calendar year. It shall be adjusted annually thereafter by the Secretary to reflect the change in the Consumer Price Index for all urban consumers for the twelve-month period ending with August of the preceding year, and rounded to the nearest multiple of $10. The outpatient prescription drug benefit shall not be included in a Medicare supplement policy sold after December 31, 2005.

9.6 Make-up of two Medicare supplement plans mandated by The Medicare Prescription Drug, Improvement and Modernization Act of 2003 (MMA);

9.6.1 Standardized Medicare supplement benefit plan "K" shall consist of only those benefits described in Section 8.4.1.

9.6.2 Standardized Medicare supplement benefit plan "L" shall consist of only those benefits described in Section 8.4.2.

9.7 New or Innovative Benefits: An issuer may, with the prior approval of the commissioner, offer policies or certificates with new or innovative benefits in addition to the benefits provided in a policy or certificate that otherwise complies with the applicable standards. The new or innovative benefits may include benefits that are appropriate to Medicare supplement insurance, new or innovative, not otherwise available, cost-effective, and offered in a manner which is consistent with the goal of simplification of Medicare supplement policies. After December 31, 2005, the innovative benefit shall not include an outpatient prescription drug benefit.

10.1 This section shall apply to Medicare Select policies and certificates, as defined in this section. No policy or certificate may be advertised as a Medicare Select policy or certificate unless it meets the requirements of this section.

10.2 For the purposes of this section:

10.2.1 “Complaint” means any dissatisfaction expressed by an individual concerning a Medicare Select issuer or its network providers.

10.2.2 “Grievance” means dissatisfaction expressed in writing by an individual insured under a Medicare Select policy or certificate with the administration, claims practices or provision of services concerning a Medicare Select issuer or its network providers.

10.2.3 “Medicare Select Issuer” means an issuer offering, or seeking to offer, a Medicare Select policy or certificate.

10.2.4 “Medicare Select Policy” or “Medicare Select Certificate” mean respectively a Medicare supplement policy or certificate that contains restricted network provisions.

10.2.5 “Network Provider” means a provider of health care, or a group of providers of health care which has entered into a written agreement with the issuer to provide benefits insured under a Medicare Select policy.

10.2.6 “Restricted Network Provision” means any provision which conditions the payment of benefits, in whole or in part, on the use of network providers.

10.2.7 “Service Area” means the geographic area approved by the Commissioner within which an issued is authorized to offer a Medicare Select policy.

10.3 The Commissioner may authorize an issuer to offer a Medicare Select policy or certificate, pursuant to his section and section 4358 of the Omnibus Budget Reconciliation Act (OBRA) of 1990 if the Commissioner finds that the issuer has satisfied all of the requirements of this regulation.

10.4 A Medicare Select issue shall not issue a Medicare Select policy or certificate in this State until its plan of operation has been approved by the Commissioner.

10.5 A Medicare Select issuer shall file a proposed plan of operation with the Commissioner in a format prescribed by the Commissioner. The plan of operation shall contain at least the following information:

10.5.1 Evidence that all covered services that are subject to restricted network provisions are available and accessible through network providers, including a demonstration that:

10.5.1.1 Services can be provided by network providers with reasonable promptness with respect to geographic location, hours of operation and after-hour care. The hours of operation and availability of after-hour care shall reflect usual practice in the local area. Geographic availability shall reflect the usual travel times within the community.

10.5.1.2 The number of network providers in the service area is sufficient, with respect to current and expected policyholders, either:

10.5.1.2.1 To deliver adequately all services that are subject to a restricted network provision; or

10.5.1.2.2 To make appropriate referrals.

10.5.1.3 There are written agreements with network providers describing specific responsibilities.

10.5.1.4 Emergency care is available twenty-four (24) hours per day and seven (7) days per week.

10.5.1.5 In the case of covered services that are subject to a restricted network basis, there are written agreements with network providers prohibiting the providers from billing or otherwise seeking reimbursement from or recourse against any individual insured under a Medicare Select policy or certificate. This paragraph shall not apply to supplemental charges or coinsurance amounts as stated in the Medicare Select policy or certificate.

10.5.2 A statement or may providing a clear description of the service area.

10.5.3 A description of the grievance procedure to be utilized.

10.5.4 A description of the quality assurance program, including:

10.5.4.1 The formal organizational structure;

10.5.4.2 The written criteria for selection, retention and removal of network providers; and

10.5.4.3 The procedures for evaluating the quality of care provided by network providers, and the process to initiate corrective action when warranted.

10.5.5 A list and description, by specialty, of the network providers.

10.5.6 Copies of the written information proposed to be used by the issuer to comply with section 10.9.

10.5.7 Any other information requested by the Commissioner.

10.6 A Medicare Select issuer shall file any proposed changes to the plan of operation, except for changes to the list of network providers with the Commissioner prior to implementing such changes. Such changes shall be considered approved by the Commissioner after thirty (30) days unless specifically disapproved. An updated list of network providers shall be filed with the Commissioner at least quarterly.

10.7 A Medicare Select policy or certificate shall not restrict payment for covered services provided by non-network providers if:

10.7.1 The services are for symptoms requiring emergency care or are immediately required for an unforeseen illness, injury or a condition; and

10.7.2 .It is not reasonable to obtain such services through a network provider.

10.8 A Medicare Select policy or certificate shall provide payment for full coverage under the policy for covered services that are not available through network providers.

10.9 A Medicare Select issuer shall make a full and fair disclosure in writing of the provisions, restrictions, and limitations of the Medicare Select policy or certificate to each applicant. This disclosure shall include at least the following:

10.9.1 An outline of coverage sufficient to permit the applicant to compare the coverage and premiums of the Medicare Select policy or certificate with:

10.9.1.1 Other Medicare supplement policies or certificates offered by the issuer; and

10.9.1.2 Other Medicare Select policies or certificates.

10.9.2 A description (including address, phone number and hours of operation) of the network providers, including primary care physicians, specialty physicians, hospitals, and other providers.

10.9.3 A description of the restricted network provisions, including payments for coinsurance and deductibles when providers other than network providers are utilized. Except to the extent specified in the policy or certificate, expenses incurred when using out-of-network providers do not count toward the out-of-pocket annual limit contained in plans K and L.

10.9.4 A description of coverage for emergency and urgently needed care and other out of service area coverage.

10.9.5 A description of limitations on referrals to restricted network providers and to other providers.

10.9.6 A description of the policyholder’s rights to purchase any other Medicare supplement policy or certificate otherwise offered by the issuer.

10.9.7 A description of the Medicare Select issuer’s quality assurance program and grievance procedure.

10.10 Prior to the sale of a Medicare Select policy or certificate, a Medicare Select issuer shall obtain from the applicant a signed and dated form stating that the applicant has received the information provided pursuant to section 10.9 of this section and that the applicant understands the restrictions of the Medicare Select policy or certificate.

10.11 A Medicare Select issuer shall have and use procedures for hearing complaints and resolving written grievances from the subscribers. Such procedures shall be aimed at mutual agreement for settlement and may include arbitration procedures.

10.11.1 The grievance procedure shall be described in the policy and certificates and in the outline of coverage.

10.11.2 At the time the policy or certificate is issued, the issuer shall provide detailed information to the policyholder describing how a grievance may be registered with the issuer.

10.11.3 Grievances shall be considered in a timely manner and shall be transmitted to appropriate decision-makers who have authority to fully investigate the issue and take corrective action.

10.11.4 If a grievance is found to be valid, corrective action shall be taken promptly

10.11.5 All concerned parties shall be notified about the results of a grievance.

10.11.6 The issuer shall report no later than each March 31st to the Commissioner regarding its grievance procedure. The report shall be in a format prescribed by the Commissioner and shall contain the number of grievances filed in the past year and a summary of the subject, nature and resolution of such grievances.

10.12 At the time of initial purchase, a Medicare Select issuer shall make available to each applicant for a Medicare Select policy or certificate the opportunity to purchase any Medicare supplement policy or certificate otherwise offered by the issuer.

10.13 Opportunity to Purchase Medicare Supplement Policy

10.13.1 At the request of an individual insured under a Medicare Select policy or certificate, a Medicare Select issuer shall make available to the individual insured the opportunity to purchase a Medicare supplement policy or certificate offered by the issuer which has comparable or lesser benefits and which does not contain a restricted network provision. The issuer shall make the policies or certificates available without requiring evidence of insurability after the Medicare Select policy or certificate has been in force for six (6) months.

10.13.2 For the purposes of this subsection, a Medicare supplement policy or certificate will be considered to have comparable or lesser benefits unless it contains one or more significant benefits not included in the Medicare Select policy or certificate being replaced. For the purposes of this paragraph, a significant benefit means coverage for the Medicare Part A deductible, coverage for at-home recovery services or coverage for Part B excess charges.

10.14 Medicare Select policies and certificates shall provide for continuation of coverage in the event the Secretary of Health and Human Services determines that Medicare Select policies and certificates issued pursuant to this section should be discontinued due to either the failure of the Medicare Select Program to be re-authorized under law or its substantial amendment.

10.14.1 Each Medicare Select issuer shall make available to each individual insured under a Medicare Select policy or certificate the opportunity to purchase any Medicare supplement policy or certificate offered by the issued which has comparable or lesser benefits and which does not contain a restricted network provision. The issuer shall make such policies and certificates available without requiring evidence of insurability.

10.14.2 For the purposes of this subsection, a Medicare supplement policy or certificate will be considered to have comparable or lesser benefits unless it contains one or more significant benefits not included in the Medicare Select policy or certificate being replaced. For the purposes of this paragraph, a significant benefit means coverage for the Medicare Part A deductible, coverage for at-home recovery services or coverages for Part B excess charges.

10.15 A Medicare Select issuer shall comply with reasonable requests for data made by state or federal agencies, including the United States Department of Health and Human Services, for the purpose of evaluating the Medicare Select Program.

11.1 An issuer shall not deny or condition the issuance or effectiveness of any Medicare supplement policy or certificate available for sale in this state, nor discriminate in the pricing of such a policy or certificate because of the health status, claims experience, receipt of health care, or medical condition of an applicant in the case of an application for a policy or certificate that is submitted prior to or during the six (6) month period beginning with the first day of the first month in which an individual is both 65 years of age or older and is enrolled for benefits under Medicare Part B. Each Medicare supplement policy and certificate currently available from an issuer shall be made available to all applicants who qualify under this subsection without regard to age or eligibility for a group Medicare supplement plan. At a minimum, issuers shall make available, in accordance with this section, Medicare supplement policies or certificates having benefit packages classified as Plans A, B, C and F.

11.2 Exclusions and Preexisting Conditions

11.2.1 If an applicant qualifies under section 11.1 and submits an application during the time period referenced in section 11.1 and, as of the date of the application, has had a continuous period of creditable coverage of at least six months, the issuer shall not exclude benefits based on a preexisting condition.

11.2.2 If the applicant qualifies under section 11.1 and submits an application during the time period referenced in section 11.1 1 and, as of the date of application, has had a continuous period of creditable coverage that is less than six months, the issuer shall reduce the period of any preexisting condition exclusion by the aggregate of the period of creditable coverage applicable to the applicant as of the enrollment date. The Secretary shall specify the manner of the reduction under this subsection.

11.3 Except as provided in section 11.2 and sections 12 and 23.1, section 11.1 shall not be construed as preventing the exclusion of benefits under a policy, during the first six (6) months, based on a preexisting condition for which the policyholder or certificateholder received treatment or was otherwise diagnosed during the six (6) months before the coverage became effective.

12.1 Guaranteed Issue

12.1.1 Eligible persons are those individuals described in section 12.2, who seek to enroll under the policy during the period specified in section 12.3, and who submit evidence of the date of termination, disenrollment, or Medicare Part D enrollment with the application for a Medicare supplement policy.

12.1.2 With respect to eligible persons, an issuer shall not deny or condition the issuance or effectiveness of a Medicare supplement policy described in section 12.5 that is offered and is available for issuance to new enrollees by the issuer, shall not discriminate in the pricing of such a Medicare supplement policy because of health status, claims experience, receipt of health care, or medical condition, and shall not impose an exclusion of benefits based on a preexisting condition under such a Medicare supplement policy.

12.2 An eligible person is an individual described in any of the following paragraphs:

12.2.1 The individual is enrolled under an employee welfare benefit plan that provides health benefits that supplement the benefits under Medicare; and the plan terminates, or the plan ceases to provide some or all such supplemental health benefits to the individual; or the individual is enrolled under an employee welfare benefit plan that is primary to Medicare and the plan terminates or the plan ceases to provide some or all health benefits to the individual because the individual leaves the plan.

12.2.2 The individual is enrolled with a Medicare Advantage organization under a Medicare Advantage plan under part C of Medicare, and any of the following circumstances apply, or the individual is 65 years of age and is enrolled with a Program of All-Inclusive Care for the Elderly (PACE) provider under Section 1894 of the Social Security Act, and there are circumstances similar to those described below that would permit discontinuance of the individual’s enrollment with such provider if such individual were enrolled in a Medicare Advantage plan:

12.2.2.1 The certification of the organization or plan under this part has been terminated; or

12.2.2.2 The organization has terminated or otherwise discontinued providing the plan in the area in which the individual resides;

12.2.2.3 The individual is no longer eligible to elect the plan because of a change in the individual’s place of residence or other change in circumstances specified by the Secretary, but not including termination of the individual’s enrollment on the basis described in section 1851(g)(3)(B) of the federal Social Security Act (where the individual has not paid premiums on a timely basis or has engaged in disruptive behavior as specified in standards under section 1856), or the plan is terminated for all individuals within a residence area;

12.2.2.4 The individual demonstrates, in accordance with guidelines established by the Secretary, that

12.2.2.4.1 The organization offering the plan substantially violated a material provision of the organization’s contract under this part in relation to the individual, including the failure to provide an enrollee on a timely basis medically necessary care for which benefits are available under the plan or the failure to provide such covered care in accordance with applicable quality standards; or

12.2.2.4.2 The organization, or agent or other entity acting on the organization’s behalf, materially misrepresented the plan’s provisions in marketing the plan to the individual; or

12.2.2.5 The individual meets such other exceptional conditions as the Secretary may provide.

12.2.3 The individual is enrolled with:

12.2.3.1 An eligible organization under a contract under section 1876 of the Social Security Act (Medicare Cost);

12.2.3.2 A similar organization operating under demonstration project authority, effective for periods before April 1, 1999;

12.2.3.3 An organization under an agreement under section 1833(a)(1)(A) of the Social Security Act (health care prepayment plan); or

12.2.3.4 An organization under a Medicare Select policy; and

12.2.3.5 The enrollment ceases under the same circumstances that would permit discontinuance of an individual’s election of coverage under section 12.2.2.

12.2.4 The individual is enrolled under a Medicare supplement policy and the enrollment ceases because:

12.2.4.1 Of the insolvency of the issuer or bankruptcy of the non-issuer organization or of other involuntary termination of coverage or enrollment under the policy;

12.2.4.2 The issuer of the policy substantially violated a material provision of the policy; or

12.2.4.3 The issuer, or an agent or other entity acting on the issuer’s behalf, materially misrepresented the policy’s provisions in marketing the policy to the individual;

12.2.5 Subsequent first time enrollment with Medicare Advantage

12.2.5.1 The individual was enrolled under a Medicare supplement policy and terminates enrollment and subsequently enrolls, for the first time, with any Medicare Advantage organization under a Medicare Advantage plan under part C of Medicare, any eligible organization under a contract under section 1876 of the Social Security Act (Medicare cost), any similar organization operating under demonstration project authority, any PACE provider under section 1894 of the Social Security Act, or a Medicare Select policy; and

12.2.5.2 The subsequent enrollment under subparagraph (a) is terminated by the enrollee during any period within the first twelve (12) months of such subsequent enrollment (during which the enrollee is permitted to terminate such subsequent enrollment under section 1851(e) of the federal Social Security Act); or

12.2.6 The individual, upon first becoming eligible for benefits under Part A of Medicare at age 65, enrolls in a Medicare Advantage plan under Part C of Medicare, or with a PACE provider under section 1894 of the social Security Act, and disenrolls from the plan or program by not later than twelve (12) months after the effective date of enrollment.

12.2.7 The individual enrolls in a Medicare Part D plan during the initial enrollment period and, at the time of enrollment in Part D, was enrolled under a Medicare supplement policy that covers outpatient prescription drugs and the individual terminates enrollment in the Medicare supplement policy and submits evidence of enrollment in Medicare Part D along with the application for a policy described in section 12.5.4.

12.3 Guaranteed Issue Time Periods

12.3.1 In case of an individual described in section 12.2.1, the guaranteed issue period begins on the later of:

12.3.1.1 the date the individual receives a notice of termination or cessation of all supplemental health benefits (or if a notice is not received, notice that a claim has been denied because of such a termination or cessation); or

12.3.1.2 the date that the applicable coverage terminates or ceases; and ends sixty-three (63) days thereafter;

12.3.2 In the case of an individual described in sections 12.2.2, 3, 5 or 6 whose enrollment is terminated involuntarily, the guaranteed issue period begins on the date that the individual receives a notice of termination and ends sixty-three (63) days after the date the applicable coverage is terminated;

12.3.3 In the case of an individual described in section 12.2.4.1, the guaranteed issue period begins on the earlier of:

12.3.3.1 the date that the individual receives a notice of termination, a notice of the issuer’s bankruptcy or insolvency, or other such similar notice if any, and

12.3.3.2 the date that the applicable coverage is terminated and ends on the date that is sixty-three (63) days after the date the coverage is terminated;

12.3.4 In the case of an individual described in sections 12.2.2, 12.2.4.2, 12.2.4.3, 12.2.5 or 12.2.6 who disenrolls voluntarily, the guaranteed issue period begins on the date that is sixty (60) days before the effective date of the disenrollment and ends on the date that is sixty-three (63) days after the effective date:

12.3.5 In the case of an individual described in section 12.2.7, the guaranteed issue period begins on the date the individual receives notice pursuant to section 1882(v)(2)(B) of the Social Security Act from the Medicare supplement issuer during the sixty-day period immediately preceding the initial Part D enrollment period and ends on the date that is sixty-three (63) days after the effective date of the individual's coverage under Medicare Part D; and

12.3.6 In the case of an individual described in 12.2 but not described in the preceding provisions of this subsection, the guaranteed issue period begins on the effective date of disenrollment and ends on the date that is sixty-three (63) days after the effective date.

12.4 Extended Medigap Access for Interrupted Trial Periods

12.4.1 In the case of an individual described in 12.2.5. (or deemed to be so described, pursuant to this paragraph) whose enrollment with an organization or provider described in 12.2.5.1 is involuntarily terminated within the first twelve (12) months of enrollment, and who, without an intervening enrollment, enrolls with another such organization or provider, the subsequent enrollment shall be deemed to be an initial enrollment described in section 12.2.5.

12.4.2 In the case of an individual described in section 12.2.6 (or deemed to be so described, pursuant to this paragraph) whose enrollment with a plan or in a program described in section 12.2.6 is involuntarily terminated within the first twelve (12) months of enrollment, and who, without an intervening enrollment, enrolls in another such plan or program, the subsequent enrollment shall be deemed to be an initial enrollment described in section 12.2.6; and

12.4.3 For purposes of sections 12.2.5 and 6, no enrollment of an individual with an organization or provider described in section 12.2.5.1, or with a plan or in a program described in section 12.2.6, may be deemed to be an initial enrollment under this paragraph after the two-year period beginning on the date on which the individual first enrolled with such an organization, provider, plan or program.

12.5 Products to Which Eligible Persons are Entitled.

The Medicare supplement policy to which eligible persons are entitled under:

12.5.1 Section 12.2.1, 2, 3, and 4 is a Medicare supplement policy which has a benefit package classified as Plan A, B, C, F (including F with a high deductible) K or L offered by any issuer.

12.5.2

12.5.2.1 Subject to section 12.5.2.2, Section 12.2.5 is the same Medicare supplement policy in which the individual was most recently previously enrolled, if available from the same issuer, or, if not so available, a policy described in section 12.5.1.

12.5.2.2 After December 31, 2005, if the individual was most recently enrolled in a Medicare supplement policy with an outpatient prescription drug benefit, a Medicare supplement policy described in this subsection is:

12.5.2.2.1 The policy available from the same issuer but modified to remove outpatient prescription drug coverage; or

12.5.2.2.2 At the election of the policyholder, an A, B, C, F (including F with a high deductible), K or L policy that is offered by any issuer;

12.5.3 Section 12.2.6 shall include any Medicare supplement policy offered by any issuer.

12.5.4 Section 12.2.7 is a Medicare supplement policy that has a benefit package classified as Plan A, B, C, F (including F with a high deductible), K or L, and that is offered and is available for issuance to new enrollees by the same issuer that issued the individual's Medicare supplement policy with outpatient prescription drug coverage.

12.6 Notification Provisions

12.6.1 At the time of an event described in section 12.2 because of which an individual loses coverage or benefits due to the termination of a contract or agreement, policy, or plan, the organization that terminates the contract or agreement, the issuer terminating the policy, or the administrator of the plan being terminated, respectively, shall notify the individual of his or her rights under this section, and of the obligations of issuers of Medicare supplement policies under section 12.1. Such notice shall be communicated contemporaneously with the notification of termination.

12.6.2 At the time of an event described in section 12.2 because of which an individual ceases enrollment under a contract or agreement, policy, or plan, the organization that offers the contract or agreement, regardless of the basis for the cessation of enrollment, the issuer offering the policy, or the administrator of the plan, respectively, shall notify the individual of his or her rights under this section, and of the obligations of issuers of Medicare supplement policies under section 12.1. Such notice shall be communicated within ten (10) working days of the issuer receiving notification of disenrollment.

13.1 An issuer shall comply with section 1882(c)(3) of the Social Security Act (as enacted by section 408 1(b)(2)(C) of the Omnibus Budget Reconciliation Act of 1987 (OBRA), Pub. L. No. 100—203) by:

13.1.1 Accepting a notice from a Medicare carrier on dually assigned claims submitted by participating physicians and suppliers as a claim for benefits in place of any other claim form otherwise required and making a payment determination on the basis of the information contained in that notice;

13.1.2 Notifying the participating physician or supplier and the beneficiary of the payment determination;

13.1.3 Paying the participating physician or supplier directly;

13.1.4 Furnishing at the time of enrollment, each enrollee with a card listing the policy name, number, and a central mailing address to which notices from a Medicare carrier may be sent;

13.1.5 Paying user fees for claim notices that are transmitted electronically or otherwise; and

13.1.6 Providing to the Secretary of Health and Human Services, at least annually, a central mailing address to which all claims may be sent by Medicare carriers.

13.2 Compliance with the requirements set forth in Subsection A above shall be certified on the Medicare supplement insurance experience reporting form.

14.1 Loss Ratio Standards

14.1.1 A Medicare Supplement policy form or certificate form shall not be delivered or issued for delivery unless the policy form or certificate form can be expected, as estimated for the entire period for which rates are computed to provide coverage, to return to policyholders and certificateholders in the form of aggregate benefits (not including anticipated refunds or credits) provided under the policy form or certificate form:

14.1.1.1 At least 75 percent of the aggregate amount of premiums earned in the case of group policies, or