DEPARTMENT OF HEALTH AND SOCIAL SERVICES

Division of Medicaid and Medical Assistance

PROPOSED

PUBLIC NOTICE

Federal Medical Assistance Percentage Claiming Methodology for the Adult Group

In compliance with the State's Administrative Procedures Act (APA - Title 29, Chapter 101 of the Delaware Code) and under the authority of Title 31 of the Delaware Code, Chapter 5, Section 512, Delaware Health and Social Services (DHSS) / Division of Medicaid and Medical Assistance (DMMA) has submitted an amendment to the Medicaid State Plan regarding the Federal Medical Assistance Percentage (FMAP) specifically, the FMAP claiming methodology for the adult group.

Any person who wishes to make written suggestions, compilations of data, testimony, briefs or other written materials concerning the proposed new regulations must submit same to Sharon L. Summers, Planning & Policy Development Unit, Division of Medicaid and Medical Assistance, 1901 North DuPont Highway, P.O. Box 906, New Castle, Delaware 19720-0906 or by fax to 302-255-4425 by March 31, 2014.

The action concerning the determination of whether to adopt the proposed regulation will be based upon the results of Department and Division staff analysis and the consideration of the comments and written materials filed by other interested persons.

SUMMARY OF PROPOSAL

The proposed provides notice to the public that Delaware Health and Social Services/Division of Medicaid and Medical Assistance (DHSS/DMMA) has submitted a state plan amendment to the Centers for Medicare and Medicaid Services (CMS) relating to the availability of increased Federal Medical Assistance Percentage (FMAP) rates for certain adult populations under the Delaware Medicaid Program, specifically, adult group FMAP claiming methodology. The increased FMAP rates will be applicable beginning January 1, 2014.

Statutory Authority

Background

On March 29, 2013, the Centers for Medicare and Medicaid Services (CMS) issued a final rule with request for comment to implement provisions of the Affordable Care Act on increased Federal Medical Assistance Percentage (FMAP), or matching, rates for certain Medicaid beneficiaries in states. This rule codifies the increased FMAP rates that will be applicable beginning January 1, 2014 and outlines a simplified methodology states will use to claim the appropriate matching rates.

Overview

An increased FMAP rate is available for medical services provided to people defined as “newly eligible” who are enrolled in the new eligibility group for adults up to 133 percent of poverty. In general, individuals are “newly eligible” if they are enrolled in the new adult group and would not have been eligible for full benefits, benchmark benefits, or benchmark-equivalent benefits under the eligibility rules in that state in effect in December 2009. The rule also describes the increased FMAP available under the Affordable Care Act in a defined “expansion state” if the state had expanded coverage to the adult group prior to enactment of the Affordable Care Act.

Based on public comments on the proposed rule and additional CMS analysis, the final rule selects the threshold methodology, one of the three methodologies described in the proposed rule, as the methodology that states will use to determine the appropriate FMAP related to “newly eligible” Medicaid beneficiaries in the new eligibility group for adults. Supported by states and other commenters, the threshold methodology is designed to provide for a simplified, individualized methodology for determining the appropriate FMAP that does not require states to maintain two sets of eligibility rules or to solicit information from applicants that is not necessary to determine eligibility.

Provisions of the Final Rule

The final rule implements the increased FMAP rates provided by the Affordable Care Act. It establishes a structure and process for their application, setting out applicable definitions and describing the threshold methodology that states will use to claim the new FMAP rates.

Increased FMAP rates through the Affordable Care Act (ACA)

The final rule establishes the following increased FMAP rates:

Threshold Methodology

The final rule also describes the threshold methodology, which states will use to claim expenditures at the appropriate FMAP. The threshold methodology begins with a simplified method for determining the individuals who are and are not newly eligible, comparing their modified adjusted gross income (MAGI) based income (as calculated for purposes of eligibility determination) to converted modified MAGI-based income thresholds for relevant eligibility categories in effect in December 2009. It then describes, and in some cases, offers states options, regarding the treatment of other factors that may be relevant for purposes of claiming the appropriate FMAP. This final rule reaffirms CMS’ overall policy interest in promoting simplicity as states implement the Affordable Care Act.

The final threshold methodology rule:

Summary of Proposal

Pursuant to the public notice requirements of section 1902(a)(13)(A) of the Social Security Act and 42 CFR 447.205, DHSS/DMMA notifies the public that on January 17, 2014 a state plan amendment was submitted to CMS to modify the methodology and standards that it uses to reimburse for services delivered to eligible individuals under the Delaware Medicaid Program. Upon CMS approval, the proposed changes will update Attachment 2.6-A with new Supplement 18, Methodology for Identification of Applicable Federal Medical Assistance Percentage (FMAP) Rates. This plan page describes how the State will claim the appropriate FMAP for expenditures for the new adult group. The proposed effective date for this SPA is January 1, 2014.

NOTE: Consistent with federal law and the Medicaid State Plan, DMMA provided notice to the public regarding the proposed FMAP rates state plan amendment in the December 19, 2013 issue of the News Journal and the Delaware State News, respectively.

The provisions of the state plan amendment are subject to approval by the Centers for Medicare and Medicaid Services (CMS).

Fiscal Impact Statement

Increased FMAP rates through the Affordable Care Act (ACA):

Based upon preliminary estimates, it is anticipated that the federal fiscal impact will be as follows:

|

|

Federal Fiscal Year 2014

|

Federal Fiscal Year 2015

|

|

Federal Funds

|

$ 78,254,636

|

$ 137,495,659

|

State Plan Under Title XIX of the Social Security Act

State: Delaware

METHODOLOGY FOR IDENTIFICATION OF APPLICABLE FMAP RATES

TN: DE SPA #14-001 Approval Date: _____________ Effective Date: January 1, 2014

The State will determine the appropriate FMAP rate for expenditures for individuals enrolled in the adult group described in 42 CFR 435.119 and receiving benefits in accordance with 42 CFR Part 440 Subpart C. The adult group FMAP methodology consists of two parts: an individual-based determination related to enrolled individuals, and as applicable, appropriate population-based adjustments.

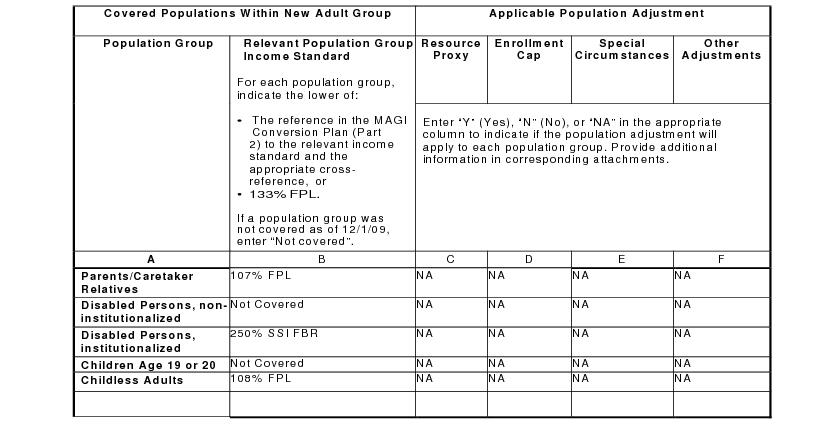

For individuals eligible in the adult group, the state will make an individual income-based determination for purposes of the adult group FMAP methodology by comparing individual income to the relevant converted income eligibility standards in effect on December 1, 2009, and included in the MAGI Conversion Plan (Part 2) approved by CMS on July 31, 2013. In general, and subject to any adjustments described in this SPA, under the adult group FMAP methodology, the expenditures of individuals with incomes below the relevant converted income standards for the applicable subgroup are considered as those for which the newly eligible FMAP is not available.The relevant MAGI-converted standards for each population group in the new adult group are described in Table 1.

Table 1: Adult Group Eligibility Standards and FMAP Methodology Features

A. Optional Resource Criteria Proxy Adjustment (42 CFR 433.206(d))

1. The state:

Applies a resource proxy adjustment to a population group(s) that was subject to a resource test that was applicable on December 1, 2009.

X Does NOT apply a resource proxy adjustment (Skip items 2 through 3 and go to Section B).

Table 1 indicates the group or groups for which the state applies a resource proxy adjustment to the expenditures applicable for individuals eligible and enrolled under 42 CFR 435.119. A resource proxy adjustment is only permitted for a population group(s) that was subject to a resource test that was applicable on December 1, 2009.

The effective date(s) for application of the resource proxy adjustment is specified and described in Attachment B.

2. Data source used for resource proxy adjustments:

The state:

Applies existing state data from periods before January 1, 2014.

Applies data obtained through a post-eligibility statistically valid sample of individuals.

Data used in resource proxy adjustments is described in Attachment B.

3. Resource Proxy Methodology: Attachment B describes the sampling approach or other methodology used for calculating the adjustment.

B. Enrollment Cap Adjustment (42 CFR 433.206(e))

1. An enrollment cap adjustment is applied by the state (complete items 2 through 4).

X An enrollment cap adjustment is not applied by the state (skip items 2 through 4 and go to Section C).

2. Attachment C describes any enrollment caps authorized in section 1115 demonstrations as of December 1, 2009 that are applicable to populations that the state covers in the eligibility group described at 42 CFR 435.119 and received full benefits, benchmark benefits, or benchmark equivalent benefits as determined by CMS. The enrollment cap or caps are as specified in the applicable section 1115 demonstration special terms and conditions as confirmed by CMS, or in alternative authorized cap or caps as confirmed by CMS. Attach CMS correspondence confirming the applicable enrollment cap(s).

3. The state applies a combined enrollment cap adjustment for purposes of claiming FMAP in the adult group:

Yes. The combined enrollment cap adjustment is described in Attachment C

No.

4. Enrollment Cap Methodology: Attachment C describes the methodology for calculating the enrollment cap adjustment, including the use of combined enrollment caps, if applicable.

C. Special Circumstances (42 CFR 433.206(g)) and Other Adjustments to the Adult Group FMAP Methodology

1. The state:

Applies a special circumstances adjustment(s).

X Does not apply a special circumstances adjustment.

2. The state:

Applies additional adjustment(s) to the adult group FMAP methodology (complete item 3).

X Does not apply any additional adjustment(s) to the adult group FMAP methodology (skip item 3 and go to Part 3).

3. Attachment D describes the special circumstances and other proxy adjustment(s) that are applied, including the population groups to which the adjustments apply and the methodology for calculating the adjustments.

A. Transitioning Previous Section 1115 and State Plan Populations to the New Adult Group

X Individuals previously eligible for Medicaid coverage through a section 1115 demonstration program or a mandatory or optional state plan eligibility category will be transitioned to the new adult group described in 42 CFR 435.119 in accordance with a CMS-approved transition plan and/or a section 1902(e)(14)(A) waiver. For purposes of claiming federal funding at the appropriate FMAP for the populations transitioned to new adult group, the adult group FMAP methodology is applied pursuant to and as described in Attachment E, and where applicable, is subject to any special circumstances or other adjustments described in Attachment D.

The state does not have any relevant populations requiring such transitions.

A. Expansion State Designation

The state:

Does NOT meet the definition of expansion state in 42 CFR 433.204(b). (Skip section B and go to Part 5)

X Meets the definition of expansion state as defined in 42 CFR 433.204(b), determined in accordance with the CMS letter confirming expansion state status, dated October 23, 2013.

B. Qualification for Temporary 2.2 Percentage Point Increase in FMAP.

The state:

X Does NOT qualify for temporary 2.2 percentage point increase in FMAP under 42 CFR 433.10(c) (7).

Qualifies for temporary 2.2 percentage point increase in FMAP under 42 CFR 433.10(c)(7), determined in accordance with the CMS letter confirming eligibility for the temporary FMAP increase, dated __________ The state will not claim any federal funding for individuals determined eligible under 42 CFR 435.119 at the FMAP rate described in 42 CFR 433.10(c)(6).

The State attests to the following:

A. The application of the adult group FMAP methodology will not affect the timing or approval of any individual’s eligibility for Medicaid.

B. The application of the adult group FMAP methodology will not be biased in such a manner as to inappropriately establish the numbers of, or medical assistance expenditures for, individuals determined to be newly or not newly eligible.

ATTACHMENTS

Not all of the attachments indicated below will apply to all states; some attachments may describe methodologies for multiple population groups within the new adult group. Indicate those of the following attachments which are included with this SPA:

X Attachment A – Conversion Plan Standards Referenced in Table 1

Attachment B – Resource Criteria Proxy Methodology

Attachment C – Enrollment Cap Methodology

Attachment D – Special Circumstances Adjustment and Other Adjustments to the Adult Group FMAP Methodology

X Attachment E – Transition Methodologies

PRA Disclosure Statement

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is 0938-1148. The time required to complete this information collection is estimated to average 4 hours per response, including the time to review instructions, search existing data resources, gather the data needed, and complete and review the information collection. If you have comments concerning the accuracy of the time estimate(s) or suggestions for improving this form, please write to: CMS, 7500 Security Boulevard, Attn: PRA Reports Clearance Officer, Mail Stop C4-26-05, Baltimore, Maryland 21244-1850.