DEPARTMENT OF NATURAL RESOURCES AND ENVIRONMENTAL CONTROL

Division of Energy and Climate

GENERAL NOTICE

Director's Determination under 26 Del.C. §354(i) & (j) and 7 DE Admin. Code 104 Implementation of Renewable Energy Portfolio Standards Cost Cap Provisions

March 15, 2016

Summary

The Director of the DNREC Division of Energy & Climate is required under 26 Del.C. §354(i) & (j) and 7 DE Admin. Code 104 Implementation of Renewable Energy Portfolio Standards Cost Cap Provisions to review the calculations of the costs and benefits of Delaware's Renewable Portfolio Standards (RPS), consult with the Public Service Commission, and determine whether to freeze the RPS and the solar PV carve-out of the RPS.

For Compliance Year 2014/15 (June 1, 2014 to May 31, 2015) the benefits exceeded the costs of compliance for the RPS and the solar PV carve-out.

The externality benefits and the economic benefits of solar PV used to satisfy DPL's solar carve-out of the RPS totaled 4.58 percent, far greater than the 1.50 percent cost of solar PV compliance. Based on this analysis, and exercising my statutory discretion, I have determined to not freeze the solar PV carve-out of the RPS.

Further, the externality benefits and the economic benefits of renewable energy used to satisfy DPL's RPS requirement totaled 7.29 percent, far greater than the 3.93 percent cost of RPS compliance. Based on this analysis, and exercising my statutory discretion, I have determined to not freeze the RPS.

Background

The Division of Energy & Climate has reported on the cost of RPS compliance as required under Section 4.0 of 7 DE Admin. Code 104 Implementation of Renewable Energy Portfolio Standards Cost Cap Provisions promulgated under 26 Del.C. §354(i) & (j). The Director of the Division may, in consultation with the PSC, decide to freeze the RPS as provided in Section 5.0 of the Regulation. Thomas Noyes, the responsible staff member in this matter, has reported on the costs and benefits of RPS compliance.

I and Mr. Noyes briefed the Public Service Commission on the calculations on the costs and benefits of RPS compliance on February 23, 2016. Mr. Noyes has revised the calculations in response to comments received before the PSC briefing. His memorandum with the revised calculations of the costs and benefits, with supporting appendices, is available online at http://www.dnrec.delaware.gov/energy/information/otherinfo/Pages/Renewable.aspx.

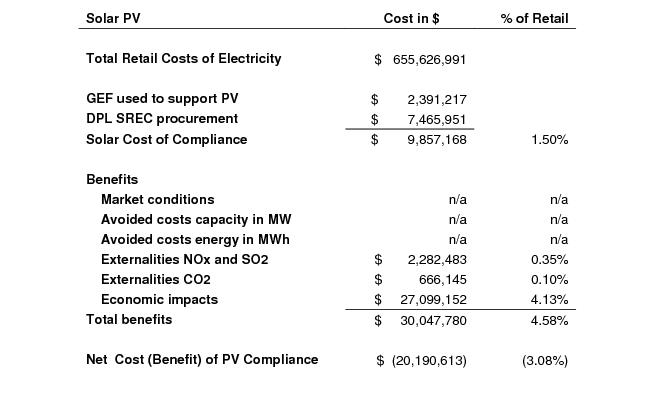

Calculation of the Costs and Benefits of Solar PV Carve-out

The solar PV cost of compliance has been calculated as follows:

Section 4.3 Solar Renewable Energy Cost of Compliance

The Solar Energy Cost of Compliance in Compliance Year 2014/15 was $9,857,168, or 1.50 percent of the total retail cost of electricity of $655,626,991. The benefits have been calculated as follows:

Section 5.4.1 Overall energy market conditions

Overall market energy conditions have not changed sufficiently enough to significantly affect this analysis.

Section 5.4.2 Avoided cost benefits from solar PV carve-out

Avoided cost benefits are those market benefits known as price suppression effects attributable to reduced demand because of distributed renewable energy generation in PJM, which leads to lower capacity and energy prices particularly at times of peak demand. Since the methods for calculating these benefits are still being developed and no calculation has been performed.

Section 5.4.3 Externality benefits due to solar PV carve-out

Externality benefits of the RPS totaled $21,828,158, or 3.16 percent of the total retail costs of electricity in CY 2014/15. Of the total externality benefits, 14.25 percent are attributed to solar PV based on the ratio of MWh generated of solar PV to all renewable energy generated during the compliance year. The solar PV portion of the externality benefits totaled $2,948,628, or 0.45 percent of the total retail cost of electricity.

Section 5.4.4 Economic impacts of the deployment of renewable energy in Delaware.

The Division, working through the Maryland-D.C.-Virginia Solar Energy Industries Association (MDV-SEIA), surveyed the local solar energy industry in Delaware. The survey reported 300 jobs totaling $21 million in salaries. The Division gave the survey results to the Delaware Economic Development Office (DEDO), which ran the numbers through its IMPLAN software package. The IMPLAN results show that the total direct, indirect and induced economic benefits are $37,637,711, which would be 5.74 percent of total retail costs of electricity.

In response to some comments received by the Division, Division staff researched the question of how many of the 300 solar jobs in Delaware support the development of solar PV in state, and how many support the development of solar PV in neighboring states (Maryland, Pennsylvania and New Jersey). Staff consulted with the MDV-SEIA and spoke directly with large and small solar energy companies on a confidential basis to review their sales and employment figures. Based on this research, staff concluded that the economic impact analysis should be adjusted by a factor of 0.72 to reflect the amount of work performed to build solar PV in neighboring states by employees located in Delaware. This reduces the economic impact of the PV industry in Delaware from $37,637,711 to $27,099,152 in direct, indirect and induced economic effects.

The results summarized below clearly show that the benefits of the solar PV carve-out exceed the costs:

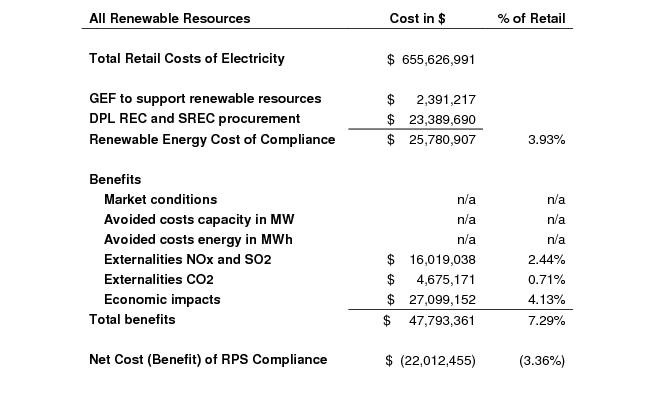

Calculation of the Costs and Benefits of RPS Compliance

The RPS cost of compliance is calculated as follows:

Section 4.2 Renewable Energy Cost of Compliance

The Cost of RPS Compliance in Compliance Year 2014/15 was $25,780,907, 3.93 percent of the total retail costs of electricity. The benefits to have been calculated as follows:

Section 5.4.1 Overall energy market conditions

Overall market energy conditions have not changed sufficiently enough to significantly affect this analysis.

Section 5.4.2 Avoided cost benefits from the RPS

Avoided cost benefits are described in more detail above. This calculation has not been performed for CY 2014/15.

Section 5.4.3 Externality benefits due to the RPS

Delmarva Power calculated the externality benefits of renewable energy in its 2014 Integrated Resource Plan (IRP). This externality benefit calculation incorporates the avoided mortality costs for NOx and SO2 and the social cost of CO2 emissions. DPL calculated the externality benefits of reduced emissions of NOx and SO2 due to renewable energy in Delaware to be $16,019,038 based on the assumption that renewable energy displaced 50 percent of the PJM generation mix (which can be considered a conservative estimate due to the efficiency of the grid).

The cost of CO2 is calculated to be $4,675,171. DPL set the cost of CO2 to be $1 per metric ton, the low end of the EPA/OMB range of the social cost of carbon (SCC) at the time the IRP was prepared. The EPA/OMB social cost of carbon (SCC) has been updated since then. Using these updated figures, Division staff took the figure of $36.00 per metric ton for 2015, which assumes a 3.0 percent discount rate of future costs in 2007 dollars. The figure in 2007 dollars has been adjusted using the CPI, resulting in a SCC of $32.19 in 2015 dollars. As with DPL's other externality calculations, it is assumed that renewable energy displaced 50 percent of the PJM generation mix.

The Regulation includes "improvements to habitat" as part of the definition of externality benefits. We have not developed methods for calculating habitat benefits of renewable energy.

Externality benefits of the RPS in Delaware in CY 2014/15 totaled $20,694,209, or 3.16 percent of the total retail costs of electricity.

Section 5.4.4 Economic impacts of the deployment of renewable energy in Delaware.

The economic impacts of solar PV in Delaware are described above, and the results are incorporated into the overall RPS calculations.

The results summarized below clearly show that the benefits exceeded the cost of compliance:

Conclusions

The externality benefits and the economic benefits of the solar PV used to satisfy DPL's solar carve-out of the RPS totaled 4.58 percent, far greater than the 1.50 percent cost of solar PV compliance. Based on this analysis, and exercising my statutory discretion, I have determined to not freeze the solar PV carve-out of the RPS.

The externality benefits and the economic benefits of renewable energy used to satisfy DPL's RPS requirement total 7.29 percent, far greater than the 3.93 percent cost of RPS compliance. Based on this analysis, and exercising my statutory discretion, I have determined to not freeze the RPS.

Members of the public may submit comments up until 4:30 p.m. on April 22, 2016 to:

Thomas Noyes

Principal Planner for Utility Policy

Department of Natural Resources and Environmental Control

Division of Energy & Climate

100 W. Water Street, Suite 5A

Dover, DE 19904

thomas.noyes@state.de.us

Fax: (302)739-1840

Approved:

Philip T. Cherry, Director

March 15, 2016