department of health and social services

Division of Social Services

PUBLIC NOTICE

proposed

Child Care Subsidy Program

In compliance with the State's Administrative Procedures Act (APA - Title 29, Chapter 101 of the Delaware Code) and under the authority of Title 31 of the Delaware Code, Chapter 5, Section 512, Delaware Health and Social Services (DHSS) / Division of Social Services (DSS) is proposing to amend the Division of Social Services Manual (DSSM) regarding the Child Care Subsidy Program.

Any person who wishes to make written suggestions, compilations of data, testimony, briefs or other written materials concerning the proposed new regulations must submit same to Sharon L. Summers, Policy and Program Development Unit, Division of Social Services, 1901 North DuPont Highway, P.O. Box 906, New Castle, Delaware 19720-0906 by December 31, 2005.

The action concerning the determination of whether to adopt the proposed regulation will be based upon the results of Department and Division staff analysis and the consideration of the comments and written materials filed by other interested persons.

Summary of Provisions

Statutory Basis

Summary of Changes

DSS is proposing to amend several sections in the Division of Social Services Manual (DSSM) to clarify and update existing Child Care Subsidy Program policy. This includes updating, revising, clarifying, (and deleting where necessary) the following policy sections due, in part, to the integration of the previous Child Care Management system into the current DCIS II Child Care eligibility system:

1) DSSM 11003.6, Income Limits; DSSM 11003.7, Income Eligible Child Care; DSSM 11004.7.1, Child Care Fee Scale and Determination of Fee; and, DSSM 11006.4, Provider Reimbursement. Additionally, DSSM 11006.4.6, Reimbursement is combined with DSSM 11006.4.

2) Further clarifications were made in DSSM 11002.9, Definitions and Explanation of Terms; DSSM 11003.9.1, Income; and, DSSM 11003.9.2., Whose Income to Count. Sections 11002.9 and 11003.9.1 redefine employment/wages to include the standard as minimum wage or an equivalent. DSSM 11004.4.2 is a new section added to update and explain the Purchase of Care Plus (POC+) program. This change reflects the agency’s desire to offer POC+ to all clients who wish to participate in POC+.

These changes provide consistency with DSS programs and underscore the Division’s mission of self-sufficiency.

DSS PROPOSED REGULATIONS #05-71a

REVISIONS:

11003.6 Income Limits

To be eligible for child care services, a family is to have gross income equal to or less than 200 percent of the current federal poverty level for a family of equal size. This income requirement typically applies to all income eligible child care programs. Refer to Appendix I for current income limits the most current Cost of Living Adjustment Administrative Notice for current rates.

Income Limits Per Family Size

Family Monthly

Size Income

1 $1,552

2 $2,082

3 $2,612

4 $3,142

5 $3,672

6 $4,202

7 $4,732

8 $5,262

Each Additional Child $530

11003.7 Income Eligible Child Care

A. DSS provides child care to families who are financially eligible to receive care because the family's gross income is equal to or under 200 percent of the federal poverty level and they have one or more of the following a needs for care as outlined below:. These families are considered income eligible. DSS has two funding streams, CCDF and SSBG, that cover income eligible individuals.

1. a low-income (200 percent or less of the federal poverty level) parent/caretaker needs child care in order to accept employment or remain employed and would be at risk of becoming eligible for TANF if child care were not provided (At-Risk Child Care, Category 31); or

2. a low-income (200 percent or less of the federal poverty level) parent/caretaker needs child care in order to work, attend a job training program, or participate in an educational program, or is receiving or needs to receive protective services (CCDBG Child Care, Category 31); or

3. a parent/caretaker needs child care to work or participate in education or training; searches one month for employment after losing a job; because the child or the parent/caretaker or other adult household member has special needs; because they care for a protective child who is active with the Division of Family Services or the parent/caretaker is homeless. (SSBG Child Care, Category 31).

B. DSS programmed the DCIS II Child Care Sub system to identify the need and include all the above child care needs into one category, Category 31. Therefore, Case Managers will only have to consider whether parents/caretakers meet just one of the above needs to include them in a Category 31 funding stream. However, DSS also programmed the DCIS II Child Care Sub system so that it could make the policy distinctions needed to make payments from the appropriate funding source for each child in care. Though Case Managers will not have to make these distinctions, it is helpful to know them.

They are:

1. At-Risk Child Care will only include parents/caretakers who need child care to accept a job or to keep a job.

It will include parents/caretakers who have the need for child care because of a special needs child or a protective child, but it will always coincide with the parent/caretaker's need to accept or keep a job.

2.1. CCDBG CCDF Child Care will include:

a. parents/caretakers who need child care to accept or keep a job, and/or

b. participate in education or training as outlined in section 11003.7.4 and 11003.7.5, or

c. children who receive or need to receive protective services.,

d. parents/caretakers who are homeless and need care to accept or keep a job or participate in education or training as outlined in sectoin 11003.7.4 and 11003.7.5.

It will also include parents/caretakers who need care because of a special needs child. It will always coincide with the parent/caretaker's need to work or participate in education or training. It will not include parents/caretakers who have a special need or other adult household member who has a special need.

3.2. SSBG Child Care will include:

a. parents/caretakers who need child care to accept or keep a job,

b. parents/caretakers who need child care to participate in education or training as outlined in section 11003.7.4 and 11003.7.5,

c. parents/caretakers whose only need is a special need child or special needs adult household member,

d. children who need protective services, or

e. parents/caretakers who are homeless.

(Break in Continuity of Sections)

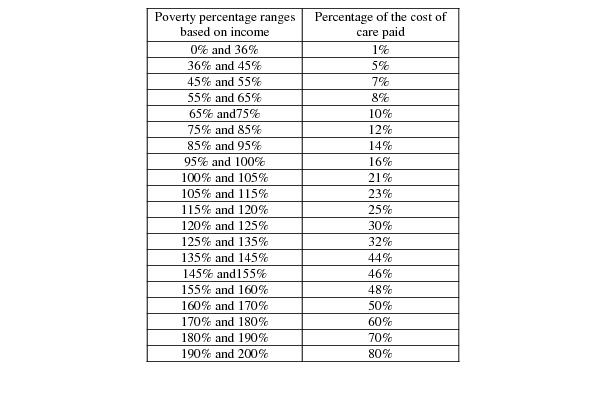

11004.7.1 Child Care Parent Fee Scale and Determination of Fee

The assessed child care parent fee is based on family size, family income as a percentage of the poverty scale and the cost of care. The current child care fee scale used to determine the child care parent fee is attached as Appendix III located in Administrative Notices as the Child Care Sliding Fee Scale Appendix III of the Cost of Living Adjustment Notice.

To arrive at the actual fee, look at this scale the current Child Care Sliding Fee Scale (noted above) and use the following steps.

A. Determine the family size as outlined in section 11003.9.3.

B. From the family size column, determine the income range of the parent/caretaker.

C. At the top of the income ranges are percentages from 0% to 36% all the way up to 190% to 200%. These are the percentages of the federal poverty scale as it relates to family income by family size. It means that a family’s income can range between 0% to 36% all the way up to 190% to 200% of the federal poverty scale. Find the appropriate percentage column for your family.

D. Finally, based on family size and income at that appropriate percentage range, look at the percentages below (these are ranges from 1% to 80%). This is the percentage of the cost of care that this family will pay per child based on the percentage of their income as it relates to the federal poverty level.

Families with income between: 0% and 36% of poverty, pay 1% of the cost of care

E. Finally, based upon the type of care (i.e., home, center, etc.) a parent/caretaker selects, multiply the percentage of the cost of care by the cost for that type of care. This is the parent fee the parent/caretaker will pay.

This is a per child fee. If more than one child is in care, repeat the calculations for each child, then combine all the per child fees to arrive at the total fee.

EXAMPLE: Based upon income and family size, a parent is to pay seven percent of the cost of care for a three year old child in a contracted child care center. If the cost of care for a child over two in a center is $12.40 per day, multiply $12.40 by .07, giving the parent a fee of .87 cents per day for that child.

NOTE: This is a per child fee. If more than one child is in care, repeat the calculations for each child, then combine all the per child fees to arrive at the total fee. Use the same rules for determining family size for the child care fee scale as done for determining family size for income. Include all of the family's children under age18 in the family size even if not all will need child care services. In other words, the people whose needs and income are included together are counted together to comprise the definition of family size. Review Section 11003.9.3 for further guidance.

DSS programmed the CCMIS DCIS II Child Care Sub system to do the actual child care parent fee calculation. As long as the appropriate information is entered (the appropriate family size, adults, and children) on the CHILD CARE CASE PARTICIPANT screen, the casehead by type (either a PAR for parent or CAR for caretaker) is identified, and the appropriate income and category information is entered, the CCMIS will calculate the child care fee.

NOTE: Include all of the family's children under 18 in the family size even if not all will need child care services. The child care parent fee which initially shows in the CCMIS DCIS II Child Care Sub system is the fee for a full day of child care actual amount of care that is authorized. The actual fee may differ depending on the amount of care authorized, i.e. full day, half day, day and a half, or two days. The actual fee the parent/caretaker pays for that child is also indicated on the authorization form.

INCOME POVERTYRANGE 0%-36% 36%-45% 45%-55% 55%-65% 65%-75% 75%-85% 85%-95% 95%-100% 100%-105% 105%-115% 115%-120% 120%-125% 125%-135% 135%-145% 145%-200%

FAMILY SIZE 1% 5% 7% 8% 10% 12% 14% 16% 21% 23% 25% 30% 32% 44% 46% 48

1 $0.00 $ 242.01 $ 302.01 $ 369.01 $ 436.01 $ 503.01 $ 570.01 $ 637.01 $ 671.01 $ 705.01 $ 772.01 $ 805.01 $ 839.01 $ 906.01 $ 973.01

$242.00 $ 302.00 $ 369.00 $ 436.00 $ 503.00 $ 570.00 $ 637.00 $ 671.00 $ 705.00 $ 772.00 $ 805.00 $ 839.00 $ 906.00 $ 973.00 $1,040.00

2 $0.00 $ 326.01 $ 407.01 $ 498.01 $ 588.01 $ 679.01 $ 769.01 $ 860.01 $ 905.01 $ 950.01 $1,041.01 $1,086.01 $1,131.01 $1,222.01 $1,312.01

$326.00 $ 407.00 $ 498.00 $ 588.00 $ 679.00 $ 769.00 $ 860.00 $ 905.00 $ 950.00 $1,041.00 $1,086.00 $1,131.00 $1,222.00 $1,312.00 $1,402.00

3 $0.00 $ 410.01 $ 512.01 $ 626.01 $ 740.01 $ 854.01 $ 967.01 $1,081.01 $1,138.01 $1,195.01 $1,309.01 $1,366.01 $1,423.01 $1,536.01 $1,650.01

$410.00 $ 512.00 $ 626.00 $ 740.00 $ 854.00 $ 967.00 $1,081.00 $1,138.00 $1,195.00 $1,309.00 $1,366.00 $1,423.00 $1,536.00 $1,650.00 $1,764.00

4 $ 0.00 $ 494.01 $ 617.01 $ 754.01 $ 891.01 $1,028.01 $1,165.01 $1,302.01 $1,371.01 $1,440.01 $1,577.01 $1,645.01 $1,714.01 $1,851.01 $1,988.01

$494.00 $ 617.00 $ 754.00 $ 891.00 $1,028.00 $1,165.00 $1,302.00 $1,371.00 $1,440.00 $1,577.00 $1,645.00 $1,714.00 $1,851.00 $1,988.00 $2,125.00

5 $0.00 $ 578.01 $ 722.01 $ 883.01 $1,043.01 $1,204.01 $1,364.01 $1,525.01 $1,605.01 $1,685.01 $1,846.01 $1,926.01 $2,006.01 $2,167.01 $2,327.01

$578.00 $ 722.00 $ 883.00 $1,043.00 $1,204.00 $1,364.00 $1,525.00 $1,605.00 $1,685.00 $1,846.00 $1,926.00 $2,006.00 $2,167.00 $2,327.00 $2,487.00

6 $0.00 $ 662.01 $ 827.01 $1,011.01 $1,195.01 $1,379.01 $1,562.01 $1,746.01 $1,838.01 $1,930.01 $2,114.01 $2,206.01 $2,298.01 $2,481.01 $2,665.01

$662.00 $ 827.00 $1,011.00 $1,195.00 $1,379.00 $1,562.00 $1,746.00 $1,838.00 $1,930.00 $2,114.00 $2,206.00 $2,298.00 $2,481.00 $2,665.00 $2,849.00

7 $0.00 $ 746.01 $ 932.01 $1,139.01 $1,346.01 $1,553.01 $1,760.01 $1,967.01 $2,071.01 $2,175.01 $2,382.01 $2,485.01 $2,589.01 $2,796.01 $3,003.01

$746.00 $ 932.00 $1,139.00 $1,346.00 $1,553.00 $1,760.00 $1,967.00 $2,071.00 $2,175.00 $2,382.00 $2,485.00 $2,589.00 $2,796.00 $3,003.00 $3,210.00

8 $0.00 $ 830.01 $1,037.01 $1,268.01 $1,498.01 $1,729.01 $1,959.01 $2,190.01 $2,305.01 $2,420.01 $2,651.01 $2,766.01 $2,881.01 $3,112.01 $3,342.01

$830.00 $1,037.00 $1,268.00 $1,498.00 $1,729.00 $1,959.00 $2,190.00 $2,305.00 $2,420.00 $2,651.00 $2,766.00 $2,881.00 $3,112.00 $3,342.00 $3,572.00

(Break in Continuity of Sections)

11006.4 Provider Reimbursement

Reimbursement is monthly as indicated on the Day Care Contract (Compensation, Method of Payment, and Collection of Fee sections). Complete records must be retained by the provider for a period of three years, listing each child's daily attendance, accurately stating the number of authorized days present by type, and the number of absent days. These records will be monitored on a regular basis.

Payment will be made only for the number of days and type of authorization indicated on individual Form 618d and in accordance with absent day policy. Reimbursement rates differ for children under the age of two and children two years of age and older.

FFY 2005 CHILD CARE PROVIDER RATES

NEW CASTLE COUNTY

LICENSED HOMES CENTERS IN-HOME/RELATIVES

Regular Special Needs Regular Special Needs Regular Special Needs

0 $ 105.00 $ 110.25 $ 140.00 $ 147.00 $ 105.00 $ 110.25

1 $ 100.00 $ 100.00 $ 117.00 $ 122.85 $ 100.00 $ 105.00

2 to 5 $ 77.35 $ 81.20 $ 86.25 $ 90.55 $ 58.00 $ 60.90

6 & over$ 77.35 $ 81.20 $ 81.40 $ 85.45 $ 58.00 $ 60.90

KENT & SUSSEX COUNTIES

LICENSED HOMES CENTERS IN-HOME/RELATIVES

Regular Special Needs Regular Special Needs Regular Special Needs

0 $ 75.00 $ 78.75 $ 95.00 $ 99.75 $ 75.00 $ 78.75

1 $ 75.00 $ 78.75 $ 80.00 $ 84.00 $ 75.00 $ 78.75

2 to 5 $ 61.20 $ 64.25 $ 65.00 $ 68.25 $ 45.90 $ 48.20

6 & over$ 61.20 $ 64.25 $ 65.00 $ 68.25 $ 45.90 $ 48.20

CHILD CARE INCOME LIMITS - EFFECTIVE 10/01/2004

FAMILY SIZE INCOME

1 $ 1,552.00

2 $ 2,082.00

3 $ 2,612.00

4 $ 3,142.00

5 $ 3,672.00

6 $ 4,202.00

7 $ 4,732.00

8 $ 5,262.00

Additional person add $ 530.00

FFY 2006 CHILD CARE PROVIDER RATES | ||||||||

NEW CASTLE COUNTY | ||||||||

LICENSED HOMES | CENTERS | IN-HOME/RELATIVES | ||||||

Regular | Special Needs | Regular | Special Needs | Regular | Special Needs | |||

0 | $ 110.00 | $ 115.50 | $ 145.00 | $ 152.25 | $ 105.00 | $ 110.25 | ||

1 | $ 105.00 | $ 110.25 | $ 122.00 | $ 128.10 | $ 100.00 | $ 105.00 | ||

2 to 5 | $ 82.35 | $ 86.45 | $ 104.60 | $ 109.85 | $ 58.00 | $ 60.90 | ||

6 & over | $ 84.30 | $ 88.50 | $ 104.60 | $ 109.85 | $ 58.00 | $ 60.90 | ||

KENT COUNTY | ||||||||

LICENSED HOMES | CENTERS | IN-HOME/RELATIVES | ||||||

Regular | Special Needs | Regular | Special Needs | Regular | Special Needs | |||

0 | $ 80.00 | $ 84.00 | $ 97.50 | $ 102.40 | $ 75.00 | $ 78.75 | ||

1 | $ 75.00 | $ 78.75 | $ 85.00 | $ 89.25 | $ 75.00 | $ 78.75 | ||

2 to 5 | $ 66.20 | $ 69.50 | $ 70.00 | $ 73.50 | $ 45.90 | $ 48.20 | ||

6 & over | $ 68.15 | $ 71.55 | $ 71.95 | $ 75.55 | $ 45.90 | $ 48.20 | ||

SUSSEX COUNTY | ||||||||

LICENSED HOMES | CENTERS | IN-HOME/RELATIVES | ||||||

Regular | Special Needs | Regular | Special Needs | Regular | Special Needs | |||

0 | $ 75.50 | $ 79.30 | $ 97.50 | $ 102.40 | $ 75.00 | $ 78.75 | ||

1 | $ 75.00 | $ 78.75 | $ 85.00 | $ 89.25 | $ 75.00 | $ 78.75 | ||

2 to 5 | $ 66.20 | $ 69.30 | $ 70.00 | $ 73.50 | $ 45.90 | $ 48.20 | ||

6 & over | $ 68.15 | $ 71.53 | $ 71.95 | $ 75.55 | $ 45.90 | $ 48.20 | ||

CHILD CARE INCOME LIMITS - EFFECTIVE 10/01/2005 | ||

FAMILY SIZE | INCOME | |

1 | $ 1,596.00 | |

2 | $ 2,140.00 | |

3 | $ 2,682.00 | |

4 | $ 3,226.00 | |

5 | $ 3,770.00 | |

6 | $ 4,312.00 | |

7 | $ 4,856.00 | |

8 | $ 5,400.00 | |

Additional person add | $ 544.00 | |

11006.4.6 Reimbursement

Payment will be made only for the number of days and type of authorization indicated on individual Form 618d and in accordance with absent day policy. Reimbursement rates differ for children under the age of two and children two years of age and older.

FFY 2005 CHILD CARE PROVIDER RATES

NEW CASTLE COUNTY

LICENSED HOMES CENTERS IN-HOME/RELATIVES

Regular Special Needs Regular Special Needs Regular Special Needs

0 $ 105.00 $ 110.25 $ 140.00 $ 147.00 $ 105.00 $ 110.25

1 $ 100.00 $ 105.00 $ 117.00 $ 122.85 $ 100.00 $ 105.00

2 to 5 $ 77.35 $ 81.20 $ 86.25 $ 90.55 $ 58.00 $ 60.90

6 & over $ 77.35 $ 81.20 $ 81.40 $ 85.45 $ 58.00 $ 60.90

KENT & SUSSEX COUNTIES

LICENSED HOMES CENTERS IN-HOME/RELATIVES

Regular Special Needs Regular Special Needs Regular Special Needs

0 $ 75.00 $ 78.75 $ 95.00 $ 99.75 $ 75.00 $ 78.75

1 $ 75.00 $ 78.75 $ 80.00 $ 84.00 $ 75.00 $ 78.75

2 to 5 $ 61.20 $ 64.25 $ 65.00 $ 68.25 $ 45.90 $ 48.20

6 & over $ 61.20 $ 64.25 $ 65.00 $ 68.25 $ 45.90 $

DSS PROPOSED REGULATIONS #05-71b

REVISIONS:

11002.9 Definitions And Explanation Of Terms

The following words and terms, when used in the context of these policies will, unless clearly indicated otherwise, have the following meanings.

(Break in Continuity of Sections)

K. Child Care Parent Fee - The amount the parent/caretaker must pay toward the cost of child care. The fee is based on the income of the parent(s) and children, or the child if the child lives with a caretaker, family size and a percentage of the cost of care based on type of care requested.

(Break in Continuity of Sections)

Q. Employment - Either part-time or full time work for which the parent/caretaker receives income. wages equal to minimum wage or an equivalent. It also includes periods of up to one month of continued child care services when parents/caretakers lose one job and need to search for another, or when one job ends and another job has yet to start.

(Break in Continuity of Sections)

R. Family Size - The total number of persons whose needs and income are considered together. This will always include the parent(s) (natural, legal, adoptive, step, and unmarried partners with a child in common) and all their dependent children under 18 living in the home.

(Break in Continuity of Sections)

AT. Purchase of Care Plus (POC+) – Care option that allows providers to charge for fee paying most DSS clients the difference between the DSS reimbursement rate up to the provider’s private fee for service. The provider receives the DSS rate, the DSS determined child care parent fee, if applicable, and any additional provider-determined co-pay.

(Break in Continuity of Sections)

11003.9.1 Income

A. Countable income

All sources of income, earned (such as wages) and unearned (such as child support, social security pensions, etc.) are countable income when determining a family's monthly gross income. Monthly gross income typically includes the following:

1. Money from wages or salary, such as total money earnings from work performed as an employee, including wages, salary, Armed Forces pay, commissions, tips, piece rate payments and cash bonuses earned before deductions are made for taxes, bonds, pensions, union dues, etc. Wages need to be equal to minimum wage or an equivalent.

Gross income from farm or non-farm self-employment is determined by subtracting the self-employment standard deduction for producing income as described below. The individual's personal expenses (lunch, transportation, income tax, etc.) are not deducted as business expenses but are deducted by using the TANF standard allowance for work connected expenses. In the case of unusual situations (such as parent/caretaker just beginning business), refer to DSSM 9056 and 9074.

Self-Employment Standard Deduction for Producing Income

The cost for producing income is a standard deduction of the gross income. This standard deduction is a percentage of the gross income determined annually and listed in the Cost-of-Living Adjustment (COLA) notice each October.

The standard deduction is considered the cost to produce income. The gross income test is applied after the standard deduction. The earned income deductions are then applied to the net self-employment income and any other earned income in the household.

The standard deduction applies to all self-employed households with costs to produce income. To receive the standard deduction, the self-employed household must provide and verify they have business costs to produce income. The verifications can include, but are not limited to, tax records, ledgers, business records, receipts, check receipts, and business statements. The self-employed household does not have to verify all its business costs to receive the standard deduction.

Self-employed households not claiming or verifying any costs to produce income will not receive the standard deduction.

2. Social Security pensions, Supplemental Security Income, Veteran’s benefits, public assistance payments, net rental income, unemployment compensation, workers compensation, pensions, annuities, alimony, adoption assistance, disability benefits, military allotments, Rail Road Retirement, and child support.

B. Disregarded Income

Monies received from the following sources are not counted:

1. per capita payments to, or funds held in trust for, any individual in satisfaction of a judgement judgment of Indian Claims Commission or the Court of Claims;

2. payments made pursuant to the Alaska Native Claims Settlement Act to the extent such payments are exempt from taxation under ESM 21(a) of the Act;

3. money received from the sale of property such as stocks, bonds, a house or a car (unless the person was engaged in the business of selling such property, in which case the net proceeds are counted as income from self-employment);

4. withdrawal of bank deposits;

5. money borrowed or given as gifts;

6. capital gains;

7. the value of USDA donated foods and Food Stamp Act of 1964 as amended;

8. the value of supplemental food assistance under the Child Nutrition Act of 1966 and the special food service program for children under the National School Lunch Act, as amended;

9. any payment received under the Uniform Relocation Assistance and Real Property Acquisition Policies Act of 1970;

10. loans or grants such as scholarships obtained and used under conditions that preclude their use for current living costs;

11. any grant or loan to any undergraduate student for educational purposes made or insured under any program administered by the Commissioner of Education under the Higher Education Act;

12. home produce utilized for household consumption;

13. all of the earned income of a minor or minor parent (under 18) who is a full-time student or a part-time student who is working but is not a full-time employee (such as high school students who are employed full-time during summer);

14. all payments derived from participation in projects under the Food Stamp Employment & Training (FS E&T) program or other job training programs;

15. all Vista income.; and

16. all income derived as a Census taker.

Resources (such as cars, homes, savings accounts, life insurance, etc.) are not considered when determining financial eligibility or the parent fee.

9 DE Reg. 564 (10/01/05)

11003.9.2 Whose Income to Count

In all Categories, count all income attributable to the parent(s) and children included in the family size according to section 11003.9.1 as family income. Family size as used here means those persons whose needs and income are considered together as defined in section 11003.9.3. A person who acts as a child's caretaker (as defined in Section 11002.9) is not included in the definition of family. In this instance, any income attributable to the child or children is the income which is counted.

Income of active DFS referrals/cases is excluded. Active DFS referrals/cases do not need to meet financial eligibility.

11003.9.3 Family Size

The people whose needs and income are considered together comprise the definition of family size. Family size is the basis upon which DSS looks at income to determine a family's financial eligibility and the child care parent fee. Therefore, knowing who to include in the determination of family size is an important part in deciding financial eligibility. Rules to follow when considering family size are relationship and whose income is counted.

In all instances, the people counted together for family size when determining financial eligibility are the same people counted for family size when determining the family's child care parent fee.

A. Family size is defined as Pparents (natural, legal, adoptive, or step, and unmarried partners with a child in common) and their children under 18 living in the home, will always be included together in the make up determination of family size.

EXAMPLE 1: Ms. Brown, a single mother, lives together with her two year old daughter. She is applying for child care as a Category 31, income eligible case. Mrs. Brown and her daughter are a family size of two.

EXAMPLE 2: Susan Jones and Mark Evans live together as unmarried partners. Susan has a one year old child from a previous relationship. She applies for Category 13 31 child care. Susan and her child are a family size of two. Mark is not counted. His income is not considered since he is not the father of the child and there is no child in common between Susan Jones and Mark Evans. (NOTE: If Mark Evans admits to being the natural parent of the child, his income is counted and this is a family of three.)

EXAMPLE 3: Ms. Johnson, a single parent, has three children ages 13, 10, and 5. She works and needs child care for her youngest child who attends preschool. She is applying for Category 31 child care. Even though she needs care for only one child, her family size is a family size of four when looking at financial eligibility.

EXAMPLE 4: Ms. Green cares for her three year old niece. Ms. Green works and needs child care. Since Ms. Green is the aunt and not the parent of the child, she is considered a caretaker. Therefore, Ms. Green's income is not counted and she is not included in the family composition. Ms. Green's niece is considered a family size of one and any income attributable to the niece is countable income.

EXAMPLE 5: Mom and step-dad live with mom's two children, ages two and five, from a previous marriage. Mom and step-dad both work and need child care. Mom, step-dad, and her two children are a family size of four. Step-dad is included.

EXAMPLE 6: Mom and step-dad live with mom's three year old child from a previous marriage. Step-dad also has a five year old child from a previous marriage living in the home. Mom and step-dad both work and need child care. This family is a family size of four.

EXAMPLE 7: Mom and her unmarried partner have a child in common. Mom and the unmarried partner also have one child each from previous relationships. Since Mom and the unmarried partner have a child in common the needs and income of each parent will be considered for all three children. This would be a family size of 5. In this example the Child Care Sub system will first build the family together as one AG. If the AG fails the system will break this family down into 3 AG’s to determine as many persons eligible as possible. The three AG’s would be Mom, unmarried partner and child in common, Mom and child from a previous relationship, unmarried partner and his child from a previous relationship.

B. Adults who are not the natural, legal, adoptive, or step-parent of any of the child or children under 18 living in the home are not included when determining family size and child care fee.

EXAMPLE : Mom lives with her grandmother. Mom has two children ages 10 and 6 for whom she needs after-school care. Mom and her two children are considered a family size of three. Grandmother is not included because she is not the parent of the children nor is her income counted.

NOTE: In all instances, the people counted together for family size when considering financial eligibility are the same people counted for family size when considering the family's child care fee.

(Break in Continuity of Sections)

11004.4.2 Purchase of Care Plus (POC+)

POC+ is a care option that allows providers to charge DSS clients the difference between the DSS reimbursement rate up to the provider’s private fee for service. The provider receives the DSS rate, the DSS determined child care parent fee if applicable, and any additional provider determined co-pay.

This option is primarily for DSS fee-paying clients. DSS chooses not to limit childcare options for any group of individuals. DSS will allow all DSS purchase of care clients eligible for POC with no parent fee the opportunity to waive their right to receive childcare with no additional provider co-pays and choose a POC+ slot.

POC+ is an option for all DSS clients, not a requirement. If a provider does not have a regular POC slot available, the client can choose to self arrange, enter into a POC+ arrangement or find another provider that will take the regular DSS payment.

It is the provider’s responsibility to include in their contract with the DSS client the explanation of POC+, the length of POC+ if it is specified, the co-payment amount, the providers policy on non-payment of fees, and a statement that they have explained to the client their options and that the client chooses to participate in POC+.

In order for providers to be able to participate in the POC+ option they must agree to take a percentage of DSS waived fee clients and attend training on POC+.

If a client is currently participating in POC+ and goes to a zero parent fee for DSS, the client can stay POC+ or request a regular POC slot. If a regular POC slot is not available the client can chose to remain in a POC+ slot, self arrange, or find a provider with a regular POC slot.

A provider cannot change a zero parent fee client from a regular POC slot to a POC+ slot.

NOTE: It is important to explain to DSS clients who receive POC and Food Stamps that if they choose to participate in POC+ they need to inform the DSS worker of the co-payment amount so that the Food Stamp case can be updated.