DELAWARE HEALTH AND SOCIAL SERVICES

Division of Social Services

PROPOSED

PUBLIC NOTICE

Temporary Assistance for Needy Families (TANF) Employment and Training Program

In compliance with the State's Administrative Procedures Act (APA - Title 29, Chapter 101 of the Delaware Code) and under the authority of Title 31 of the Delaware Code, Chapter 5, Section 512, Delaware Health and Social Services (DHSS) / Division of Social Services (DSS) is proposing to amend the Division of Social Services Manual (DSSM) regarding the Temporary Assistance for Needy Families (TANF) Employment and Training Program. Any person who wishes to make written suggestions, compilations of data, testimony, briefs or other written materials concerning the proposed new regulations must submit same to Sharon L. Summers, Policy and Program Development Unit, Division of Social Services, 1901 North DuPont Highway, P.O. Box 906, New Castle, Delaware 19720-0906 or by fax to (302) 255-4454 by August 31, 2006.

The action concerning the determination of whether to adopt the proposed regulation will be based upon the results of Department and Division staff analysis and the consideration of the comments and written materials filed by other interested persons.

SUMMARY OF PROVISIONS

Citations

Summary of Provisions with Cost/Budgetary Impact

TANF Program

1) Division of Social Services Manual (DSSM) 3001, 3006.2, 3006.2.1, 3006.3, 3006.4, 3008.1.4, 3009, 3010.2, 3011

The purpose of these changes to existing policy is due to the new interim final regulations that mandate states to meet stricter participation requirements.

These changes encourage Employment and Training participation.

TANF Program

2) Division of Social Services Manual (DSSM) 3009.1, 3009.2, 3009.3, 3009.2, 3009.3, 3011.1, 3011.2, 3011.3, 3012, 3012.1, 3012.2, 3031, 3031.2 and 3031.4

The purpose of these changes to existing policy is due to the new interim final regulations that require states to meet stricter participation requirements. Changes were also made to simplify the sanctioning process.

The changes to the Employment and Training sanction policy for not meeting the required participation hours eliminates the progressive 1/3, 2/3, and permanent sanction. The families are no longer permanently sanctioned off TANF. It is replaced with a full family TANF sanction that closes the TANF case once the individual does not meet the required hours of participation. Families may receive TANF benefits again as long as they complete a required consecutive 4 weeks of full participation.

The teen sanction changed so that a teen under the age of 16 not attending school will have the TANF grant sanctioned $50.00 each month until either the child returns to school, the mother works with the appropriate agencies, or the TANF grant is reduced to zero. If the mother works with the appropriate agencies and the child still does not return to school the benefit will be restored.

The sanction for teens over 16 and not attending school is the removal of the teen from the assistance group and the reduction of the household size. If the teen returns to school or participates with Employment and Training for the required hours they can be added back to the assistance case.

DSS PROPOSED REGULATIONS #06-31

REVISIONS:

3000 Temporary Assistance for Needy Families (TANF) - Definition

(Break in Continuity of Sections)

3001 Definitions

The following words and terms, when used in the context of these policies, will, unless clearly indicated otherwise, have the following meanings:

A. Benefits (Non-Time-Limited) - the receipt of TANF benefits that are not subject to a time limitation.

Benefits (Time-Limited) - the receipt of TANF benefits for a limited period of time.

B. Caretaker (Needy) - a parent or non-parent included in the grant who is caring for a needy child. Needy caretakers are required to comply with the CONTRACT OF MUTUAL RESPONSIBILITY to receive benefits. Needy caretakers are subject to the time limit requirements.

Caretaker (Non-Needy) - a non-parent, not included in the grant, who is caring for a needy child. Non-needy caretakers are required to comply with the CONTRACT OF MUTUAL RESPONSIBILITY to receive benefits. Non-needy caretakers are not subject to the time limit requirements. These caretakers will receive benefits under the Children's Program.

C. Children's program - the name of the agency's program for persons who receive non-time-limited benefits. Persons in this program are not subject to the usual time limits for the receipt of benefits. However, persons in this program must comply with a non-work-related CONTRACT OF MUTUAL RESPONSIBILITY, e.g., participation in parenting classes, school attendance for the child or immunizations as necessary.

D. Contract of Mutual Responsibility – an agreement between the TANF client and the agency which sets obligations and expectations between the TANF client and agency in exchange for benefits.

E. Cumulative Months - the total number of months, not necessarily consecutive months, which make up a particular time period.

F. Delaware’s Temporary Assistance for Needy Families (TANF) Program - the title of Delaware's new welfare reform program.

G. Employable - the ability to engage in activities necessary to acquire and retain a job, at a wage level at least equal to the minimum wage; an employable person is physically and mentally able to participate in employment or activities necessary to seek and obtain employment, e.g. job search, job training, job readiness, etc. While an individual is employable the receipt of benefits is time-limited.

H. Employment (Subsidized) - a public or private sector job for which the employer receives a grant or allotment to pay all or a portion of the employee’s wage.

Employment (Unsubsidized) - a public or private sector job for which the employer receives no grant or allotment to pay either all or a portion of the employee's wage.

I. Good Cause - An adult recipient may have legitimate reasons for not cooperating either in the development of the Contract of Mutual Responsibility or the requirements as set forth in the Contract. The adult recipient has "good cause" when either a circumstance or condition exists in either her/his personal or family situation beyond which she/he has no control, and which would prevent cooperation and/or participation.

Good cause for quitting a job would include but not necessarily be limited to:

J. H.B. 251 (1995) - House Bill 251 established the Delaware Welfare Employment Program. This is a program where the agency places TANF clients in jobs with local employers while subsidizing the client’s salary up to the State’s minimum wage for a maximum of six months.

K.J. Pay After Performance - A work experience and/or Employment and Training program required for families with employable adults where the adult has not found employment or has lost a job. Families who were continuously on TANF prior to 01/01/2000 will have 24 months before being required to enter into this program. Families reapplying on or after 01/01/2000 will immediately enter this program. Participants will work to earn TANF benefits.

L.K. Sanction - a financial penalty for TANF client’s failure or refusal without good cause to meet her/his work Employment and Training participation requirements. If the client refuses or fails to meet work related requirements (job search, training, etc.) or quits a job without good reason, for the 1st offense the penalty is 1/3 reduction of the grant; the second offense is a 2/3 reduction; and the 3rd is permanent loss of the entire grantthe client’s TANF case will be closed. If the TANF client refuses or fails to attend a Contract of Mutual Responsibility requirement (e.g., participate in parenting education) the penalty is a $50.00 reduction in the grant for each month the client refuses or fails to participate.

M.L. Suitable Employment - employment that provides income at least equal to the payment standard after deduction of work expenses, the TANF work deduction and child care as paid, and provides wages at least equal to the minimum wage. Individuals will be expected to work at jobs that are below their skill levels, if such positions provide the only available employment.

N.M. Two Parent Program - able-bodied parents and their children who meet the standard of need and all TANF eligibility requirements, except deprivation, will be eligible for cash benefits. Eligibility for this program is based on need; there is no deprivation requirement. Cash benefits are time limited and both parents must comply with a Contract of Mutual Responsibility.

When one parent in an intact family is incapacitated, the family should not be placed in the two-parent program.

O.N. Unemployable - the inability to engage in activities necessary to work for at least the minimum wage; the person is prohibited because s/he is physically or mentally disabled. An unemployable individual cannot participate in employment or activities necessary to seek and obtain employment, e.g., job search, job training, job readiness, etc.

The determination and duration of unemployability are made by a health care professional (e.g., doctor, nurse, nurse practitioner, therapist, etc.). Periods of unemployability are not counted toward the cumulative months of benefit eligibility under the time-limited program.

O. Week - A week is defined as seven consecutive days, Monday through Sunday.

9 DE Reg. 1370 (03/01/06)

(Break in Continuity of Sections)

3006 TANF Employment and Training Program

Delaware's Temporary Assistance To Needy Families welfare reform effort is based on the idea that TANF is a transitional benefit and should not become a way of life. The Division maintains that the way for persons to avoid TANF dependency is for them to find and maintain employment.

3006.1 Mandatory Participants

All adult caretakers and other adults in the assistance unit who are not exempt must participate in Employment and Training related activities. The two exemptions are: 1) a parent caring for a child under 13 weeks of age or 2) an individual determined unemployable by a health care professional.

Able bodied children age 16 or older who are not attending school must participate in work or other alternative activities, e.g., GED.

3006.2 TANF Employment and Training Participation and Participation Rates

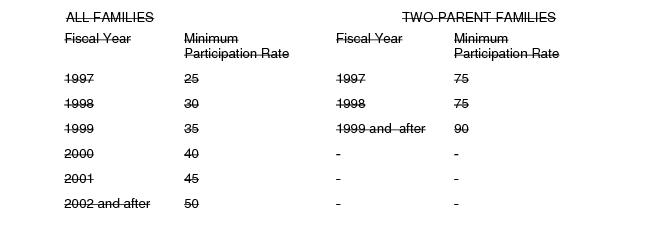

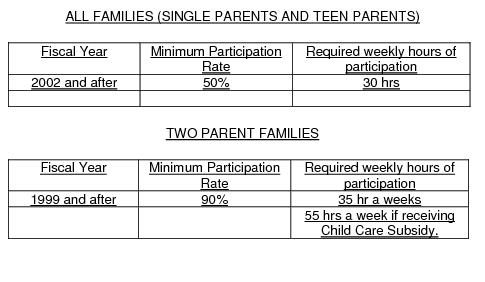

Under the Temporary Assistance For Needy Families Block Grant, DSS is required to meet the following work participation rates with respect to all families that include an adult or minor child head of household receiving assistance:

DSS may face a lower work participation rate if it experiences a net caseload reduction compared to FY 1995 2005.

Example: If it is determined that DSS' average monthly caseload in FY 1997 2006 was 4 percentage points lower than average monthly caseloads in FY 1996 2005, then, rather than having to meet at 30% 50% work participation rate requirement in FY 1998 2006, the rate would be lowered by 4 percentage points to 26% 46%.

To be counted toward meeting the work participation rate, each individual must meet the minimum required number of hours averaged over a each month week. This differs from the old JOBS requirement in which the hours were averaged among participants, and where participants only had to meet at least 75% of the scheduled hours.

Single parents who are not working 30 hours a week or making an equivalent of 30 hours a week times minimum wage are required to participate in work and/or work related activities. Participation in work and work related activities must equal of 30 hours a week.

Two-parent families where one parent is not working at least 35 hours a week or making the equivalent of 35 hours a week times minimum wage are required to participate in work and/or work related activities. Participation in work and work related activities must equal 35 hours a week.

Two parent families who receive federally funded Purchase of Care services who are not working at least 55 hours a week or making the equivalent of 55 hours a week times minimum wage are required to participate in work and/or work related activities. Participation in work and work related activities for one parent must equal 35 hours a week. The spouse must participate in work or work related activities equaling 20 hours a week.

Teen parents are required to attend school, work, or participate in the employment and training activities. Elementary, secondary, post-secondary, vocational, training school, and participation in a GED program meets participation requirement for the month and is the equivalent to work If they are not attending one of the above types of school or working for 30 hours a week they must participate in employment and training activities for 30 hours a week.

Single custodial parents with a child under 12 months of age are able to receive an exemption from Employment and Training requirements for a total of 12 months in their lifetime. These 12 months can be used any time the parent has a child less than 12 months of age. Once the youngest child reaches 12 months of age the parents are required to participate in Employment and Training. If they are already working the equivalent of their required Employment and Training Hours (20, 30, 55), the DCIS II system will code them as volunteers for Employment and Training.

Example: Under JOBS, if Ms. Jones was scheduled for 20 hours and attended 15, she was counted as having participated for 20 hours. Under TANF, Ms. Jones would fail to meet her 20 hours requirement, and DSS could not count her as participating. In addition, under JOBS, you could pair participants and combine their hours to get more participants to the 20 hour level. For instance, one participant working 25 hours could be paired with one participant working 15 hours to get two participants. Under TANF, only one participant could count as having met the 25 hour rule.

The monthly participation rate is calculated as follows:

Numerator: # of families receiving assistance that include an adult or minor head of household who is engaged in work for the requisite hours

divided by

Denominator: # of families that include an adult or a minor child head of household receiving assistance, less # of families sanctioned in that month for failure to participate in work (for up to 3 months in preceding 12 month period), less the number of non-needy caretaker households, less the number of temporarily incapacitated households, less the number of mothers with a child under 13 weeks old.

8 DE Reg. 1618 (5/01/05)

3006.2.1 TANF Employment and Training Participants Who Count for TANF Participation

According to provisions of Delaware's Temporary Assistance For Needy Families, the following individuals must participate in work related activities and are included in the denominator for calculating the Federal participation rates.

3006.3 TANF Employment and Training Activities

The Division of Social Services, in conjunction with the Delaware Department of Labor and the Delaware Economic Development Office, has developed employment and training programs to move TANF clients to economic independence. These agencies will conduct initial and ongoing assessments of client employability and appropriateness of employment and training related activities. For individuals deemed unable to work because s/he is they are physically or mentally disabled a referral is to be made to the Division of Vocational Rehabilitation. Use Form 134.

The Division will establish has agreements with the Delaware Department of Labor and the Delaware Economic Development Office to offer employment and training activities.

The goal is to place the adult recipient in an unsubsidized job in as timely a manner as possible. The Department of Labor will have the option of recycling through job search those adult recipients who are unsuccessful in finding work, and/or placing the adult recipient in an alternative work experience, OJT, remediation, or a skills training program. Also, both the Division and the Department of Labor are jointly responsible for the development of an Employability Development Plan.

Although the Department of Labor assumes primary responsibility for assigning adult recipients to employment-related activities for this age group, the Division retains responsibility for sanctions, federal reporting and other TANF requirements.

3006.4 TANF Employment and Training Activities Which Constitute Participation Under TANF

The following are employment-related activities that count as participation:

Education and Training

Students who do not meet the Blevins Bill requirements in section 3006.6 can receive 1.5 hours of study time for each credit hour if the education or training class requires homework and study time to be completed outside of class time. A 3-credit course would equal 7.5 hours of participation. (3 + (3 x 1.5) = 7.5.

If a recipient is attending training or a program that does not have a designated credit hour, a determination of the amount of study time required for this training will have to be determined independently. This will be reported on the General Activity Screen in the DCIS II Employment and Training sub-system. A question will ask if this activity requires study time, if it is answered yes, then a mandatory screen will appear to enter the amount of weekly study hours. The amount of study hours necessary will be determined by the contractor.

The student must be in good standing as it relates to attendance and achievement as defined by the program the student is attending.

Example: A participant who is working 15 hours a week and taking 2 three-credit classes will have a participation rate of 30 hours. (15 hours of work + 6 credit hours of class + 9 hours of study time.

9 DE Reg. 1372 (03/01/06)

3006.5 TANF Employment and Training Participants Who Count for TANF Participation

According to provisions of Delaware's TEMPORARY ASSISTANCE TO NEEDY FAMILIES, the following individuals must participate in work related activities and are included in the denominator for calculating the Federal participation rates.

8 DE Reg. 1618 (5/1/05)

9 DE Reg. 798 (11/01/05)

(Break in Continuity of Sections)

3008 Eligibility of Certain Minors

3008.1.1 Babies Born To Teen Parents

This policy applies to both applicants and recipients not covered by family cap rules.

Babies born after December 31, 1998 to a teenage parent are not eligible for cash assistance (TANF and GA) unless the parent is:

An emancipated minor is considered an adult and therefore, the baby would be eligible for cash assistance. If both parents live in the home, both parents must be at least eighteen (18) years of age or married for the baby to be eligible. Once the minor parent turns 18, the parent and the baby are both eligible for cash assistance, if otherwise eligible.

Babies not receiving cash assistance are eligible for all other DSS services and programs including food stamps, grant-related Medicaid, and Welfare Reform child care. In lieu of cash assistance, the Division may provide non-cash assistance services. (See DSSM 3008.1.3)

Determining financial eligibility and grant amounts for an assistance unit which contains a child(ren) affected by this provision:

The child(ren) is/are included when determining the assistance unit’s need for assistance. The child(ren)’s income and resources are included when determining the assistance unit’s income and resources. The child(ren) is/are not included when determining the payment standard for the assistance unit.

Exception:

This restriction will not apply when:

9 DE Reg. 1978 (06/01/06)

3008.1.2 Three Generation Households

In a three (3) generation household, the grandparent could receive benefits for him/herself and for the teen parent but not for the child of the teen parent. This means that there is not grandparent deeming in these cases.

3008.1.3 Providing Non-cash Assistance:

The services that non-cash assistance will provide are as follows:

DSS will offer non-cash assistance to these families after their request for cash assistance has been denied. The purpose of the voucher program is so the caretaker can purchase necessary items for the child denied benefits due to the parent being unmarried and a minor. Necessary items may include formula, if the minor parent and child are not WIC eligible, diapers, baby wipes, clothing. This is not an all inclusive list. Items covered by Medicaid are not eligible. A determination of need is to be completed by the contracted vendor. Though a baby may receive these services in subsequent months, the service ends when the parent either marries or turns eighteen.

A monthly voucher is to be no more than $69. The primary caseworker will explain that the family could receive a monthly voucher that may cover more than one month, but shall not exceed $207, the amount of three months of A Better Chance Welfare Reform Program grant awarded to children born before January 1, 1999. When a customer receives a monthly voucher greater than $69, the customer will be ineligible to receive services as follows:

The primary caseworker will make the initial referral for the non-cash assistance to the contracted vendor. Referrals will include the name and Social Security number of the adult caretaker and the minor parent, the name and date of birth of the baby, address, a phone number for contacting the family and a DCIS II case number. The adult caretaker will contact the vendor if there is a need for services in subsequent months. The case record will be documented when a referral for this program is made to a contracted vendor.

Provide families referred for this service with appropriate vendor address and telephone number.

3008.1.4 Minor Teen Parents

Teen parents are required to attend either:

If these minor teen parents are not participating in any of the above activities they should be referred to the Employment and Training contractors.

Refer to DSSM 3012.2, DSSM 3012.4 and DSSM 3012.5 to be able to receive TANF.

(Break in Continuity of Sections)

3009 Contract of Mutual Responsibility

The caretaker enters into a Contract of Mutual Responsibility with DSS. The Contract will specify self-sufficiency components such as, but not limited to, employment activities, cooperation in securing child support, school attendance requirements, family planning, parenting education classes, substance abuse treatment, and immunization requirements. The Contract is designed to be individualized to the specific needs and situation of each family. Therefore, the exact requirements within the Contract may vary from family to family. This document will be revised as the needs and the situation of the family evolve. (See DSSM 3010.2.5)

The State will ensure that services related to these provisions are available to the recipient. Additionally, other supportive services will be available (such as child care) if necessary. If the services are not available to the recipient and it is in the Contract, the recipient will not be sanctioned. The Contract will be modified to reflect that the service is unavailable at that time. For instance, if a recipient was directed to seek substance abuse treatment on an in-patient level, but a bed was not available for four months, that part of the Contract would be suspended until a bed became open for the individual.

In establishing and enforcing the Contract, the DSS worker has primary responsibility for ensuring that clients understand what is expected of them. While sanctions will be imposed for failure to meet the expectations of the Contract, the intended result of the sanction process is to convince clients of the need to cooperate. An important element of the process is "coaching" the client to transcend any barriers to meeting Contract expectations.

In the past, such barriers may have been good cause factors for clients not accomplishing what they need to do. Under TANF, however, the client and worker must become partners in efforts to surmount any and all obstacles to success. While it is expected that the client verbalize any difficulties s/he may have or expect to have in meeting TANF requirements, the worker also has a duty to do whatever s/he can to elicit from the client any information needed to identify and overcome hurdles.

Coaching is without question a difficult task, given the multitude and variety of problems a client may face and the many steps along the road to self-sufficiency. Nevertheless the worker needs to embrace it as a critical element in the achievement of our welfare reform objectives.

Certainly we want TANF clients to be clear at all times about their obligation to exercise personal responsibility in exchange for benefits. When clients have a clear understanding, yet still fail to meet their obligations, workers need to respond quickly. The swiftness of our actions will demonstrate the seriousness of our intentions. This was the primary reason we requested federal waiver of the conciliation process.

However, the ultimate goal of the sanction process should not only demonstrate how serious we are, but that we are available to help them become self-sufficient. We want clients to realize it is to their advantage to work with us and not against us.

Workers who truly understand the foundations upon which our sanction policies exist are in a better position to successfully steer clients through the welfare reform process. Keep in mind the following guidelines:

a) At every step of the way, workers should make the sanction process clear for clients; that is, explain clearly what the client’s responsibilities are and what the consequences are for failure to meet these responsibilities.

b) Encourage clients to discuss any problems they face in meeting TANF requirements. Coach them in a positive way to overcome these hurdles. Offer assistance, but make it clear that the client has ultimate responsibility for meeting requirements.

c) If and when clients fall short of expectations, before taking action to apply sanctions, make sure that clients understand exactly what requirement(s) was not met and the consequences of it. This is not to say that we want workers to offer conciliation, but rather that we want workers to emphasize cause and effect. In this way clients should more readily recognize the benefits of cooperating and doing what is expected in the future.

Sanctions are not our desired result. They are a means to accomplish the goal of client cooperation.

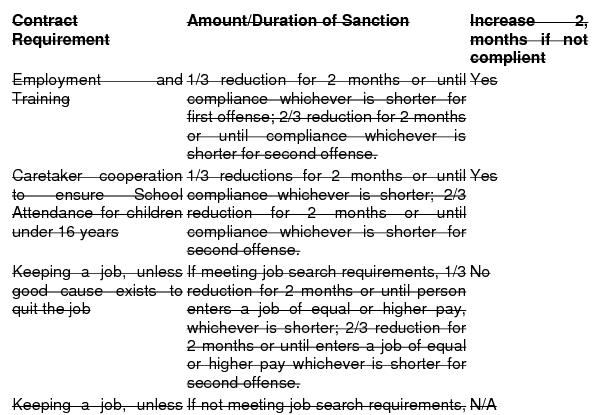

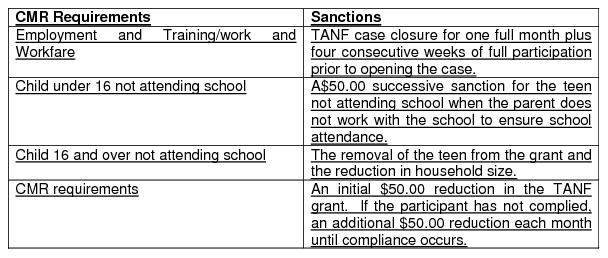

3009.1 Failure to Comply With CMR and Imposition of Sanctions

The Contract of Mutual Responsibility encompasses three broad categories of requirements: 1) enhanced family functioning, 2) self-sufficiency and 3) teen responsibility requirements.

1) Enhanced family functioning requirements of the Contract of Mutual Responsibility include, but are not limited to, attending family planning and parenting education sessions, ensuring that children are immunized, and participating in substance abuse assessment and treatment. Sanctions for non-compliance with these requirements start at $50.

2) Self-sufficiency requirements of the Contract of Mutual Responsibility are employment and training responsibilities., work related and ensuring school attendance requirements for dependent children under age 16. Sanctions for non-compliance with these requirements start at a one-third reduction in benefits result in the closure of the TANF case.

3) Teen responsibility requirements include maintaining satisfactory school attendance. Teens under the age of 16 must maintain satisfactory school attendance. The parent must work with the child and school to ensure satisfactory attendance. If the teen does not maintain satisfactory attendance at school and the parent fails to work with the school or appropriate agency to ensure school attendance, the case will be sanctioned. This sanction is an initial reduction of $50. This reduction will increase by $50 every month until there is compliance with the requirement. If the parent complies and works with the school the TANF benefit will be restored, even if the child does not return to school.

3) Teen responsibility requirements include maintaining satisfactory school attendance, or ensuring satisfactory attendance, for dependent children 16 years of age and older or participating in employment and training activities. The sanction for non-compliance with these requirements is $68, if the teen does not comply, and an additional $68 if the caretaker does not work to remedy the situation. the removal of the teen from the assistance grant. The teen can not be added back into the case until verification of school attendance is received or verification of four consecutive weeks of participation and one month of being removed from the grant.

The severity of the sanctions differs depending upon the type and number of violations. Individual penalties and the cure for each are noted in the policy sections which follow. However, when imposing sanctions, these are the rules in which sanctions are applied:

1. The penalty for failure to comply with self-sufficiency requirements of the Contract of Mutual Responsibility (employment and training responsibilities) is a 1/3 reduction of the TANF benefit for the first occurrence, 2/3 reduction of the TANF benefit for the second occurrence and a total loss of the TANF benefit for the third occurrence the closure of the TANF case.

2. The penalty for failure to comply with teen responsibility requirements for a child under 16 years of age is a $68 50 reduction in the grant, if the teen does not comply, . and an additional $68 if If the caretaker does not work with the appropriate agencies to remedy the situation, an additional $50 penalty continues each month until the mother works with the appropriate agency, the child returns to school or the grand reduces to zero. The only way to cure the sanction is for the mother to work with the appropriate agency and/or the child returns to school. If the child does not return to school but he mother has been working with he appropriate agency then the sanction can be lifted.

Failures to comply with self-sufficiency requirements are not treated as separate activity violations, but as one component. Accordingly, a person who quits employment without good cause and is sanctioned 1/3, receives a 2/3 sanction for the second violation whether it is for a job quit or noncompliance with employment and training activities or cooperation to ensure compliance with school attendance for dependent children under age 16.

3. The sanction for teens 16 years or older who do not attend school and/or employment and training activity for the required hours is the removal of that teen from the TANF grant and a reduction in the house hold size. The sanction can only be cured when the teen is removed from the grant for one month and participation in employment and training for four consecutive weeks is verified or satisfactory school attendance is verified.

3. 4. The penalty for failure to comply with enhanced family functioning requirements of the Contract of Mutual Responsibility is an initial $50 reduction of the TANF benefit. This reduction will increase by $50 every month until there is compliance with the requirement. The initial $50 reduction will be imposed whether the family fails to comply with one, or more than one, family functioning requirement. Clients will have to comply with all requirements before the sanction can end.

4. 5. Failing to comply with both enhanced family functioning and self-sufficiency requirements of the Contract of Mutual Responsibility will result in combined penalties for each. For example, both a $50 reduction and 1/3 reduction to the TANF benefit. For example, impose the $50 reduction and then close the case.

Failures to comply with self-sufficiency requirements are not treated as separate activity violations, but as one component. Accordingly, a person who quits employment without good cause and is sanctioned 1/3, receives a 2/3 sanction for the second violation whether it is for a job quit or noncompliance with employment and training activities or cooperation to ensure compliance with school attendance for dependent children under age 16.

When there are multiple sanctions always impose the monetary sanctions first; enhanced family functioning and teen under 16. The removal of a teen from the case is second, and the self-sufficiency which results in a case closure is last. All sanctions need to be imposed.

3009.2 Sanctions Flow Chart

Below is a flow chart, which describes in graphic detail the sanction process. This chart is intended to be a conceptual representation of the process and does not take into account the level of worker discretion and understanding needed to make sanction decisions. It will give workers a quick review of how the sanction process works and flows in the ideal, but is not a literal account of the way workers will always confront the process in actual practice.

One thing of note, the chart depicts the eligibility interview, the Employment and Training interview and initial participation with Contractor/DOL programs as one Orientation process not as individual events. This means clients, who fail to attend their employment and training interview and then comply, are not sanctioned a second time if they fail to attend contractor or DOL orientation. It simply means they have not completed the Orientation process and therefore, have not completely cured their initial sanction. In order to show compliance with the entire Orientation process, clients must attend the missed event and demonstrate cooperation for two weeks. Any failure to do this means the initial sanction continues. However, as noted further in these policies, should non-compliance continue beyond two months, workers will initiate a second sanction regardless of completion of the process.

3009.3 Benefit Reduction for Multiple Sanction Types

The sanctions for failure to meet Contract requirements allow for the possibility of multiple penalties to be imposed at the same time. The hierarchy is as follows:

1. If in place, the one-third penalty for failing to meet work and training requirements and the one-third penalty for not cooperating with school or agency officials to meet attendance requirements for dependent children under the age of 16 are the first to be imposed by DCIS.

2. 1. If in place, The $68 sanction for teens 16 and over teens who fail to meet school attendance requirements and an additional $68 for their parents who do not cooperate to remedy the situation is imposed next is the removal of the teen from the grant first, if applicable.

3. 2. If in place, The $50 sanction for failure to meet enhanced family functioning requirements (CMR) and the teen under 16 years of age sanction is first imposed next. by DCIS.

3. The self sufficiency sanction, failure to meet participation requirements is a full TANF sanction resulting in a case closure. This is imposed last.

The order in which sanctions are imposed is important, since different sequences result in different benefit amounts. By being familiar with the hierarchy, workers will be able to explain to clients how multiple penalties will impact benefits. because we can not sanction a closed case. If a client has both an enhanced family function and a self-sufficiency sanction for the same period it is important to make sure the enhanced family sanction that reduces the TANF grant is imposed prior to the self sufficiency sanction that closes the case.

(Break in Continuity of Sections)

3010 Participation and Cooperation in Developing CMR

It is mandatory that the caretaker enter into a Contract of Mutual Responsibility. The Contract applies to those families in the Time Limited Program and Children's Program, as well as to teen parents. Other family members within the assistance unit may be subject to compliance with provisions of the Contract, even if the caretaker is a non-needy caretaker relative payee.

If the caretaker is a non-needy caretaker relative, the individual would not be required to participate in employment-related activities, but may be required to participate in other Contract activities.

The caretaker may object to certain aspects of the Contract. The caretaker needs to present any objections up front, at the time of the initial Contract or upon Contract revision. DSS retains the ultimate decision making authority as to what elements are put into the Contract of Mutual Responsibility.

DSS expects clients to cooperate in the development of the Contract of Mutual Responsibility. Certain aspects of the Contract, such as, but not limited, to participation in employment-related activities, meeting school attendance requirements and immunization, cannot be amended. However, even though certain aspects cannot be amended, this does not imply that caretakers cannot discuss and/or negotiate Contract requirements. Further, this is not to imply that such discussion and/or negotiation is non-cooperation. To the extent possible, each caretaker should be able to mutually develop her/his Contract. DSS is to give caretakers the opportunity to understand the Contract and its requirements, as well as to discuss the Contract with persons outside the DSS office. Reasons for requesting such an outside review of the Contract include, but are not limited to, language barriers, developmental disabilities, or to seek legal or other counsel. Caretakers therefore, should be granted their requests to remove proposed Contracts from the DSS office in order to review it with another person. This should not be considered non-cooperation.

Negotiating elements of the CMR can mean that aspects of the CMR are waived. On a case by case basis, elements of the CMR can be waived if good cause exists. If the particular circumstances of a family warrant waiving elements of the CMR it is to be justified and properly documented in the case record.

See Administrative Notice A-10-99 DFS/DSS Procedures.

For example: a parent's only child is terminally ill. It is reasonable to determine that a parent would want to spend as much time with the child as possible. Therefore, waiving school attendance requirements and parenting education requirements are reasonable. Document the child's illness and the reason for the waiving of the CMR requirements in the case record.

3010.1 Penalties for Not Cooperating in Development of CMR

The fiscal sanction for not cooperating, without good cause, in the development of the Contract will be an initial $50.00 reduction in TANF benefits. This reduction will increase each month by $50.00, either until there is compliance or the case is closed.

If caretakers are actively negotiating the terms of their Contracts, DSS will not impose the $50.00 penalty. DSS will provide caretakers up to 10 days to reach a resolution. After this time, DSS will consider caretakers as not cooperating if they refuse to participate in the further development of their Contracts.

DSS will also give those caretakers, who choose to do so, the opportunity to discuss their Contracts with persons outside of the DSS office. DSS will allow caretakers up to 10 days to take Contracts outside of the office, during which DSS will not impose the $50.00 penalty. DSS will consider caretakers who have not returned Contracts after that time as not cooperating and subject to the $50.00 penalty.

3010.2 Contract of Mutual Responsibility and Domestic Violence Screenings

3010.2.1 Family Development Profile

The Family Development Profile is a an assessment tool used to identify possible social, family and emotional barriers to self-sufficiency as they affect an individual’s ability to obtain and retain employment. The Family Development Profile covers issues of self-esteem, health and family relationships. This tool is designed to surface those issues which, when resolved, will increase the participant’s ability to become truly self-sufficient. This assessment tool is a mandatory assessment tool for all adult and teen TANF recipients.

(Break in Continuity of Sections)

3011 Employment and Training and Work

DSS expects employable adults to participate in either employment or activities related to finding work (e.g., employment and training activities) for 30 hours a week for two consecutive weeks prior to TANF benefits to being authorized. The TANF benefit will continue uninterrupted as long as the participation in work or work activities continues for the required number of hours per week (see section 3006.2). Either an employable adult is working or is participating in activities to secure employment. DSS also expects caretakers to cooperate as necessary with school and other officials to ensure satisfactory school attendance by dependent children under age 16. The failure of clients to maintain any of these activities represent sanctionable offenses, which are components of the self-sufficiency requirements.

3011.1 Employment and Training Requirements

Clients must keep appointments with employment and training staff, cooperate in the development of the Employability Plan, and participate in employment and training activities equivalent to the required weekly amounts.

Clients who have secured employment are expected to continue employment unless they have good cause for terminating a job (see Good Cause definition under 3001 Definitions) and participate in approved employment and training activities.

Parents are expected to cooperate with school officials and other service providers in helping their child(ren) maintain satisfactory attendance. Penalties can be imposed if parents do not cooperate. Since Parents with children under age 16 are expected to exert more influence over their children, and since early school attendance is so important in moving children down the path to self-sufficiency., this requirement is grouped with employment and training and work requirements as part of the overall self-sufficiency requirements, which invoke harsher penalties for noncompliance. (See section DSSM 3009 and 3012 for requirements and sanctions related to cooperation to ensure school attendance by children 16 and over and children under the age of 16.). A third non-compliance will not result in a permanent but a curable penalty of loss of cash benefits. See DSSM 3011.2.

3011.2 Sanctions for Failing to Comply With Requirements

See Administrative Notice: A-7-99 Child Care Issues

Self-sufficiency requirements include those related to employment and training, and work, and cooperation with officials to ensure satisfactory school attendance by dependents under age 16.

The fiscal sanction for failure without good cause to meet school attendance requirements for a child under 16 are the same as for other self-sufficiency requirements. This includes teen parents who are dependent children.

The penalty for noncompliance with the self-sufficiency requirements will be:

a) for the first offense, a 1/3 reduction in TANF

b) for the second offense, a 2/3 reduction in TANF

c) for the third offense, a loss of all cash benefits.

the closure of the entire TANF case for one month and a mandatory four consecutive weeks of participation. The four consecutive week participation is mandatory to cure the sanction and reopen the case. The case may remain closed longer than one month if the four consecutive weeks of participation have not been completed.

The duration of the first and second sanctions will each be two months or until the person complies, whichever is shorter. If, after one month, the person has not complied, DSS will schedule an interview to explain again the participation requirements. If at the end of the two month period there is no demonstrated compliance, the sanction will increase to the next level. If the penalty is related to work non-compliance then the third penalty is permanent loss of benefits, If unless the adult is deemed unemployable, remove the sanction and enter the correct exemption. Then the case may be reopened for the length of time that the adult is not able to work. If there is a third penalty and it is related to school attendance, it can be cured by the adult caretaker cooperating with school officials to remedy the situation.

The penalty for individuals who quit their jobs without good cause, but who comply with subsequent job search requirements, will be:

a) for a first offense, a 1/3 reduction in TANF, to be imposed for a period of two months or until the individual obtains a job of equal or higher pay.

b) for a second offense, a 2/3 reduction in TANF, to be imposed for a period of two months or until the individual obtains a job of equal or higher pay.

c) for a third offense, a permanent loss of all cash benefits.

The penalty for individuals who quit their jobs without good cause and do not comply with subsequent job search requirements will be loss of all cash benefits for two months or until the individual obtains a job of equal or higher pay

Because the third sanction is for the duration of the demonstration, an additional supervisory review of case circumstances will be required before imposing the third sanction, in order to determine whether good cause for noncompliance exists. Impose the third sanction, after such a review, if good cause is found not to exist.

Noncompliance with more than one of the self-sufficiency requirements at a point in time will result in a one-third benefit reduction for each sanction.

Example: A person fails to attend the DOL orientation and, prior to a cure then fails to cooperate with officials to ensure school attendance by his/her 14 year old child. The resulting sanctions would result in a 2/3 (1/3 + 1/3) loss of case benefits.

Note: Under TANF regulations, Section 402(e)(2), DSS cannot impose sanctions when individuals refuse to participate in work or work-related activities if these individuals are single custodial parents with at least one child under age six, and these parents have demonstrated an inability to obtain needed child care. This provision neither makes parents exempt from participation in work activities, nor makes them exempt from time limits. It only restricts DSS authority to sanction.

Parents must demonstrate the following:

the unavailability of appropriate child care within a reasonable distance from their home or work (reasonable distance is defined as care that is located in proximity to either a parent’s place of employment or near the parent’s home, generally care that is within one hour’s drive);

the unavailability or unsuitability of informal child care by a relative or under other arrangements (unsuitability of informal care is defined as care that would not meet the physical or psychological needs of the child);

the unavailability of appropriate and affordable formal child care arrangements (affordable care is defined as care that would provide access to a full range of child care categories and types of providers ; and appropriate care is care that meets the health and safety standards as defined by State licensing guidelines, as well as the needs of the parents and children).

Parents who claim an inability to obtain needed child care must contact a DSS worker to press their claim. Parents will have 10 days, either from the date when they first attempted to find child care or ten days from the date DSS instructed them to participate in work activities, to contact the worker. DSS staff will have 20 days to review and decide whether the parents have a legitimate claim. If DSS determines that the parents did not demonstrate their claim, workers are to impose the sanctions. DSS will not sanction parents who have demonstrated their claims. Document reasons in DCIS under Case Remarks.

3011.3 Curing Sanction Penalties

Clients must keep appointments with Employment and Training staff, complete the Employability Development Plan and follow through with the recommendations of the Employment and Training staff for a minimum period of one month, including four two weeks consecutive weeks of 30 hours of participation.

Clients, unless indicated otherwise, must participate in the work and/or work related activities attachment model for a minimum period of two four consecutive weeks.

EXAMPLE: A client fails to keep her initial appointment with Employment and Training staff, and to meet the required hours of participation and is sanctioned. In order to cure this sanction, the client must not only keep her appointment with Employment and Training staff, but must also keep her appointment with DOL contact the Employment and Training staff, and follow through with her DOL work activity for 30 hours a week (client’s required hours) for a minimum period of two four consecutive weeks before the sanction is considered cured.

The failure to keep appointments with both Employment and Training staff and DOL staff in the above example would be considered the first offense for sanctioning purposes. (It is a first offense because both Employment and Training and DOL are part of the same Orientation process, for which the cure can only be participation in DOL activity for two weeks). Any failure to continue the recommended activity after that point would be considered a second offense. For which the cure is participation in the activity to which the person was previously assigned, or an activity designed by Employment and Training to lead to full participation, for a minimum period of two weeks.

The sanction for quitting a job will end when the individual returns to the former job or obtains a job of equal or higher pay. However, cash benefits can be restored at a reduced level, depending upon the number of offenses (first or second), as long as there is compliance with the job search requirement for a period of two weeks. If after two months, clients have maintained compliance with the job search requirement, benefits can be restored in full.

DSS expects employable adults to participate in either employment or activities related to finding work (e.g., employment and training activities) for TANF benefits to continue uninterrupted. Either an employable adult is working or is participating in activities to secure employment. The failure of clients to maintain either of these activities is are a sanctionable offense.s, which are similar components of the employment and work related activity requirements.

3012 School Attendance Requirements

School attendance requirements exist for both adults and children. Children are expected to maintain satisfactory school attendance. Acceptable school attendance will be defined by the individual school. If the school does not define what is acceptable, use an 85% attendance rate.

Parents are expected to cooperate with school officials and other service providers in helping their child(ren) maintain satisfactory attendance. Penalties can be imposed if parents do not cooperate. These penalties will differ depending upon whether a child is under the age of 16 or is over age 16.

3012.1 Sanctions and Cures for Unsatisfactory School Attendance

CHILDREN UNDER 16 YEARS OLD

The fiscal sanction for noncompliance, without good cause, with school attendance (including dropping out of school) or alternative participation requirements will be:

A $50.00 reduction in the TANF grant each month if the parent does not work with the teen and the school to ensure school attendance. If the parent works with the school and the teen still does not comply with the requirement the sanction is removed.

CHILDREN AGE 16 AND OLDER, INCLUDING TEEN PARENTS WHO ARE DEPENDENT CHILDREN OR HEAD OF HOUSEHOLD

The fiscal sanction for noncompliance, without good cause, with school attendance, including dropping out of school, or alternative participation requirements will be:

A reduction of $68.00 in TANF which represents the teen's portion of the grant. The removal of the child from the grant and the subsequent reduction in household size.

If the parent or caretaker is not cooperating with school officials or other agencies, as appropriate, to remedy the situation, an additional $68.00 reduction in TANF will be imposed.

Teens who drop out of school can only have their need restored to the grant if they participate in work, or agree to re-enroll in school. So for teens to be in satisfactory compliance with school attendance requirements, they will either have to remain in school or, if not, they must be working.

To cure the sanction teens over 16 must first serve a full month sanction and either return to school, work, or participate in employment and training for four consecutive weeks whichever is longest.

3012.2 Curing Sanction Penalties

Compliance exists when there is evidence that the caretaker has cooperated with school officials, and the student has subsequently attained satisfactory attendance at the school.

Teen Parent up to age 18 Education/Training Requirements

Teen parents are required to attend either a). elementary, b). secondary, c). post-secondary, d). vocational, or e). training school, participate in a GED program or work.

Sanction for not meeting Teen Parent Education/Training requirement

A reduction of $68.00 in TANF.

Curing Teen Parent Education/Training Sanction

The sanction will end when either the Teen Parent re-enrolls in school or GED program, or participates in work.

(Break in Continuity of Sections)

3031 Work For Your Welfare

When a family applies for TANF assistance they will be referred to the contractor to participate and complete their required two consecutive weeks of required hours (30, 35, or 55) in approved employment related activities.

All two-parent households, who are without employment, must enter a Work For Your Welfare activity to qualify for benefits. Single adult recipients, who reach their 22nd month of benefit and are without employment, and all eligible applicants on or after 01/01/2000, must enter a Work For Your Welfare activity to qualify for benefits. Additionally, all TANF recipients who are employed must have regular earnings of the current federal minimum wage at twenty-five hours per week. (The current federal minimum wage is $5.15 per hour, which at 25 hours per week equals $128.75 per week earnings.) A person who is employed but not earning at least the equivalent of the current federal minimum wage at twenty-five thirty hours per week will be considered mandatory for Work for Your Welfare. A contracted worker must receive his or her wages on a regular basis to be exempted from this requirement.

Work for Your Welfare is defined as a work experience program in which participants work to earn their benefits. In addition, DSS requires each participant to complete 10 hours of job search activity approved employment related activities per week. The failure to complete job search the required 10 hours of approved activities as required will result in a progressive 1/3 sanction full family sanction, closing the entire TANF case. For two parent households, one parent must participate in the work for your welfare program in order to earn benefits. The second parent, unless exempt, must also participate in required employment related activities as defined by DSS and the DSS contractor.

Currently DSS operates the work for your welfare program under contract with a work for your welfare services provider. The provider assumes responsibility for the assessment, placement and monitoring of all work for your welfare participants in unsalaried work assignments. The work assignments are with public or nonprofit organizations. In return for their services, participants earn the amount of the benefit they are eligible to receive.

Work for your welfare is not preferable to participants obtaining unsubsidized employment. Though the work for your welfare assignment should be a safe assignment, it should not be more attractive than unsubsidized employment.

DSS is to ensure that no participants placed in work for welfare activities displace regular paid employees of any of the organizations providing the placements.

Since placements are not voluntary, DSS expects participants to accept assignments unless the assignment represents an unreasonable health and safety risk (e.g., the participant has a health condition, which would be aggravated by the assignment).

Participants cannot appeal their assignments to work for your welfare work sites.

8 DE Reg. 1024 (1/1/05)

8 DE Reg. 1618 (5/1/05)

3031.1 Hours of Participation - One Parent Families

Effective 10/1/98, participants in single parent households are required to work for up to 30 hours per week. The 30 hours are the maximum participation hours. DSS determines the actual hours of participation by dividing the TANF and Food Stamp benefits by the minimum wage. If the hours determined by dividing the grants by the minimum wage exceeds 30 hours per week, participants are to complete no more than the 30 hours maximum. In addition to these hours, every participant is expected to participate in 10 hours of job search approved employment related activities per week.

EXAMPLE: The TANF grant amount for two is $270. Divided by the minimum wage ($6.15), this equates to 52 hours per month for the TANF grant (always round down to the nearest whole number). The Food Stamp allotment amount is $224. Divided by the minimum wage ($6.15), this equates to 43 hours per month for the Food Stamp allotment. Together this would mean that the participant must work 95 hours per month. Divide the 95 monthly hours by 4.33 (number of weeks per month) to arrive at a weekly participation rate. 95 divided by 4.33 is 21 hours per week. So the above participant must participate 21 hours per week in a work-for-your welfare placement in order to receive his/her full grant and allotment.

Total performance hours are based on grant amounts regardless of sanctions. In other words, a participant who has a 1/3 sanction does not perform fewer hours because of the sanction. Performance is based on what the total grant would have been without the sanction.

EXAMPLE: A family of two has a grant of $270. The grant, however, has been reduced by 1/3 $50.00 because of an employment and training sanction a CMR sanction. When DSS assigns this adult to work, the total performance hours are based on the grant amount of $270 despite the 1/3 $50.00 sanction.

The 10 hours of approved employment related activities per week job search requirement still applies. The failure to complete the 10 hours of job search approved employment related activities is a sanctionable offense, punishable by the progressive 1/3 penalty for failure to comply with an employment and training activity resulting in a full TANF sanction which closes the entire TANF case.

Participants who fail to complete the hours required by dividing their grant by the minimum wage will have their grant adjusted entire TANF case closed. For each hour not worked, participants will have the grant adjusted downward by the amount of the minimum hourly wage.

EXAMPLE: A participant in a family size of 2 is required to work 52 hours in a month. The participant however, only works 50 hours. This participant will have the grant reduced by $6.15 (minimum wage) x 2. DSS will reduce the grant amount for this participant by $10.00, always rounding down to the nearest dollar amount.

Once DSS determines the hours participants are to work, the contractor will assign participants to a work site. At the work site, participants must complete their assigned hours within the time period determined by the contractor and the work site.

3031.2 Hours of Participation - Two Parent Families

Two parent households must participate in work for your welfare as soon as DSS determines the household eligible for benefits. In two parent households, one parent must participate at their assigned maximum performance hours (35 hours per week), and the second parent must participate in required employment related activities as determined by DSS and the DSS work for your welfare contractor, unless the second parent is otherwise exempt (e.g., caring for a disabled child or is incapacitated). DSS requires the second parent in the two-parent household to go to the workfare contractor to be placed in a component other than workfare approved employment related activities.

If the families of two-parent households receive federally subsidized child care, together they must participate in at least 55 hours per week of required activity. In this case, one parent will do work for your welfare activity, and the second parent must participate in a sufficient number of hours with the work for your welfare contractor so that, when combined with the hours of the first parent, together they equal 55 hours. If the one parent in the two parent household who is participating in work for your welfare does not complete his/her required performance hours, the grant allowance for the entire family is reduced by the hours not worked times the minimum wage TANF case is closed. The grant adjustment occurs case closes regardless of whether the second parent completed his/her required hours of employment related activities.

If the second parent does not complete or refuses to complete the required employment related activities, DSS will impose a separate 1/3 sanction on this second parent TANF full family sanction which closes the entire TANF case. This sanction will increase by 1/3 as long as this second parent refuses to complete his/her required activities. DSS will treat the second parent’s 1/3 sanctions separately from the first parent’s sanctions. For example, if the first parent in this two-parent family already has a 1/3 sanction, the 1/3 sanction for the second parent will not increase the sanction level to 2/3 for the entire family. However, the highest sanction level of either parent will determine the entire sanction level for the family

3031.3 Initiating Work For Your Welfare - One Parent Families Reserved

3031.3.1 Families That Have A Forty-eight (48) Month Time Limit Who Are Continuously On Assistance: Reserved

DSS will alert single parent families to report to the work for your welfare contractor in the 22nd month of their receipt of benefits. The contractor will schedule participants for an interview for assessment and placement in a work for welfare activity. Participants’ failure to keep their scheduled interview with the contractor will result in the progressive 1/3 penalty for an employment and training activity.

Participants whose cases are closed can only have benefits restored once they have agreed to and have cooperated for two weeks with their work for your welfare assignment. If a participant fails to cooperate by not completing any portion of this two weeks of his/her work for your welfare placement, DSS will not restore benefits.

Participants are to begin their work for your welfare assignment on the 12th of the 23rd month of benefit receipt. Participants will have until the 11th of their 24th month to complete their work for your welfare monthly assignment in order to receive a benefit for their 25th month. Otherwise, DSS will reduce benefits for the 25th month based on any hours not worked.

FOR EXAMPLE: Mary Jones is a single parent receiving benefits. September 1998 is her 22nd month of TANF benefit receipt. On Post Adverse Action day in August, Mary’s October benefit as well as her work for your welfare requirement is calculated. A letter is generated to Mary informing her that she must participate in work for your welfare beginning in October. The letter also informs her of the required hours per day she must complete, and that she will have from October 12th until November 11th to complete her assignment if she is to get benefits in December. If Mary does not complete any of her Work For Your Welfare hours, she receives no benefit for December and her case closes. In order for her to start receiving benefits again, Mary would have to agree to go to her assigned Work For Your Welfare work site, and cooperate by completing her assigned hours for up to two weeks. If she fails to do this, her case remains closed.

3031.3.2 Families That Have A Thirty-Six Month Time Limit And Families That Have A Forty-eight Month Time Limit Who Reapply On or After January 1, 2000 Reserved

DSS will alert single adult families to report to the work for your welfare contractor immediately after they are approved to receive benefits. Participants will be required to participate in the Work For Your Welfare program activities to receive benefits for the month following initial approval. The contractor will schedule participants for an interview for assessment and placement in a work for welfare activity. Participants’ failure to keep their scheduled interview with the contractor will result in the progressive 1/3 penalty for an employment and training activity.

Participants whose cases are closed can only have benefits restored once they have agreed to and have cooperated for two weeks with their work for your welfare assignment. If a participant fails to cooperate by not completing any portion of this two weeks of his/her work for your welfare placement, DSS will not restore benefits.

FOR EXAMPLE: Sammy Smith is a single parent who applied for and was approved to receive TANF on December 2, 2000. A letter is generated to Sammy informing him that he must participate in work for your welfare beginning the following month. The letter also informs him of the required hours per day he must complete, and that he will have from January 12th until February 11th to complete his assignment if he is to get benefits in March.

3031.4 Initiating Work For Your Welfare - Two Parent Families

For two parent families, only one parent will have to complete a work for your welfare assignment. DSS will inform the family of their work for your welfare obligation once the family is eligible for benefits, usually within 30 days of the intake interview refer the family to the contractor at the time of application for TANF. In addition, the other parent in the family, unless exempt, must also participate in employment and training activities. Participation in Employment and Training for the required hours is required for two weeks prior to the receipt of benefits. Again, DSS will send a letter to the family instructing them that one parent must report to a work for your welfare assignment and the other parent must participate with the work for your welfare contractor in a component other than work for your welfare. The family must decide which parent will complete the work for your welfare assignment and which parent will participate in employment and training activities with the work for your welfare contractor. The failure to report to the contractor will result in a progressive 1/3 penalty for an employment and training activity. In addition, the parent who participates in the work for your welfare assignment must also complete 10 hours of job search approved employment related activities per week.

The following month is the first required month for which participation hours are calculated. DSS will calculate hours the same as it does for single parent families. That is, the parent in the two parent family must report by the 12th of the month and will have until the 11th of the following month to complete his/her work for your welfare hours.

For Example: Janet and Jim Roberts apply for cash assistance in October. By November DSS determines them eligible. The family decides that Jim will complete the Work For Your Welfare hours. Having calculated the hours Jim must complete, DSS sends them a letter instructing Jim that he has from November 12th until December 11th to complete his hours if the family is to receive benefits in January. In addition, the letter instructs Janet that she is to report to the Work For Your Welfare contractor to participate in a component other than Work For Your Welfare.

3031.5 Ending a Work For Welfare Placement

Work for welfare placements will end when any of the following circumstances occur:

Note: Participants in either one parent or two parent households are exempt from work for your welfare participation if a parent is working 25 30 or more hours per week in a non-subsidized job.

8 DE Reg. 1024 (1/1/05)