DEPARTMENT OF HEALTH AND SOCIAL SERVICES

Division of Medicaid and Medical Assistance

FINAL

ORDER

Reimbursement Methodology for FQHCs

NATURE OF THE PROCEEDINGS:

Delaware Health and Social Services ("Department") / Division of Medicaid and Medical Assistance initiated proceedings to amend Title XIX Medicaid State Plan regarding the reimbursement methodology for Federally Qualified Health Centers (FQHCs), specifically, to align DMMA reimbursement policy with the costs of operating Delaware FQHCs. The Department's proceedings to amend its regulations were initiated pursuant to 29 Delaware Code Section 10114 and its authority as prescribed by 31 Delaware Code Section 512.

The Department published its notice of proposed regulation changes pursuant to 29 Delaware Code Section 10115 in the April 2018 Delaware Register of Regulations, requiring written materials and suggestions from the public concerning the proposed regulations to be produced by May 1, 2018 at which time the Department would receive information, factual evidence and public comment to the said proposed changes to the regulations.

SUMMARY OF PROPOSAL

Effective for services provided on and after April 1, 2018 Delaware Health and Social Services/ Division of Medicaid and Medical Assistance proposes to amend Title XIX Medicaid State Plan regarding the reimbursement methodology for Federally Qualified Health Centers (FQHCs), specifically, to align DMMA reimbursement policy with the costs of operating Delaware FQHCs.

Background

In 2017, one of Delaware's Federally Qualified Health Centers (FQHCs) and the Division of Medicaid and Medical Assistance (DMMA) began a review of the FQHC's Medicaid reimbursement methodologies. At that time, it became apparent that current DMMA reimbursement policy - based on a methodology developed years ago - was in need of an update to be more in line with the present, true costs incurred by FQHCs for serving Medicaid members. The proposed update to the FQHC reimbursement policy will allow for more flexibility around adjusting for future changes in the spectrum of services offered by the providers.

Statutory Authority

Section 1902(bb) of the Social Security Act

Purpose

The purpose of this proposed regulation is to better align DMMA reimbursement policy with the costs of operating Delaware Federally Qualified Health Centers (FQHCs).

Public Notice

In accordance with the federal public notice requirements established at Section 1902(a)(13)(A) of the Social Security Act and 42 CFR 447.205 and the state public notice requirements of Title 29, Chapter 101 of the Delaware Code, Delaware Health and Social Services (DHSS)/Division of Medicaid and Medical Assistance (DMMA) gives public notice and provides an open comment period for thirty (30) days to allow all stakeholders an opportunity to provide input on the proposed regulation. Comments were to have been received by 4:30 p.m. on May 1, 2018.

Centers for Medicare and Medicaid Services Review and Approval

The provisions of this state plan amendment (SPA) are subject to approval by the Centers for Medicare and Medicaid Services (CMS). The draft SPA page(s) may undergo further revisions before and after submittal to CMS based upon public comment and/or CMS feedback. The final version may be subject to significant change.

Provider Manuals and Communications Update

Also, there may be additional provider manuals that may require updates as a result of these changes. The applicable Delaware Medical Assistance Program (DMAP) Provider Policy Specific Manuals and/or Delaware Medical Assistance Portal will be updated. Manual updates, revised pages or additions to the provider manual are issued, as required, for new policy, policy clarification, and/or revisions to the DMAP program. Provider billing guidelines or instructions to incorporate any new requirement may also be issued. A newsletter system is utilized to distribute new or revised manual material and to provide any other pertinent information regarding DMAP updates. DMAP updates are available on the Delaware Medical Assistance Portal website: https://medicaid.dhss.delaware.gov/provider

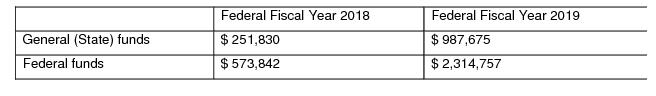

Fiscal Impact Statement

Updating the current methodology as intended could result in approximately $251,830 in additional cost to the State in 2018, and approximately $987,675 in 2019. Additionally, to completely implement the revised FQHC reimbursement methodology, independent auditing services will be necessary to validate the costs as reported by the FQHCs.

Summary of Comments Received with Agency Response and Explanation of Changes

Comment: One commenter inquired if DMMA was establishing rates for assisted living.

Agency Response: The revised reimbursement methodology for FQHCs does not apply to rates for assisted living via Delaware Medicaid, nor does DMMA establish such rates.

No changes were made to the regulation as a result of this comment.

Comment: Another commenter had three separate comments.

First, The two methodologies are referred to as "a prospective payment system (PPS) rate" or the "per-visit cost". Please clarify that both methods are in fact a PPS rate, with a different basis for the rate. The first basis is 100% of reasonable costs based upon historical cost reports inflated by the Medicare Economic Index and the second basis is the per visit cost. Both methods are a PPS rate because the payment under either methodology is made regardless of the intensity of the actual service provided.

Agency Response: Per the Centers for Medicare and Medicaid Services:

"In 2000, Section 702 of the Medicare, Medicaid, and Benefits Improvement and Protection Act adapted the payment methodology for FQHCs, moving from a retrospective cost-based system to prospective payment system (PPS) methodology. This created a PPS per-visit rate equal to 100 percent of costs in the previous year. States are permitted to use an alternative payment methodology (APM); however, the new payment methodology must ensure that health centers do not receive less than what they would have received under PPS and the health centers have to agree to it."

As a result of the Prospective Payment System (PPS) having a very specific Federal statutory definition, for reimbursement purposes, the per-visit cost method option must be considered an alternate payment methodology (APM).

Second, Please provide additional details as to how the wraparound payment would be billed to DMMA and what day the 90 day timeframe is from (i.e. Date of service? Date of claim submission?)

Agency Response: Per the proposed reimbursement methodology revision, "The Delaware Medicaid Program will verify that the FQHC has received at least the PPS correct rate for every visit. If there is a discrepancy in payment amounts, DE will make a wraparound payment to the FQHC within 90 days." To clarify, if a discrepancy in payment amounts is observed and verified, the 90-day resolution timeframe commences from the date that the claim is submitted.

Third, The cost report is historically due on June 30. We support the audit performed by a certified public accountant under the per-visit cost method, however, are concerned about the timing of such audit given the effective date of July 1. We encounter significant problems when we have to retroactively bill the managed care organizations due to rate changes. An estimate should be made for the length of time the audit will take, and the cost report due date adjusted accordingly so that the July 1 effective date can be achieved without rebilling.

Agency Response: DMMA recommends allowing for at least one month of lead time to allow for the auditing component of the "per-visit cost" method. Therefore, it is recommended that the FQHC submit their cost report to DMMA by no later than June 1, given a rate effective date of July 1.

DMMA is pleased to provide the opportunity to receive public comments and greatly appreciates the thoughtful input given.

FINDINGS OF FACT:

The Department finds that the proposed changes as set forth in the April 2018 Register of Regulations should be adopted.

THEREFORE, IT IS ORDERED, that the proposed regulation to amend Title XIX Medicaid State Plan regarding the reimbursement methodology for Federally Qualified Health Centers (FQHCs), specifically, to align DMMA reimbursement policy with the costs of operating Delaware FQHCs, is adopted and shall be final effective June 12, 2018.

Kara Odom Walker, MD, MPH, MSHS, Secretary, DHSS

5/31/18

FINAL Attachment 4.19-B

Page 13

STATE PLAN UNDER TITLE XIX OF THE SOCIAL SECURITY ACT

STATE/TERRITORY: DELAWARE

METHODS AND STANDARDS FOR ESTABLISHING PAYMENT RATES -

OTHER TYPES OF CARE

FEDERALLY QUALIFIED HEALTH CENTERS

The Centers for Medicare and Medicaid Services (CMS) requires that Federally Qualified Health Centers (FQHCs) be reimbursed in compliance with the Benefits Improvement and Protection Act (BIPA) of 2000. Effective January 1, 2001 July 1, 2018, Delaware will pay 100% of reasonable cost based on an average of the Fiscal Year 1999 and 2000 audited cost report reimburse each FQHC per-visit through one of the following two (2) methodologies, whichever nets the greater result:

1. A prospective payment system (PPS) rate, where 100 percent of the reasonable costs based upon an average of their fiscal years 1999 and 2000 audited cost reports are inflated annually by the Medicare Economic Index (MEI).

or

2. The per-visit cost as reported by the FQHC in its most recent cost report, subject to an audit performed by a certified public accountant as to the reasonableness of the reported costs.

The Medicaid Managed Care Organizations are contractually required to include the same service array and the same payment methodology as the State Medicaid FFS contracts with FQHCs. The Medicaid FFS rate is a prospective payment system (PPS) rate paid per FQHC visit. The Delaware Medicaid Program will verify that the FQHC has received at least the PPS correct rate [as calculated by methodology option one (above)] for every visit. If there is a discrepancy in payment amounts, DE will make a wraparound payment to the FQHC within 90 days [following the date the claim was submitted].

FQHCs are assigned a prospectively determined rate per clinic visit based in actual costs reported on their audited cost reports, and they do not correspond with the Federal Fiscal Year, they would span more than one fiscal year. Starting July 1, 2001, the Medicare Economic Index will be used to inflate their rates. The computation is also adjusted each year to reflect any increase or decrease in the Center's Scope of Services.

The Delaware Medical Assistance Program (DMAP) requires that a new provider submit an estimated cost report so that a rate based on reasonable costs can be established. [It is recommended that the FQHC submit their annual cost report to the DMAP at least one month (30 days) prior to the July 1 rate effective date in order to allow for sufficient lead time to conduct the above-mentioned independent audit, as well as to reduce the need for retroactive rate adjustments to the facilities.]

Any new FQHC will be capped at 100% of the highest rate that Medicaid pays to a FQHC for the initial rate year.

Primary Care costs are separated from Administrative and General costs for purposes of rate calculation. The Administrative and General component is capped at 40% of the highest cost. Each cost component is inflated by the current HCFA Medicare Economic Index

Medicaid will ensure 100% percent cost payments regardless of the payment mechanism.

The rate year for FQHC services is July 1 through June 30.

The payment methodology for FQHCs will conform to section 702 of the BIPA 2000 legislation.

The payment methodology for FQHCs will conform to the BIPA 2000 requirements Prospective

Payment System.

For services provided on or after January 2, 2017 the cost of long-acting reversible contraceptives

(LARCs) will be based on actual acquisition cost (AAC). The FQHC must submit a separate claim to be reimbursed for the AAC of a LARC.

TN No. SPA 18-002 TN No. SPA 17-003 | Approval Date Effective Date April 1, 2017 |