DEPARTMENT OF HEALTH AND SOCIAL SERVICES

Division of Social Services

PROPOSED

PUBLIC NOTICE

FOOD SUPPLEMENT PROGRAM

Countable Resources and Excluded Resources

In compliance with the State's Administrative Procedures Act (APA - Title 29, Chapter 101 of the Delaware Code) and under the authority of Title 31 of the Delaware Code, Chapter 5, Section 512, Delaware Health and Social Services (DHSS) / Division of Social Services is proposing to amend Food Supplement Program policies in the Division of Social Services Manual (DSSM) regarding Countable Resources and Excluded Resources.

Any person who wishes to make written suggestions, compilations of data, testimony, briefs or other written materials concerning the proposed new regulations must submit same to Sharon L. Summers, Policy, Program & Development Unit, Division of Social Services, 1901 North DuPont Highway, P.O. Box 906, New Castle, Delaware 19720-0906 or by fax to (302) 255-4425 by December 31, 2008.

The action concerning the determination of whether to adopt the proposed regulation will be based upon the results of Department and Division staff analysis and the consideration of the comments and written materials filed by other interested persons.

SUMMARY OF PROPOSED CHANGES

The proposed changes described below amend Food Supplement Program policies in the Division of Social Services Manual (DSSM) regarding Countable Resources and Excluded Resources.

Statutory Authority

Summary of Proposed Changes

DSSM 9046, Countable Resources and DSSM 9049, Excluded Resources: The proposed changes amend the Food Supplement Program rules to implement the mandatory provisions of Section 4104 of the Food, Conservation, and Energy Act of 2008 (the Farm Bill) that excludes retirement savings and pension plans and, educational savings plans from countable resources for the Food Supplement Program, effective October 1, 2008.

DSS PROPOSED REGULATIONS #08-49

REVISIONS:

9046 Definition of Resources

[273.8(c)]

In determining the resources of a non-categorically eligible household, the following will be included:

1. Liquid resources, such as cash on hand, money in checking or savings accounts, savings certificates, stocks or bonds, lump sum payments, funds held in Individual Retirement Accounts (IRA's), and funds held in Keogh plans which do not involve the household member in a contractual relationship with individuals who are not household members. In counting resources of household with IRA's or includable Keogh plans, include the total cash value of the account or plan minus the amount of the penalty (if any) that would be exacted for the early withdrawal of the entire amount in the account or plan.

Business and personal loans, other than deferred repayment educational loans, are counted as resources in the month received. The loan is counted as a resource even if the household anticipates spending all or some of it in the same month. For an ongoing household, excess resources anytime during the month makes a nonassistance (public assistance) household ineligible. Any amount remaining after the month of receipt continues to be counted as a resource until the money is spent.

When a client reports the receipt of a loan, staff will determine eligibility. If the loan exceeds the resource limit the household is ineligible and a notice of adverse action must be sent. Overpayments will only be processed for those cases where the loan was not spent in the months after receipt after the 10-day notice has expired.

For example, a client received a $5,000 loan on March 15th and immediately reported the change. The food stamp case was closed for April due to the resource. The client spent the loan in March. No overpayment would be processed for March.

A client received and reported a $4,000 loan on April 25th. The notice of adverse action is sent and the case is closed for June. No overpayment is processed for April or May.

A client received a $6,000 loan on May 26th. The client did not report the loan until September 1st. The client still had $4,000 remaining from the loan. The case is closed for October. No overpayment exists for May and June. An overpayment would be processed for July, August and September.

2. Non liquid resources, personal property, licensed and unlicensed vehicles, buildings, land, recreational properties and any other property, not specifically excluded under DSSM 9049.

The value of non-exempt resources, except for licensed vehicles as specified in DSSM 9051 will be its equity value. The equity value is the fair market value less encumbrances.

3. For a household containing a sponsored alien, deem the resources of the sponsor and the sponsor's spouse according to DSSM 9081.2.

[7 CFR 273.8(c)]

Count the following resources when determining eligibility for food benefit purposes for non-categorical eligible households:

A. Liquid Resources

1. Cash on hand

2. Money in checking or savings accounts

3. Savings certificates

4. Stocks

5. Bonds

6. Lump sum payments

7. Non-deferred business or personal loans in month of receipt

8. The portion of the equity value of a funeral agreement that exceeds $1,500

B. Non-Liquid Resources, not specifically excluded under 9049.

1. Personal property

2. Licensed and unlicensed vehicles

3. Buildings, land, recreational properties and any other property

The value of non-exempt resources is the equity value, except for licensed vehicles per DSSM 9051. The equity value is the fair market value minus encumbrances.

C. Deemed Resources of the sponsor (and sponsor's spouse) for sponsored aliens per DSSM 9081.2.

(Break In Continuity of Sections)

[273.8(e)]

In determining the resources of a household, only the following will be excluded:

1. The home and surrounding property which is not separated from the home by intervening property owned by others. A public right of way, such as roads which run through surrounding property and separate it from the home, will not affect the exemption of the home. The home and surrounding property will remain exempt when temporarily unoccupied for reasons of employment, training for future employment, illness, vacation, or inhabitability caused by casualty or natural disaster, if the household intends to return. Households that currently do not own a home, but own or are purchasing a lot on which they intend to build or are building a permanent home, will have the value of the lot and, if it is partially completed, the value of the home excluded.

2. Household goods, personal effects, the cash value of life insurance policies, one burial plot per household member, and the value of one bona fide funeral agreement per household member, provided that the agreement does not exceed $1,500 in equity value. If the equity value of the funeral agreement exceeds $1,500, the value above $1,500 is counted as a resource. The cash value of pension plans or funds will be excluded, except that Keogh plans which involve no contractual relationship with individuals who are not household members and individual retirement accounts (IRA's) will not be excluded.

3. Licensed vehicles per DSSM 9051.

4. Property which annually produces income consistent with its fair market value, even if used only on a seasonal basis. Such property includes rental homes and vacation homes.

5. Property or work related equipment essential to the employment of a household member. Property such as farm land or work related equipment such as the tools of a tradesman or the machinery of a farmer, which is essential to the employment or self employment of a household member. Property essential to the self employment of a household member engaged in farming continues to be excluded for one year from the date the household member terminates their self employment from farming.

6. Installment contracts for the sale of land or other property are exempt if the contract or agreement is producing income consistent with its fair market value and the value of any property sold under contract or held as security in exchange for a purchase price consistent with the fair market value of that property.

7. Governmental payments which are designated for the restoration of a home damaged in a disaster. For example, governmental payments made under the Individual and Family Grant program or the Small Business Administration. The household must be subject to a legal sanction if the funds are not used as intended.

8. Resources such as but not limited to, irrevocable trust funds, security deposits on rental property or utilities, property in probate and property which the household is making a good faith effort to sell at a reasonable price and which has not been sold. In such cases, establish that the property is for sale and that the household will accept a reasonable offer. Verification may be obtained through a collateral contact or documentation, such as an advertisement for public sale in a newspaper of general circulation, or a listing with a real estate broker. Any funds in trust or transferred to a trust, and the income produced by the trust to the extent it is not available to the household, will be considered inaccessible to the household if:

a) The trust arrangement is not likely to cease during the certification period and no household member has the power to revoke the trust arrangement or change the name of the beneficiary during the certification period;

b) The trustee administering the fund is either:

1) A court, or an institution, corporation, or organization which is not under the direction or ownership of any household member, or

2) An individual appointed by the court who has court imposed limitations placed on his/her use of the funds which meet the requirements of this paragraph.

c) Trust investments made on behalf of the trust do not directly involve or assist any business or corporation under the control, direction or influence of a household member; and

d) The funds held in irrevocable trust are either:

1) Established from the households' own funds, if the trustee uses the funds solely to make investments on behalf of the trust or to pay the educational or medical expenses of any person named by the household creating the trust, or

2) Established from non household funds by a non household member.

9. Resources, such as those of students or self employed persons which have been prorated as income under DSSM 9063.3 and DSSM 9074.

10. Indian lands held jointly with the Tribe or land that can be sold only with the approval of the Bureau of Indian Affairs; and

11. Resources which are excluded for food stamp purposes by express provision of Federal law, such as:

a) Benefits received from the Special Supplemental Food Program for Women, Infants, and Children, (WIC) (P.L. 92 443).

b) Reimbursements from the Uniform Relocation Assistance and Real Property Acquisition Policy Act of 1970 (P.L. 91 646).

c) Earned income tax credits received before January 1, 1980, as a result of P.L. 95 600, Tax Revenue Act of 1978.

d) Payments received from the Youth Incentive Entitlement Pilot Projects, the Youth Community Conservation and Improvement Programs under Title IV of the Comprehensive Employment and Training Act Amendment of 1978 (P.L. 95-524).

12. Earned Income tax credits are excluded as follows:

A Federal Earned Income tax credit received either as a lump sum or as payments under Section 3507 of the Internal Revenue Code for the month of receipt and the following month for the individual and that individual's spouse.

Any Federal, State or local earned income tax credit received by any household member shall be excluded for 12 months, provided that the household was participating in the Food Stamp Program at the time of receipt of the earned income tax credit and provided the household participates continuously during that 12-month period. Breaks in participation of one month or less due to administrative reasons, such as delayed recertification, shall not be considered as nonparticipating in determining the 12-month exclusion.

13. Where an exclusion applies because of the use of a resource by or for a household member, the exclusion will also apply when the resource is being used by or for an ineligible alien or disqualified person whose resources are being counted as part of the household's resources. For example, work related equipment essential to the employment of an ineligible alien or disqualified person will be excluded [in accordance with DSSM 9049(5)], as will one burial plot per ineligible alien or disqualified household member [in accordance with DSSM 9049(2)].

14. Energy assistance payments or allowances excluded as income under DSSM 9059 K.

15. Non liquid asset(s) against which a lien has been placed as a result of taking out a business loan and the household is prohibited by the security or lien agreement with the lien holder (creditor) from selling the asset(s).

16. Property, real or personal, to the extent that it is directly related to the maintenance or use of a vehicle excluded under DSSM 9051 #1, 2, and 6. Only that portion of real property determined necessary for maintenance or use is excludable under this provision.

For example, a household which owns a produce truck to earn its livelihood may be prohibited from parking the truck in a residential area. The household may own a 100-acre field and use a quarter-acre of the field to park and/or service the truck. Only the value of the quarter-acre would be excluded under this provision, not the entire 100-acre field.

17. All of the resources of TANF/GA/RCA and SSI recipients.

A household member is considered a recipient of these benefits even if the benefits have been authorized but not received, if the benefits are suspended or recouped, or if the benefits are not paid because they are less than a minimum amount.

Individuals entitled to Medicaid benefits only are not considered recipients of TANF/GA/ RCA or SSI.

18. Allowances paid to children of Vietnam veterans who are born with spina bifida are excluded from income and resources for food stamp purposes. (P.L. 104-204). These monthly allowances ($200, $700, or $1,200) are based on the degree of disability suffered by the child.

[7 CFR 273.8(e)]

Exclude the following resources when determining eligibility for food benefit purposes for non-categorical eligible households:

A. Property

1. Home the household resides in.

2. Property surrounding the home not separated by intervening property owned by others, except for public rights of way such as roads.

3. The home and surrounding property temporarily unoccupied for reasons of employment, training for future employment, illness, vacation, or uninhabitability caused by casualty or natural disaster, if the household intends to return.

4. The value of a lot on which a household intends to build (or is building) a permanent home as long as the household currently does not own a home.

5. Property that annually produces income consistent with its fair market value, even if used only on a seasonal basis, such as rental and vacation homes.

6. Property or work-related equipment essential to the employment or self-employment of a household member such as farmland, tools, or machinery.

7. Property essential to the self-employment of a household member engaged in farming is excluded for one year from the date the household member terminates his/her self-employment from farming.

8. Installment contracts for the sale of land or other buildings are exempt if the contract or agreement is producing income consistent with its fair market value. The value of the property sold under such contract or held as security in exchange for a purchase price consistent with the fair market value of that property is also excluded.

9. Security deposits on rental property or utilities.

10. Property in probate and property which the household is making a good faith effort to sell at a reasonable price.

11. Property (or portions of) that it is directly related to the maintenance or use of a vehicle excluded under DSSM 9051 (1, 2, and 6). For example, property used to park a produce truck on for sales, overnight parking and/or maintenance.

B. Household goods and personal effects.

C. Cash value of life insurance policies.

D. One burial plot per household member.

E. Value of one bona fide funeral agreement (not exceeding $1,500) per household member.

F. Licensed vehicles per DSSM 9051.

G. Governmental payments for the restoration of a home damaged in a disaster. Examples are payments from the Individual and Family Grant program or the Small Business Administration. The household must be subject to a legal sanction if the household does not use the funds as intended.

H. Irrevocable trust funds

1. Any funds in trust or funds transferred to a trust, and the income produced by that trust that is not available to the household is inaccessible to the household if:

(i) The trust arrangement is not likely to end during the certification period and no household member has the power to revoke the trust arrangement or change the name of the beneficiary during the certification period;

(ii) The trustee administering the fund is either:

(a) A court, or an institution, corporation, or organization which is not under the direction or ownership of any household member, or

(b) An individual appointed by the court who has court imposed limitations placed on his/her use of the funds which meet the requirements of this paragraph.

(iii) Trust investments made on behalf of the trust do not directly involve or assist any business or corporation under the control, direction or influence of a household member; and

(iv) The funds held in irrevocable trust are either:

(a) Established from the households' own funds, if the trustee uses the funds solely to make investments on behalf of the trust or to pay the educational or medical expenses of any person named by the household creating the trust, or

(b) Established from non-household funds by a non-household member.

I. Resources prorated as income, such as those of students or self-employed persons. See DSSM 9063.3 or DSSM 9074.

J . Indian lands held jointly with the Tribe or land that can be sold only with the approval of the Bureau of Indian Affairs.

K . Resources excluded by provisions of Federal law, such as:

1. Benefits received from the Special Supplemental Food Program for Women, Infants, and Children, (WIC).

2. Reimbursements from the Uniform Relocation Assistance and Real Property Acquisition Policy Act of 1970.

3. Payments received from the Youth Incentive Entitlement Pilot Projects, the Youth Community Conservation and Improvement Programs under Title IV of the Comprehensive Employment and Training Act Amendment of 1978.

4. Monthly allowances of $200, $700, or $1,200 paid to children of Vietnam veterans who are born with spina bifida based on the degree of disability suffered by the child.

5. Earned income tax credits as follows:

(i) A Federal earned income tax credit received either as a lump sum or as payments under Section 3507 of the Internal Revenue Code are excluded for the month of receipt and the following month for the individual and that individual's spouse.

(ii) Exclude any Federal, State or local earned income tax credit received by any household member for 12 months if the household was participating in the Food Supplement Program at the time of receipt of the earned income tax credit and provided the household participates continuously during that 12-month period.

(iii) Do not consider breaks in participation of one month or less due to administrative reasons as nonparticipation in determining the 12-month exclusion.

L. Excluded resources used by or for an ineligible alien or disqualified person when counted as part of a household's resources. For example, work-related equipment needed for the employment of an ineligible alien or disqualified person.

M. Energy assistance payments or allowances excluded as income under DSSM 9059.

N. Non-liquid assets that have a lien on them due to a business loan that the household cannot sell.

O. All of the resources of TANF/GA/RCA and SSI recipients* and households deemed categorically eligible due to DSSM 9042. This exclusion includes:

1. Education and Business Accounts (EBIA) (including interest) up to the $5000 maximum limit per DSSM 4002.5.

2. Saving for Education, Entrepreneurship and Down Payment (SEED) accounts (considered EBIA accounts) up to the $5000.00 limit per DSSM 4002.5.

* A household member is a 'recipient' of these benefits even if the benefits have been authorized but not received, if the benefits are suspended or recouped, or if the benefits are not paid because they are less than a minimum amount.

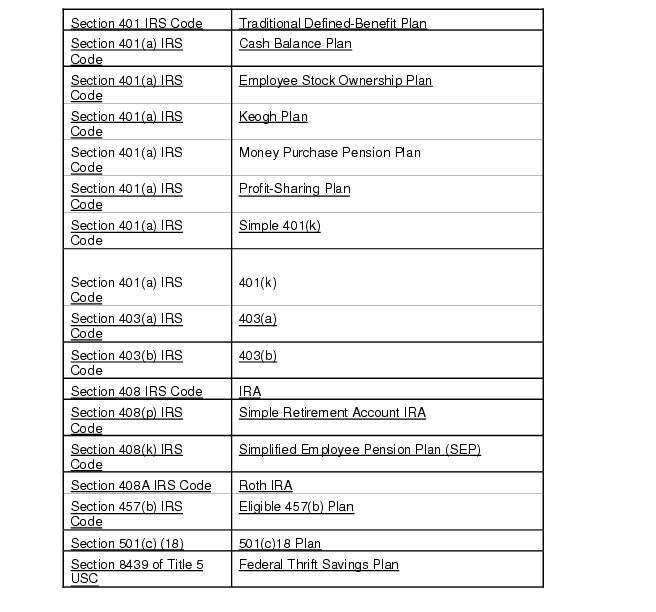

P. All retirement accounts with federal tax-preferred status in chart below.

Retirement Accounts with Federal Tax-Preferred Status Excluded for FSP

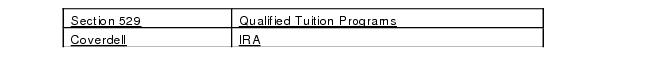

Q. Tax-preferred education savings accounts.