department of health and social services

Division of Social Services

PROPOSED

PUBLIC NOTICE

Food Stamp Program

In compliance with the State's Administrative Procedures Act (APA - Title 29, Chapter 101 of the Delaware Code) and under the authority of Title 31 of the Delaware Code, Chapter 5, Section 512, Delaware Health and Social Services (DHSS) / Division of Social Services is proposing to amend food stamp program policies in the Division of Social Services Manual (DSSM) regarding verification changes.

Any person who wishes to make written suggestions, compilations of data, testimony, briefs or other written materials concerning the proposed new regulations must submit same to Sharon L. Summers, Policy, Program and Development Unit, Division of Social Services, 1901 North Dopant Highway, P.O. Box 906, New Castle, Delaware 19720-0906 or by fax to (302) 255-4425 (new fax number) by June 30, 2007.

The action concerning the determination of whether to adopt the proposed regulation will be based upon the results of Department and Division staff analysis and the consideration of the comments and written materials filed by other interested persons.

SUMMARY OF PROPOSED CHANGES

Statutory Authority

Summary of Proposed Changes

DSS is making these changes in the Division of Social Services Manual (DSSM) due to ongoing payment accuracy errors in food stamp cases involving income and shelter/utility costs. These errors occur when clients fail to report changes at recertification. Verifying income and shelter/utility costs at recertification and for interim changes will help reduce the payment error rate. And, providing guidelines for determining outdated information will make the process of eligibility determinations consistent among all staff. This regulatory action contains revised and clarified policy as summarized below:

1) DSSM 9032, Mandatory Verification: Requires verification of shelter and utility costs at recertification and interim changes; clarified which standard utility allowance; and, the word “Changes” is substituted for “Charges” in the heading.

2) DSSM 9033, Verification of Questionable Information: This is a technical correction as DSS stopped using actual utilities several years ago when Standard Utility Allowances were mandated.

3) DSSM 9038, Verification Subsequent to Initial Certification: Requires verification of all income at recertification and interim changes; requires verification of shelter and utility costs at recertification and interim changes; and, provides guidelines for determining outdated verifications.

DSS PROPOSED REGULATIONS #07-27

REVISIONS:

[273.2(f)(1)]

(Break in Continuity of Sections)

Verify the following information prior to certification of households initially applying:

Gross nonexempt income shall be verified for all households prior to certification.

Verify termination of employment. Acceptable documentation includes employer's statement, layoff notice, etc. In addition, if the household reports no income, explore past management and potential sources of income, e.g., UC benefits, OASDI, Workmen's Compensation, etc.

When all attempts to verify income have been unsuccessful because the person or organization providing the income has failed to cooperate with the household and DSS, and all other sources of verification are unavailable, determine an amount to use based on the best available information.

Sometimes the best available information may be from a collateral contact or just from a client.

A. DSS must verify the eligible status of applicant aliens. If an alien does not wish DSS to contact INS to verify his or her immigration status, DSS will give the household the option of withdrawing its application or participating without that member.

The following information may be relevant to the eligibility of some aliens: date of admission or date status was granted; military connection; battered status; if the alien was lawfully residing in the United States on August 22, 1996; membership in certain Indian tribes; if the person was 65 or older on August 22, 1996; if a lawful permanent resident can be credited with 40 qualifying quarters of covered work and if any Federal means-tested public benefits were received in any quarter after December 31, 1996; or if the alien was a member of certain Hmong or Highland Laotian tribes during a certain period of time or is the spouse or unmarried dependent of such a person. DSS must verify these factors if applicable to the alien's eligibility.

The SSA Quarters of Coverage History System (QCHS) is used to verify whether a lawful permanent resident has earned or can receive credit for a total of 40 qualifying quarters. The QCHS may not show all qualifying quarters because SSA records do not show current year's earnings and in some cases the last year's earnings, depending on the time of request. Sometimes an applicant may have work from an uncovered employment that is not documented by SSA, but is countable toward the 40 quarters test. In both cases the individual, rather than SSA, will need to provide the evidence needed to verify the quarters.

B. An alien is ineligible until acceptable documentation is provided unless:

1. DSS has submitted a copy of a document provided by the household to INS for verification. Pending such verification, DSS cannot delay, deny, reduce, or terminate the individual's eligibility for benefits on the basis of the individual's immigration status; or

2. The applicant of DSS has submitted a request to SSA for information regarding the number of quarters of work that can be credited to the individual. SSA has responded that the individual has fewer than 40 quarters, and the individual provides documentation from SSA that SSA is conducting an investigation to determine if more quarters can be credited. DSS will certify the individual pending the results of the investigation for up to 6 months from the date of the original determination of insufficient quarters; or

3. The applicant or DSS has submitted a request to a Federal agency for verification of information which bears on the individual's eligible status. DSS will certify the individual pending the results of the investigation for up to 6 months from the date of the original request for verification.

C. DSS must provide alien applicants with a reasonable opportunity to submit acceptable documentation of their eligible status as of the 30th day following the date of application. A reasonable opportunity is at least 10 days from the date of DSS's request for an acceptable document. When DSS fails to provide an alien applicant with a reasonable opportunity as of the 30th day following the date of application, DSS must provide the household with benefits no later than 30 days following the date of application, provided the household is otherwise eligible.

D. DSS must verify a household member's citizenship or status as a non-citizen national. DSS will accept participation in another program as acceptable verification if verification of citizenship or non-citizen national was obtained for that program. If the household cannot obtain acceptable verification, DSS must accept a signed third-party statement, under penalty of perjury, which indicates a reasonable basis for personal knowledge that the member in question is a U. S. citizen or a non-citizen national.

If a household wishes to claim expenses for an unoccupied home, verify the actual utility expenses in every case and do not use the standard utility allowance.

For those households entitled to a the heating/cooling or limited standard utility allowance as specified in DSSM 9060, verify that the household actually incurs a utility expense, although there is no need to verify the amount of the expense. Verification will be on a one‑time basis unless the household has moved or changed its utilities or unless questionable as defined in DSSM 9033.

Do not verify more than one utility, except for the limited utility allowance, unless questionable in accordance with DSSM 9033.

For those households entitled to the one-utility standard, verify the actual amount of the utility at each application and recertification.

The amount of any medical expenses (including the amount of reimbursements) deductible under DSSM 9060 (C) shall be verified prior to initial certification. Verification of other factors, such as the allowability of services provided or the person incurring the cost shall be required if questionable.

[273.2(f)(1)(v)]; [273.6(c)]

DSS will verify Social Security Number(s) (SSN's) reported by the household by submitting them to the Social Security Administration (SSA) for verification through the DCIS system.

When a SSN is returned from SSA as unverified, proceed as follows:

Recontact the household to determine if the information the household provided is correct. Obtain the correct information as appropriate. As SSN's are often unverified because surnames are unmatched due to marriage, death, or adoption, question these items if the cause of mismatch is not otherwise apparent.

Correct the client information on the DCIS database so that the SSN can be resubmitted to SSA.

DSS is required to pursue the unmatched information with the client. If the household refuses to provide the correct information, take action against the household for refusal to cooperate (See DSSM 9029).

If a household claims it cannot cooperate for reasons beyond its control, substantiate the household's inability to cooperate. The casefile must adequately document the household's inability to cooperate, or the household will be terminated. For example, a household may claim it cannot verify a name change because official records were destroyed in a fire. DSS would need to verify this claim to the point that it is satisfied that documentation of the name change no longer exists.

For example, a household applied for family of five and one child does not have a birth certificate available or a Social Security Number. In order to apply for a SSN, Social Security Administration requires an original certificate to verify name and birthdate. Document the record and set short-term control to check for the SSN application, at a minimum at each redetermination. Getting copies of birth certificates from different states can take months to receive.

If the individual must appear at the SSA Office to provide the correct information and refuses to, such refusal is also grounds for termination per DSSM 9029.

When an individual household member has refused or failed without good cause to provide or apply for an SSN, that individual shall be ineligible to participate.

The disqualification applies only to the individual member not the entire household. The income and resources for the disqualified individual shall be treated as specified in DSSM 9076.2.

Do not delay the certification for or issuance of benefits to an otherwise eligible household solely to verify the SSN of a household member. Once a SSN has been verified, make a permanent annotation to the file to prevent the unnecessary recertification of the SSN in the future. Accept as verified a SSN which has been verified by another program participating in the Income and Eligibility Verification System (IEVS) (see DSSM 2013.1).

If an individual is unable to provide a SSN or does not have a SSN, require the individual to submit Form SS‑ 5, Application for a Social Security Number, to the SSA in accordance with procedures in DSSM 9012.

A completed SSA Form 2853 (message from Social Security) shall be considered proof of application for a SSN for a newborn infant.

[273.2(f)(1)(vi)]

The residency requirements of DSSM 9008 will be verified except in unusual cases where verification of residency cannot reasonably be accomplished. “Unusual cases” would include homeless households, some migrant farmworker households, or households newly arrived in a project area, where verification of residency cannot reasonably be accomplished. Verification of residency should be accomplished to the extent possible in conjunction with the verification of other information such as, but not limited to, rent and mortgage payments, utility expenses, and identity. If verification cannot be accomplished in conjunction with the verification of other information, then use a collateral contact or other readily available documentary evidence. Documents used to verify other factors of eligibility should normally suffice to verify residence as well.

Any documents or collateral contacts which reasonably establish the applicant's residency must be accepted and no requirement for a specific type of verification may be imposed. No durational residency requirement will be established. An otherwise eligible household cannot be required to reside in a permanent dwelling or to have a fixed mailing address as a condition of eligibility.

“Homeless individual” means an individual who lacks a fixed and regular nighttime residence or an individual whose primary nighttime residence is:

A supervised shelter designed to provide temporary accommodations (such as a welfare hotel or congregate shelter);

A halfway house or similar institution that provides temporary residence for individuals intended to be institutionalized (applied to individuals released from institutions who still need supervision, not prisoners considered to be detained under a Federal or State law while in a halfway house);

A temporary accommodation in the residence of another individual if the accommodation is for no more than 90 days.

The 90-day period starts at application or when a change is reported.

The 90-day period starts over when a household moves from one residence to another.

If a homeless household leaves, for whatever reason, and returns to the same residence, the 90-day period will start over again.

If a household has a break in receiving food stamps, the 90-day period will not start over if the household remains in the same residence. The 90-day period will start over if the household moved to another residence.

A place not designed for, or ordinarily used, as a regular sleeping accommodation for human beings (a hallway, a bus station, a lobby or similar places).

8 DE Reg. 1153 (2/1/05)

The identity of the person making application will be verified. Where an authorized representative applies on behalf of a household, the identity of both the authorized representative and the head of household will be verified.

Identity may be verified through readily available documentary evidence, or if this is unavailable, through a collateral contact. Any documents which reasonably establish the applicant's identity must be accepted, and no requirement for a specific type of document may be imposed. Examples of acceptable documentary evidence which the applicant may provide include, but are not limited to, a driver's license, a work or school ID, an ID for health benefits, or for other assistance or social services program, a voter registration card, wage stubs, or a birth certificate.

When verifying whether funds are exempt as a loan, a legally binding agreement is not required. A statement signed by both parties which indicates that the payment is a loan and must be repaid will be sufficient verification. However, if the household receives payments on a recurrent or regular basis from the same source but claims the payments are loans, also require that the provider of the loan sign a statement which states that repayments are being made or that payments will be made in accordance with an established repayment schedule.

Verify those shelter costs specified in DSSM 9060(F), other than utilities, at initial application, at recertification, and when shelter expenses change if allowing the expense could potentially result in a deduction. Verification will be on a one‑time basis unless the household has moved, reported an increase in the amount of its individual shelter costs that would potentially affect the level of the deduction (in which case only those changed individual costs could be reverified) or unless questionable as defined in DSSM 9033.

9032.10 Dependent Care Costs

For those households claiming dependent care cost as specified in DSSM 9060(D), verify that the household actually incurs the costs and the actual amount of the costs, if allowing the expense could potentially result in a deduction. Verification is permitted on a one time basis unless the provider has changed, the amount has changed and the change would potentially affect the level of the deduction, or unless questionable as defined in DSSM 9033.

9032.11 Household Size

Verification will be accomplished through a collateral contact or readily available documentary evidence. Any documents which reasonably establish household size must be accepted and no requirement for a specific type of document may be imposed.

Examples of acceptable documentary evidence which the applicant may provide include, but are not limited to, school records, draft cards, census records, marriage records, or those examples listed in DSSM 9032.7.

Factors involving household composition will not be verified unless questionable in accordance with DSSM 9033.

For example, a client applied for a family size of six. He provides the birth certificates or social security numbers for each member. Household size is verified. No other verifications are needed.

If a client applied for six members and his/her lease indicates eight people live there, household size is questionable. Staff then need to ask for a collateral statement or landlord form.

9032.12 Disability

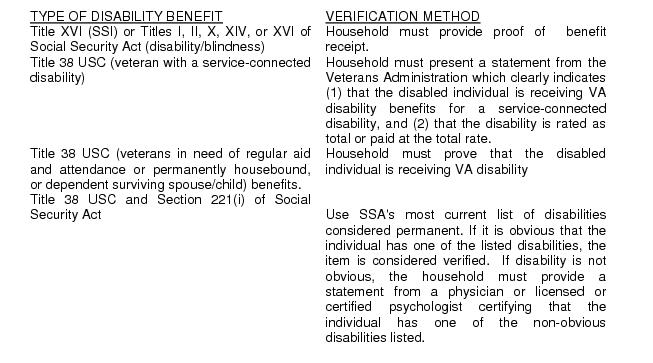

Verify disability as defined in DSSM 9013.1. For disability determinations which must be made relevant to the provisions of DSSM 9013.1(B), use the SSA's most current list of disabilities as the initial step for verifying if an individual has a disability considered permanent under the Social Security Act. However, only those individuals who suffer from one of the disabilities mentioned in the SSA list who are unable to purchase and prepare meals because of such disability will be considered disabled for the purpose of this provision.

If it is obvious that the individual is unable to purchase and prepare meals because (s)he suffers from a severe physical or mental disability, consider the individual disabled for the purpose of the provision even if the disability is not specifically mentioned on the SSA list.

If the disability is not obvious, verify the disability by requiring a statement from a physician or licensed or certified psychologist certifying that the individual (in the physician's/psychologist's opinion) is unable to purchase and prepare meals because (s)he suffers from one of the non obvious disabilities mentioned in the SSA list or is unable to purchase meals because (s)he suffers from some other severe, permanent physical or mental disease or non disease related disability.

The elderly and disabled individual (or his/her authorized representative) is responsible for obtaining the cooperation of the individuals with whom (s)he resides in providing the necessary income information about the others to DSS.

9032.13 Quality Control

Verify all factors of eligibility for households who have been terminated for refusal to cooperate with a State QC reviewer, and reapply after 95 days from the end of the annual review period. Verify all factors of eligibility for households who have been terminated for refusal to cooperate with a Federal QC reviewer and reapply after seven months from the end of the annual review period. The annual review period is the Federal Fiscal Year, October to September.

9032.14 Students

If a person claims to be physically or mentally unfit for purposes of the student exemption in DSSM 9010.1 and the unfitness is not evident, verification may be required. Appropriate verification may consist of receipt of temporary or permanent disability benefits issued by governmental or private sources, or of a statement from a physician or licenses or certified psychologist.

9032.15 Legal Obligation and Actual Child Support Payments

Verify the household's legal obligation to pay child support, the amount of the obligation, and the monthly amount of child support the household actually pays.

Documents that verify the legal obligation to pay child support cannot be used to verify the actual amount of child support payments made.

9032.16 Additional Verification for Able-bodied Adults without Dependents (ABAWDs)

A. Hours worked - individual who are satisfying the ABAWD work requirements by working, by combining work and participation in a work program, or by participating in a work or workfare program that is not operated or supervised by the State, the individual's work hours shall be verified.

B. Countable months in another State - for individuals subject to the ABAWD provisions, DSS must verify the number of countable months an individual has used in another State if there is an indication that the individual participated in that State.

[273.2(f)(2)]

Eligibility factors other than those listed in DSSM 9032 will be verified only if questionable and if they affect a household's eligibility or benefit level.

Questionable information is information inconsistent with statements made by the applicant, with other information on the application or previous applications, or with information received by the agency. Procedures described below will apply when one of the following eligibility factors is questionable:

When expenses claimed by the household for purposes of determining allowable program deductions (per DSSM 9060) or those otherwise reported during the certification interview (e.g., car payments, credit card bills) exceed declared income, ask the household to verify how such expenses were paid. New applicants must satisfactorily explain past management. Possible methods to verify payments are as follows:

Income Source | Type of Verification |

Loans and gifts | Statement from lender |

Sale of personal property | Receipt from sale |

Exchange of services/ in-kind benefits | Statement from landlord, etc. |

Gambling proceeds | Lottery tickets |

Odd jobs | Note from employer |

Benefits may be authorized if the following conditions are met:

a) A new household provides a satisfactory explanation of past management including any verification that is reasonably available to the household.

b) A participating household satisfactorily verifies factors of past management. Verification must be from the month(s) immediately preceding certification/recertification.

Additionally, households where management has been questionable will be notified that they will be responsible for verifications of all cash outflow at times of recertification if management continues to appear questionable.

A. Household Composition. Verify factors affecting the composition of a household, if questionable. Individuals who wish to be a separate household from those with whom they reside will be responsible for proving a claim that they are a separate household to the satisfaction of the Division.

Individuals who claim to be a separate household from those with whom they reside based on the various age and disability factors for determining separateness will be responsible for proving a claim of separateness in accordance with DSSM 9032.11.

B. Citizenship. The household must provide acceptable verification for any member whose U.S. citizenship is questionable.

A claim to citizenship may be considered questionable if:

1) The claim of citizenship is inconsistent with statements made by the applicant or with other information on the application or on previous applications.

2) The claim of citizenship is inconsistent with information received from another source.

3) The individual does not have a Social Security Number.

When a household's statement that one or more of its members are U.S. citizens or has the status as a non-citizen national is questionable, ask the household to provide acceptable verification. Acceptable forms of verification include birth certificates, religious records, voter registration cards, certificates of citizenship or naturalization provided by INS, such as identification cards for use of resident citizens in the United States (INS form I‑ 179 or INS form I‑ 197), or U.S. passports. Participation in the TANF Program will also be considered acceptable verification if verification of citizenship or non-citizen national status was obtained for that program. If the above forms of verification cannot be obtained and the household can provide a reasonable explanation as to why verification is not available, accept a signed statement from a third party indicating a reasonable basis for personal knowledge that the member in question is a U.S. citizen. The signed statement must contain a warning of the penalties for helping someone commit fraud, such as: “If you intentionally give false information to help this person get food stamps, you may be fined, imprisoned, or both.”

The member whose citizenship or non-citizen national status is in question will be ineligible to participate until proof of U.S. citizenship or non-citizen national status is obtained. Until proof of U.S. citizenship or non-citizen national status is obtained, the member whose citizenship or non-citizen national status is in question will have his or her income, less a prorata share, and all of his or her resources considered available to any remaining household members as set forth in DSSM 9076.2.

C. Deductible expenses. If obtaining verification for a deductible expense may delay certification, advise the household that its eligibility and benefit level may be determined without providing a deduction for the claimed but unverified expense. This provision also applies to the allowance of medical expenses per DSSM 9032. Shelter costs would be computed without including the unverified components. The standard utility allowance will be used if the household is entitled to claim it and has not verified higher actual costs.

If the expense cannot be verified within 30 days of the date of application, determine the household's eligibility and benefit level without providing a deduction of the unverified expense. If the household subsequently provides the missing verification, redetermine the household's benefits, and provide increased benefits, if any, in accordance with the timeliness standards in DSSM 9085. If the expense could not be verified within the 30‑ day processing standard because the Division failed to allow the household sufficient time per DSSM 9040 to verify the expense, the household will be entitled to the restoration of benefits retroactive to the month of application, provided that the missing verification is supplied in accordance with DSSM 9040. If the household would be ineligible unless the expense is allowed, the household's application will be handled as provided in DSSM 9040.

(Break in Continuity of Sections)

[273.2(f)(8)]

A. Recertification ‑ Verify a change in income expenses if the source has changed or the amount has changed by more than $50. Verify all income at each recertification. Verify shelter and utility expenses at each recertification. Previously unreported medical expenses and total recurring medical expenses which have changed by more than $25 shall also be verified at recertification. Do not verify income if the source has not changed and if the amount is unchanged or has changed by $50 or less unless the information is incomplete, inaccurate, or inconsistent. Do not verify total medical expenses or actual utility expenses claimed by households which are unchanged or have changed by $25 or less, unless the information is incomplete, inaccurate, or inconsistent, or outdated.

Verify any changes in the legal obligation to pay child support, the obligated amount, and the amount of actual payments made to non household members for households eligible for the child support deduction. Verify unchanged child support payments only if questionable.

Verify newly obtained Social Security Numbers at recertification according to procedures outlined in DSSM 9032.5.

Other information which has changed may be verified at recertification. Do not verify unchanged information unless the information is incomplete, inaccurate, or inconsistent, or outdated.

For individuals who are satisfying the ABAWD work requirements by working, by combining work and participation in a work program, or by participating in a work or workfare program that is not operated or supervised by the State, the individuals' work hours shall be verified.

B. Changes ‑ Changes reported during the certification period are subject to the same verification procedures as apply at initial certification, except that we shall not verify changes in income if the source has not changed and if the amount has changed by $50 or less, unless the information is incomplete, inaccurate, or inconsistent. Verify all changes in income. Verify all changes in shelter and utility expenses. Do not verify total medical expenses, unless the information is incomplete, inaccurate, or inconsistent, or outdated.

Guidelines for determining if information is outdated: